Apple (AAPL) Leads Competition in Growing Smartwatch Space

Apple’s AAPL endeavors to solidify its footprint in the smartwatch space have been gaining traction in the last couple of years, thanks to the integration of health features in its Apple Watch.

The solid adoption of Apple Watch Series 6, which features a blood oxygen sensor with additional healthcare and fitness features like Cycle Tracking, the Noise app and Activity Trends, has helped the iPhone maker strengthen its presence in the smart watch market.

In the first quarter of 2021, this Zacks Rank #2 (Buy) company witnessed 50% year-over-year growth in the demand for new Series 6 models, increasing market share of smartwatch shipment to 33.5% while overall market shipments grew 35% year over year, according to a Counterpoint Research report. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Moreover, the availability of Fitness+ subscription services built for Apple Watch and the Health Records feature within the Health app for users in the United Kingdom and Canada have been key growth drivers in boosting the adoption of Apple’s Watch.

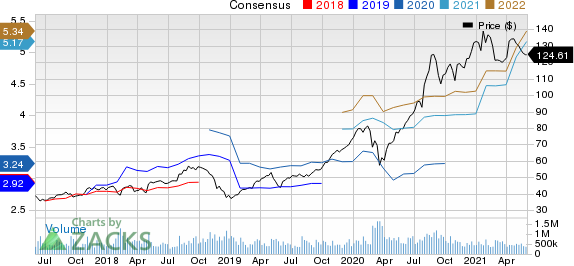

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

Smartwatch Growth Potential Aplenty

Increasing health awareness among consumers is a key factor driving growth in the smartwatch space.

Moreover, Internet of things (IoT) driven smart watches is a highly preferred choice of smart watches. Smart watches connected to the Internet offer a wide range of features such as time, health monitoring and fitness tracking, receives calls and messages, entertainment, cardless payments, and connectivity to other IoT devices to improve the quality of the user's life.

The global smart watch market is expected to grow from $49.74 billion in 2020 to $59.02 billion in 2021 at a compound annual growth rate (CAGR) of 18.7%, per Research and Markets report. The market is expected to reach $99.84 billion in 2025 at a CAGR of 14%.

Promising growth prospects have increased competition for Apple in the smartwatch segment from the likes of Garmin GRMN, Alphabet’s GOOGL Google, Sony Corporation SONY, Samsung Electronics and Huawei Technologies besides other players in the extended wearables market like Amazon AMZN, Xiaomi and LG Electronics among others.

Google’s Increasing Buyouts Create Potent Threat

Alphabet remains well-poised to rapidly penetrate the booming smartwatch space on the heels of concerted efforts by its division Google. The growing momentum of its Wear OS remains a tailwind. Additionally, the seamless synchronization of Wear OS with Google Fit and other health apps is a positive.

Recently, Google announced teaming up with Samsung on a joint software platform for smartwatches and other wearables in a move ramping up competition with market leader Apple. Samsung will use Google's Wear OS for its upcoming Galaxy smartwatches instead of its own Tizen platform.

Markedly, in the first quarter 2021, Samsung's smartwatch shipments grew 27% year over year and captured a market share of 8% driven by increased demand for its Galaxy Watch 3 and Galaxy Watch Active series.

Additionally, the company’s acquisition strategy to expand its footprint in the underlined market remains a major positive. The acquisition of Fossil’s smartwatch technology is noteworthy.

Moreover, Google completed the acquisition of the wearable fitness company Fitbit, which is termed as a remarkable buyout in the fitness tracking space. Fitbit’s market share of smartwatch shipment was 8% in the first quarter of 2021.

The latest smartwatch called Sense, which is equipped with stress management and other attractive features, remains noteworthy. Additionally, the revamped versions of its Versa, namely Fitbit Versa 3 and Fitbit Inspire 2 are gaining strong momentum.

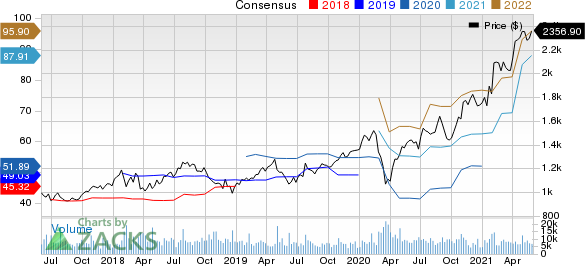

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Garmin’s Strengthening Portfolio to Pose Challenge

Garmin has been focusing on expanding its smartwatch portfolio. The company recently unveiled Descent Mk2S, a regular wear smartwatch with numerous underwater diving features.

In addition to the latest Descent Mk2S, this Zacks Rank #3 (Hold) company has introduced the EnduroTM ultraperformance GPS watch with extended battery life to help athletes train well and monitor their performance.

Expansion of its well-known Approach series of GPS golf products — the Approach S42 smartwatch, the Approach S12 watch and the Approach G12 GPS rangefinder — has been another positive for the company.

Moreover, it has announced the introduction of Venu 2 and Venu 2S GPS smartwatches to take care of the wellbeing of customers.

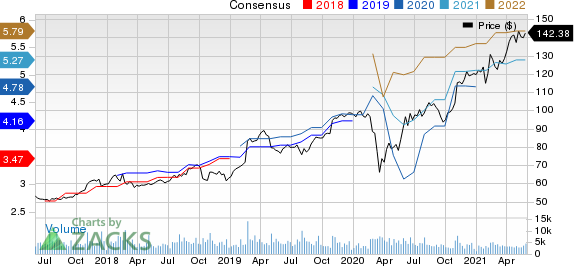

Garmin Ltd. Price and Consensus

Garmin Ltd. price-consensus-chart | Garmin Ltd. Quote

Amazon’s Fitness Tracking Service and Wearables Raise Challenge

Amazon made its foray into the smart wearables market by launching Amazon Halo and Amazon Halo Band, a fitness tracking service and a wearable.

Notably, Amazon Halo Band, which is an all-day wear water-resistant fitness band, comprises a heart rate monitor, a temperature sensor and an accelerometer. Moreover, it includes two microphones, an LED indicator light and a small sensor capsule for providing accurate data.

Apart from this, the Amazon Halo app consists of five core features, namely activity, sleep, body, tone and labs, all developed for lending meaningful healthcare insights.

In December 2020, Amazon Web Services unveiled its cloud-based healthcare service called Amazon HealthLake. Notably, the service is a HIPAA-eligible one, which helps medical providers, health insurers, and pharmaceutical companies to analyze their complete data at a petabyte scale in the cloud.

It enables them to copy health data from on-premises systems to a secure data lake in the cloud. Further, the service allows organizations to store, tag, index and standardize their data.

With rising concerns surrounding healthcare and fitness as well as increasing chronic diseases, such diverse initiatives by the abovementioned companies are expected to intensify competition in the smartwatch space.

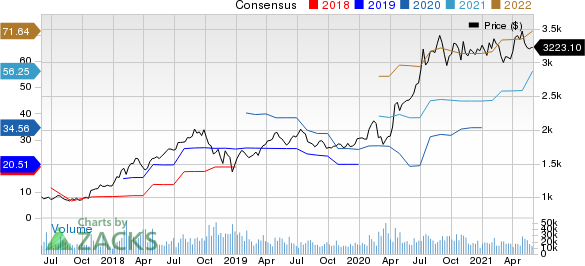

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Sony Corporation (SONY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research