Applied Materials (AMAT) Q1 Earnings & Sales Beat, Rise Y/Y

Applied Materials Inc. AMAT reported first-quarter fiscal 2023 non-GAAP earnings of $2.03 per share, surpassing the Zacks Consensus Estimate by 5.2%. Further, the figure improved 7% from the year-ago fiscal quarter’s reported figure.

Net sales of $6.74 billion climbed 7% from the year-ago fiscal quarter’s level and surpassed the Zacks Consensus Estimate of $6.69 billion.

Top line growth was driven by the strong performance of the Semiconductor Systems and Applied Global Services segments.

AMAT witnessed solid growth in geographies, namely the United States, Europe, Taiwan, Korea and Southeast Asia, which was another positive.

However, Applied Materials continued to witness sluggishness in its Display segment. Also, it faced weakening momentum in China and Japan.

Further, negative impacts of U.S. trade regulations remained overhangs.

Coming to the price performance, Applied Materials has lost 17% over a year compared with the industry’s decline of 3.4%.

Nevertheless, the company’s robust portfolio of differentiated products, expanding service business and growing momentum among leading customers at key technology inflections are likely to instill investors’ optimism in the stock in the days ahead.

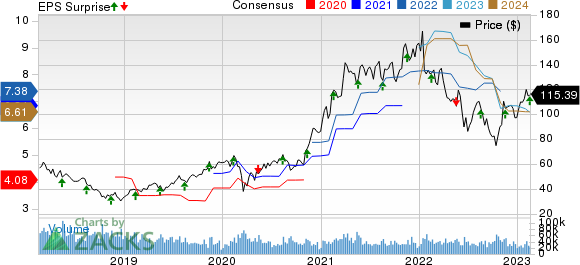

Applied Materials, Inc. Price, Consensus and EPS Surprise

Applied Materials, Inc. price-consensus-eps-surprise-chart | Applied Materials, Inc. Quote

Segments in Detail

Semiconductor Systems generated sales worth $5.2 billion, which contributed 77% to its net sales, reflecting a 13% increase from the year-ago fiscal quarter’s reading. Strength in ICAPS drove the top line growth within the segment.

Applied Global Services reported sales of $1.4 billion (20% of net sales), up 4% from the prior-year fiscal quarter’s reported number.

Sales from Display and Adjacent Markets were $167 million (3% of net sales), down 54% from the year-ago fiscal quarter’s reported level.

Revenues by Geography

The United States, Europe, Japan, Korea, Taiwan, Southeast Asia and China generated sales of $1.05 billion, $573 million, $456 million, $1.3 billion, $1.97 billion, $253 million and $1.14 billion each, contributing 16%, 8%, 7%, 19%, 29%, 4% and 17% to net sales, respectively.

Sales in the United States, Europe, Korea, Taiwan and Southeast Asia increased 24.1%, 103.9%, 15.3%, 57.6% and 12.4%, respectively, from the respective year-ago fiscal quarter’s readings. Sales in Japan and China fell 18.7% and 42.4%, respectively, from the year-ago quarter’s corresponding levels.

Operating Results

The non-GAAP gross margin was 46%, contracting 50 basis points (bps) from the year-ago fiscal quarter’s figure.

Operating expenses were $1.2 billion, up 19.5% from the year-ago fiscal quarter’s level. As a percentage of sales, the figure expanded 170 bps from the year-earlier fiscal quarter’s level to 17.4%.

The non-GAAP operating margin of 29.5% for the reported quarter contracted 220 bps from the prior-year fiscal period’s actuals.

Balance Sheet & Cash Flow

As of Jan 29, 2023, cash and cash equivalent balances and short-term investments were $4.05 billion, up from $2.6 billion as of Oct 30, 2022.

Inventories were $6.05 billion in first-quarter fiscal 2023 compared with $5.9 billion in fourth-quarter fiscal 2022. Accounts receivables decreased to $5.4 billion in the reported quarter from $6.1 billion in the previous fiscal quarter.

Long-term debt was $5.458 billion at the end of the reported quarter compared with $5.457 billion at the end of the previous fiscal quarter.

Applied Materials generated a cash flow of $2.3 billion, up from $857 million in the prior fiscal quarter.

AMAT returned $470 million to its shareholders, of which share repurchases were worth $250 million and dividend payments amounted to $220 million.

Guidance

For second-quarter fiscal 2023, Applied Materials expects net sales of $6.4 billion (+/-$400 million). The Zacks Consensus Estimate for the same is pegged at $6.12 billion.

Management expects the ongoing supply chain challenges to prevail in the fiscal second quarter. The top-line guidance also includes a headwind of $250 million associated with a cybersecurity event announced by one of AMAT’s suppliers.

AMAT anticipates Semiconductor Systems, AGS and Display revenues to be $4.84 billion, $1.34 billion and $160 million, respectively.

Management expects non-GAAP earnings per share in the band of $1.66-$2.02 per share. The Zacks Consensus Estimate for the same is pegged at $1.70.

Applied Materials expects a non-GAAP gross margin of 46.5% and non-GAAP operating expenses of $1.16 billion. It projects a non-GAAP tax rate of 12.5%.

Zacks Rank & Stocks to Considerrista Networks

Currently, Applied Materials carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Computer & Technology sector are Agilent Technologies A, Arista Network ANET and Garmin GRMN, all of which carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agilent has gained 8.4% in the past year. A’s long-term earnings growth rate is currently projected at 10%.

Arista Networks has gained 6.1% in the past year. The long-term earnings growth rate for ANET is currently projected at 17.5%.

Garmin has lost 24.6% in the past year. The long-term earnings growth rate for GRMN is currently projected at 5.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report