AptarGroup Touches 52-Week High: What's Driving the Stock?

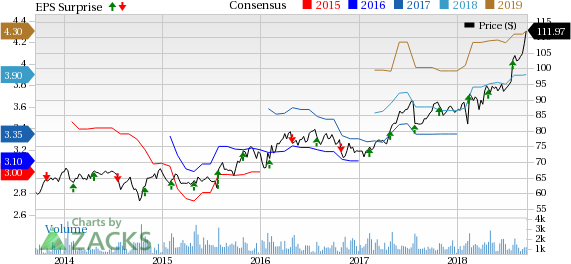

Shares of AptarGroup, Inc. ATR crafted a 52-week high of $112.16 during intra-day trading, finally closing lower at $111.97, on Sep 14.

The company has a market cap of $7 billion. Over the past three months, its average volume of shares traded has been approximately 258K.

Also, AptarGroup’s positive estimate revisions reflect optimism in the company’s potential, as earnings growth is often an indication of robust prospects. Estimates for the company moved up over the past 60 days, reflecting analysts’ bullish sentiments. The earnings estimate for 2018 has gone up 3.2%, while that of 2019 climbed 3.9%.

AptarGroup, Inc. Price, Consensus and EPS Surprise

AptarGroup, Inc. Price, Consensus and EPS Surprise | AptarGroup, Inc. Quote

Price Performance

Notably, the stock has rallied 31% in a year’s time, higher than the S&P 500’s gain of 17%. In addition, AptarGroup has outperformed 5% growth recorded by the industry during the same time frame.

Investors are optimistic on this Zacks Rank #3 (Hold) company, backed by solid second-quarter 2018 results, its focus on business transformation and improving operations. Its acquisition of CSP Technologies will also drive growth.

Moreover, AptarGroup has an impressive VGM Score of B. In this, V stands for Value, G for Growth and M for Momentum, and the score is a weighted combination of these three scores. Such a score eliminates the negative aspects of stocks and selects winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

Our research shows that stocks with Style Scores of A or B, when combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3, offer the best investment opportunities.

What’s Driving the Stock?

AptarGroup reported stellar results in the June-end quarter, wherein adjusted earnings increased 4% year over year and came in above management’s guided range. The reported figure also beat the Zacks Consensus Estimate. Its net sales grew 15% year over year, surpassing the Consensus mark. This upside was driven by core sales growth and favorable impact from exchange rates.

AptarGroup’s earnings per share guidance for the third quarter at 90-95 cents, which reflects 11% year-over-year growth at the mid-point. The company expects its core sales to be up in each segment in the third quarter.

In late 2017, AptarGroup initiated a business-transformation plan to drive top-line growth, increase operational excellence, enhance its approach to innovation and improve organizational effectiveness. The company remains on track with its business transformation which primarily focuses on the Beauty + Home segment. The company expects the plan to yield incremental EBITDA of approximately $80 million by the end of 2020, principally within the Beauty + Home segment.

AptarGroup remains committed to expand its business through inorganic growth. In sync with this, the company has made a binding offer to acquire CSP Technologies, a leader in active packaging technology based on proprietary material science expertise, for an enterprise value of $555 million. The buyout will help AptarGroup boost its business in the Pharma and Food Safety markets. The transaction is subject to customary closing conditions and is expected to close in fourth-quarter 2018.

On the manufacturing front, AptarGroup remains focused on improving operations by adding collaborative robots to reduce the amount of repetitive labor. The company also has several major scrap-reduction initiatives going on at different sites. AptarGroup also focuses on leveraging supplier network in metal parts to design and manufacture components with less material waste or lower thickness and packaging cost reductions by consolidating purchasing across sites.

The above-mentioned tailwinds have raised investors’ optimism in the stock and are anticipated to drive the company’s share price in the days ahead.

Stocks to Consider

Some better-ranked stocks in the same space include W.W. Grainger, Inc. GWW, iRobot Corporation IRBT and Atkore International Group Inc. ATKR. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Grainger has a long-term earnings growth rate of 12.5%. Its shares have appreciated 108%, over the past year.

iRobot has a long-term earnings growth rate of 21%. The company’s shares have rallied 34% in the past year.

Atkore has a long-term earnings growth rate of 10%. The company’s shares have gained 43% in the past year.

Best Electric Car Stock? You'll Never Guess It.

Zacks Research has released a report that may shock many investors. One stock stands out as the best way to invest in the surge to electric cars. And it's not the one you may think!

Much like petroleum 150 years ago, lithium battery power is set to shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge. With battery prices plummeting and charging stations set to multiply, revenues that were already at $31 billion in 2016 are expected to blast to over $67 billion by the end of 2022.

See Zacks Best EV Stock Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Atkore International Group Inc. (ATKR) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

iRobot Corporation (IRBT) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.