ArcelorMittal (MT) Unit to Add Additional Capability in Canada

ArcelorMittal's MT subsidiary, ArcelorMittal Dofasco announced the additional capability for the production of ArcelorMittal’s patented Usibor Press Hardenable Steel for automotive applications.

The investment in the coating addition of No.5 hot-dipped galvanizing line in Hamilton will enable ArcelorMittal Dofasco to be the only Canadian producer of Aluminium Silicon (Alusi) coated Usibor. It is in line with North America developments announced earlier, including a new Electric Arc Furnace (“EAF”) at AM/NS Calvert in the United States and a new hot strip mill in Mexico. The investment further strengthens Arcelor Mittal’s leadership position in the North America automotive market.

The project cost amounted to C$24 million. The first product is expected to come on stream in the second half of 2022. The No.5 line has an expected capacity of 160,000 tons of Alusi coated steel.

Shares of ArcelorMittal have gained 33.6% in the past year compared with the 17% rise of the industry.

The company, on its third-quarter earnings call, stated that it has been witnessing improvement in activity levels due to the easing of lockdown measures. However, the demand is below normal and the pace of recovery continues to be uncertain.

The company is also restarting hot-idled capacity as market demand improves. It is maintaining the flexibility to quickly adapt production as the situation evolves. ArcelorMittal is also focusing on cost reduction initiatives to support profitability amid evolving demand. It will increase production as economic activity recovers.

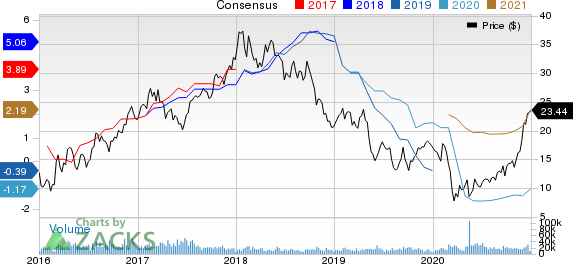

ArcelorMittal Price and Consensus

ArcelorMittal price-consensus-chart | ArcelorMittal Quote

Zacks Rank & Key Picks

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Bunge Limited BG, BHP Group BHP and Clearwater Paper Corporation CLW.

Bunge has a projected earnings growth rate of 43% for the current year. The company’s shares have gained 13.3% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BHP has an expected earnings growth rate of 32.4% for the current year. The company’s shares have gained around 20.5% in the past year. It currently flaunts a Zacks Rank #1.

Clearwater has an expected earnings growth rate of 1,960.9% for the current year. The company’s shares have surged 75.4% in the past year. It currently sports a Zacks Rank #1.

Legal Marijuana: An Investor’s Dream

Imagine getting in early on a young industry primed to skyrocket from $17.7 billion in 2019 to an expected $73.6 billion by 2027.

Although marijuana stocks did better as the pandemic took hold than the market as a whole, they’ve been pushed down. This is exactly the right time to get in on selected strong companies at a fraction of their value before COVID struck. Zacks’ Special Report, Marijuana Moneymakers, reveals 10 exciting tickers for urgent consideration.

Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BHP Group Limited (BHP) : Free Stock Analysis Report

ArcelorMittal (MT) : Free Stock Analysis Report

Clearwater Paper Corporation (CLW) : Free Stock Analysis Report

Bunge Limited (BG) : Free Stock Analysis Report

To read this article on Zacks.com click here.