Is Archer-Daniels-Midland a Buy at Its All-Time High?

- By Nathan Parsh

I have found the risk-reward for Archer-Daniels-Midland Co. (NYSE:ADM) very attractive for some time now. In addition, the company also has an incredibly long dividend growth streak and boasts a market-beating yield.

But after hitting an all-time high, is Archer-Daniels-Midland still a buy today? Let's examine the company's recent quarter and the stock valuation to determine that answer.

Earnings highlights

Archer-Daniels-Midland reported fourth-quarter and full-year earnings results on Jan. 26. For the quarter, revenue grew 10.1% to $18 billion. This was $1.5 billion above Wall Street analysts' estimates. Adjusted earnings per share declined 14.8% to $1.21, but was 12 cents better than expected.

For the year, revenue fell 0.5% to $64.4 billion, while adjusted earnings per share increased 10.8% to $3.59, a new record.

All reportable business segments demonstrated operating profit growth in the fourth quarter.

Agricultural Services and Oilseeds grew nearly 13% to $1.1 billion. Ag Services remains strong, especially in North America, which benefited from higher global demand, especially in China. Ag Services had higher export volumes and an improvement in margins. South America was lower year over year, but this is primarily due to advanced sales in the first half of 2020 as countries accelerated orders as a result of the Covid-19 pandemic.

The Crushing business experienced a near triple in operating profit as it benefited from higher demand for meal and vegetable oils. A lower global supply of soybeans was also a tailwind. Margins were up in all regions. Excluding a retroactive biodiesel tax credit in the fourth quarter of 2019, profit for Refined Products was up year over year due to gains in South American markets.

Operating profit for the Carbohydrates Solutions segment was 19.5% higher at $208 million. Lower costs for corn helped Starches and Sweeteners grow compared to the prior year, though corn oil and wet mill ethanol were both weaker. Vantage Corn Processors continues to meet demand for high-grade alcohol. Archer-Daniels-Midland has idled two dry mills used for ethanol production, which reduced results slightly due to associated fixed costs.

Nutrition was the real star of the quarter as operating profit improved 24.5% to $127 million. This marks this segment's sixth consecutive quarter of at least 20% operating profit growth. Human Nutrition experienced better overall sales and product mix in both the North American and Europe, Middle East, Africa and India regions. Flavors was the main catalyst for growth, but plant proteins, probiotics, natural health and nutrition all continue to show strength. Animal Nutrition grew in Asia and EMEAI, but faced currency exchange-related headwinds in Latin America.

Archer-Daniels-Midland ended 2020 with total assets of $49.7 billion, current assets of $27.3 billion and cash and cash equivalents of $666 million. This compares to total liabilities of nearly $30 billion and current liabilities of $18.2 billion. Total debt stands at just over $11 billion, with $2 billion of debt due within the next year.

Archer-Daniels-Midland expects to produce adjusted earnings per share growth in 2021. Consensus estimates call for $3.85 of adjusted earnings per share for the current year, which would represent a 7.2% increase from last year's record level.

The company also increased its dividend 2.8% for the March 2 distribution, slightly below the five-year compound annual growth rate of 3.7%. Archer-Daniels-Midland has now raised its dividend for 46 consecutive years, qualifying the company as a member of the Dividend Aristocrat index. Shares yield 2.6% as of Friday's close, much better than the 1.5% average yield for the S&P 500 index.

Valuation analysis

Improvements in the company's business and lengthy history of dividend growth were two items that initially drew my attention to Archer-Daniels-Midland last year.

The other was valuation. When I last discussed the food processing company back in September, I felt the stock had the potential to offer a mid-single-digit return. Since this time, however, shares are higher by more than 25%.

This has caused the valuation to climb higher. Using the most recent closing price of $57.59 and expected adjusted earnings per share for 2021, Archer-Daniels-Midland has a forward price-earnings ratio of 15. This matches the stock's 10-year average earnings multiple according to Value Line.

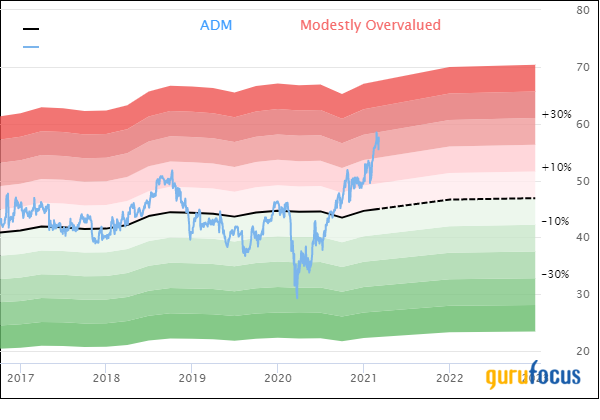

In addition, shares of the company now trade at a significant premium to its GF Value.

Archer-Daniels-Midland has a GF Value of $45.03, which results in a price-to-GF Value of 1.28. This earns the stock a rating of modestly overvalued from GuruFocus. Returning to the GF Value would result in a 22% decrease in share price, which would erase nearly all of the gains seen in the name since early September.

Final thoughts

There is a lot to like about Archer-Daniels-Midland. The company's business continues to thrive, with all major segments posting growth in the most recent quarter. Even issues such as currency or less demand in certain businesses wasn't enough to offset the core areas of the company.

Archer-Daniels-Midland has an excellent history of returning capital to shareholders through its dividend and the yield is a full percentage point better than what the market offers.

That said, my expected gain in share price since my last discussion of the company has more than come to fruition. As much as I like the company, Archer-Daniels-Midland's valuation is no longer as appealing at it was. Therefore, I am moving to the sidelines on the stock and now rate it as a hold. On a pullback, the stock could be an excellent investment for income-seeking investors.

Disclosure: The author has no position in Archer-Daniels-Midland.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.