Ares Capital (ARCC) Q3 Earnings Meet as Costs Dip, Stock Rises

Shares of Ares Capital Corporation ARCC gained 4.8% following the release of its third-quarter 2022 results. Core earnings of 50 cents per share were in line with the Zacks Consensus Estimate. The bottom line reflected a rise of 6.4% from the prior-year quarter.

Results were aided by an increase in total investment income and lower expenses. The portfolio activity remained solid in the quarter.

GAAP net income was $104 million or 21 cents per share compared with $334 million or 73 cents per share recorded in the prior-year quarter.

Total Investment Income Increases, Expenses Decline

Total investment income was $537 million, up 21.5% year over year. The rise was driven by an increase in dividend income, interest income from investments and other income. The top line beat the Zacks Consensus Estimate of $511.4 million.

Total expenses were $235 million, down 7.1% year over year.

Portfolio Activities Solid

Gross commitments worth $2.2 billion were made in the third quarter to new and existing portfolio companies. This compares with $3.1 billion worth of gross commitments in the prior-year quarter.

In the reported quarter, the company exited $2 billion of commitments compared with $2.3 billion a year ago.

The fair value of Ares Capital’s portfolio investments was $21.3 billion as of Sep 30, 2022. The fair value of accruing debt and other income-producing securities was $19.2 billion.

Balance Sheet Strong

As of Sep 30, 2022, the company’s cash and cash equivalents totaled $257 million, down from $372 million as of Dec 31, 2021.

Ares Capital had $4.3 billion available for additional borrowings under the existing credit facilities as of Sep 30, 2022. Total outstanding debt was $11.9 billion.

As of Sep 30, 2022, total assets were $22 billion and stockholders’ equity was $9.4 billion.

Net asset value was $18.56 per share, down from $18.96 as of Dec 31, 2021.

Dividend Hiked

Concurrent with the earnings release, the company’s board of directors announced a quarterly dividend of 48 cents per share, representing a hike of 11.6% from the prior payout. The dividend will be paid out on Dec 29 to shareholders of record as of Dec 15.

Our Take

Driven by a rise in the demand for customized financing, growth in total investment income is expected to continue in the quarters ahead. An increase in investment commitments will likely keep supporting the company’s financials.

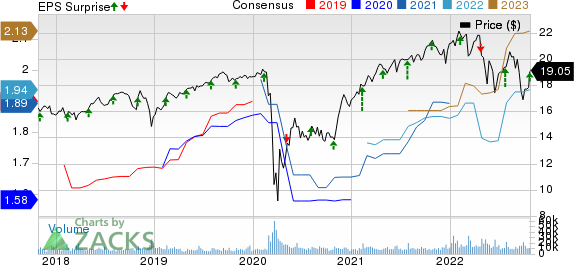

Ares Capital Corporation Price, Consensus and EPS Surprise

Ares Capital Corporation price-consensus-eps-surprise-chart | Ares Capital Corporation Quote

Currently, ARCC carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates of Other Finance Stocks

Hercules Capital, Inc. HTGC is scheduled to announce quarterly numbers on Nov 2.

Over the past 30 days, the Zacks Consensus Estimate for Hercules Capital’s third-quarter earnings has been unchanged at 35 cents. The estimate indicates a rise of 6.1% from the prior-year quarter’s reported number.

FS KKR Capital Corp. FSK is slated to announce quarterly numbers on Nov 7.

Over the past 30 days, the Zacks Consensus Estimate for FS KKR Capital’s quarterly earnings has been revised 1.4% upward to 73 cents, implying a 14.1% rise from the prior-year reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

FS KKR Capital Corp. (FSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research