Arista (ANET) Q1 Earnings Beat Estimates on Top-Line Growth

Arista Networks, Inc. ANET reported solid first-quarter 2021 results, wherein the bottom and the top lines beat the respective Zacks Consensus Estimate, driven by a healthy momentum in the enterprise vertical and solid customer additions. Also, both adjusted earnings and revenues improved year over year.

Net Income

On a GAAP basis, net income in the reported quarter improved to $180.4 million or $2.27 per share from $138.4 million or $1.73 per share in the prior-year quarter, primarily driven by top-line growth.

Excluding non-recurring items, non-GAAP net income came in at $198.8 million or $2.50 per share compared with $161.7 million or $2.02 per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 12 cents.

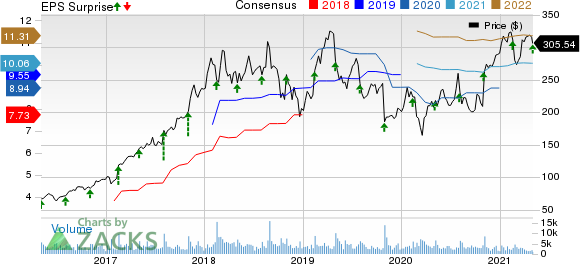

Arista Networks, Inc. Price, Consensus and EPS Surprise

Arista Networks, Inc. price-consensus-eps-surprise-chart | Arista Networks, Inc. Quote

Revenues

Quarterly total revenues were up 27.6% year over year to $667.6 million and was well ahead of the company’s guidance of $630-$650 million. The rise was primarily led by solid customer additions and growth in the enterprise vertical, partially offset by shipment constraints resulting from the COVID-19 operating environment and supply-chain disruptions. The top line surpassed the consensus estimate of $640 million.

Arista generated 75% of total revenues from the Americas and the remainder from international operations. Product revenues jumped to $539.1 million from $410.9 million, while Service revenues grew to $128.4 million from $112.1 million, supported by renewals and subscriptions. In terms of the vertical mix, cloud titans was the largest vertical followed by enterprise, financials, specialty cloud providers and service providers. With improved customer demand and visibility, the company is taking decisive steps to improve inventory levels and manufacturing capacity in order to negate supply-chain headwinds. Notably, Arista is increasingly offering software-driven, data-centric approach to help customers build their cloud architecture and augment their cloud experience.

Other Details

Non-GAAP gross profit improved to $432.1 million from $343.2 million for respective margins of 64.7% and 65.6%. The non-GAAP gross margin was at the high end of the company’s guidance of 63-65%, reflecting healthy software and services mix.

Total operating expenses increased to $219 million from $188.6 million in the prior-year quarter owing to higher R&D costs, high variable compensation and other headcount-related charges, partially offset by lower COVID-related travel and marketing expenses. Non-GAAP operating income was up to $251.3 million from $194 million in the year-ago quarter with corresponding margins of 37.6% and 37.1%, respectively.

Cash Flow & Liquidity

In the first three months of 2021, Arista generated $254.7 million of net cash from operating activities compared with $194.8 million in the prior-year period. As of Mar 31, 2021, the cloud networking company had $843.3 million in cash and cash equivalents with $225.9 million of non-current deferred tax liabilities. Arista repurchased $101 million worth of shares during the quarter at an average price of $276 per share. Notably, the company has purchased $763 million worth of shares to date since the initiation of its $1 billion share repurchase program in second-quarter 2019.

Q2 Outlook

The company expects to witness continued growth within its enterprise vertical in the forthcoming quarters with customer mix remaining the key driver. For the second quarter of 2021, Arista expects revenues of $675-$695 million. It anticipates a non-GAAP gross margin of 63-65% and a non-GAAP operating margin of around 37%.

Zacks Rank & Stocks to Consider

Arista currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the industry are Altice USA, Inc. ATUS, sporting a Zacks Rank #1 (Strong Buy), and Corning Incorporated GLW and Spirent Communications PLC SPMYY, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Altice delivered an earnings surprise of 61.5%, on average, in the trailing four quarters.

Corning has a long-term earnings growth expectation of 17.7%. It delivered an earnings surprise of 39%, on average, in the trailing four quarters.

Spirent has a forward P/E of 22.6x.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Corning Incorporated (GLW) : Free Stock Analysis Report

Spirent Communications PLC (SPMYY) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Altice USA, Inc. (ATUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research