Arnold Schneider Gains New Energy Holdings in 1st Quarter

- By Sydnee Gatewood

Schneider Capital Management founder Arnold Schneider (Trades, Portfolio) established eight positions during the first quarter. Half of his purchases were energy stocks - Oasis Petroleum Inc. (OAS), Now Inc. (DNOW), QEP Resources Inc. (QEP) and SandRidge Energy Inc. (SD).

Warning! GuruFocus has detected 4 Warning Signs with OAS. Click here to check it out.

The intrinsic value of OAS

As he believes disciplined value investing produces the best success over time, Schneider depends on research that identifies undervalued stocks with the potential for positive change. His current portfolio is composed of 62 stocks and is valued at $599 million. Energy stocks have the heaviest weighting in his portfolio at 38.3%.

Having previously sold out of Oasis in second-quarter 2015, Schneider purchased a new holding of 1.05 million shares for an average price of $14.07 per share, giving it 2.5% portfolio space. This was his largest purchase for the quarter.

The oil and gas producer has a market cap of $2.3 billion; its shares were trading around $9.70 on Wednesday with a price-book (P/B) ratio of 0.8 and a price-sales (P/S) ratio of 2.3.

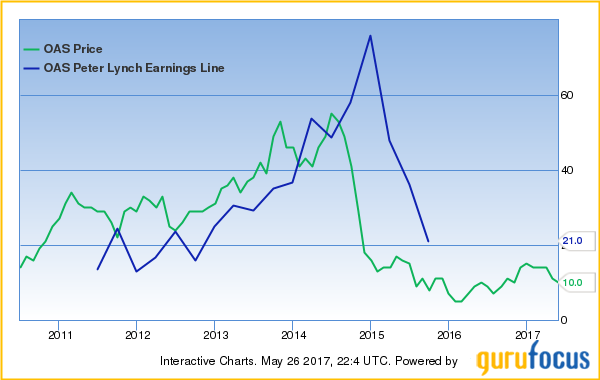

The Peter Lynch chart below illustrates the stock is trading below its fair value.

John Griffin (Trades, Portfolio) is the company's largest guru shareholder with 2.9% of outstanding shares. In all, eight gurus own the stock.

Schneider bought 174,000 shares of Now for an average price of $19.68 per share, expanding the portfolio 0.5%.

The oil and gas equipment services company has a market cap of $1.8 billion; its shares were trading around $16.48 on Wednesday with a P/B ratio of 1.5 and a P/S ratio of 0.8.

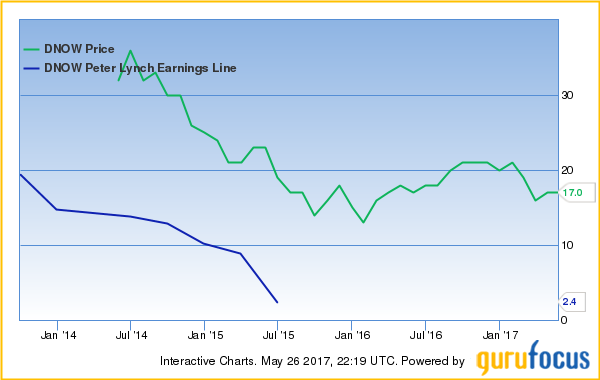

According to the Peter Lynch chart below, the stock is trading above its fair value.

Among the gurus invested in Now, First Eagle Investment has the largest holding with 7.1% of outstanding shares. In addition, eight other gurus also hold the stock.

The investor's third-largest new energy purchase is a 123,078-share stake of QEP Resources. He paid an average price of $15.74 per share, giving it a portfolio weight of 0.3%.

The oil and gas producer has a market cap of $2.4 billion; its shares were trading around $10.01 on Wednesday with a P/B ratio of 0.7 and a P/S ratio of 1.5.

Based on the Peter Lynch chart below, the stock appears to be trading evenly with its fair value.

Steven Cohen (Trades, Portfolio) is QEP's largest guru shareholder with 1.3% of outstanding shares. Jim Simons (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio) also own shares.

Schneider purchased 82,608 shares of SandRidge for an average price of $19.88 per share, expanding the portfolio 0.3%.

The oil and gas company has a market cap of $723.9 million; its shares were trading around $20.19 on Wednesday with a forward price-earnings (P/E) ratio of 14.12, a P/B ratio of 0.8 and a P/S ratio of 2.2.

The Peter Lynch chart below shows the stock is trading above its fair value.

Among the gurus invested in SandRidge, John Paulson (Trades, Portfolio) is the largest shareholder with 1.8% of outstanding shares. Francis Chou (Trades, Portfolio), Howard Marks (Trades, Portfolio) and Murray Stahl (Trades, Portfolio) are also shareholders.

During the quarter, Schneider also established positions in Enstar Group Ltd. (ESGR), Tailored Brands Inc. (TLRD), Tuesday Morning Corp. (TUES) and the iShares Russell Mid-Cap Value ETF (IWS).

Disclosure: I do not own any stocks mentioned in the article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with OAS. Click here to check it out.

The intrinsic value of OAS