Arthur J. Gallagher (AJG) Expands High Net-Worth Practice Unit

Arthur J. Gallagher & Co. AJG has acquired Lloyd Bedford Cox in its efforts to boost its high-net-worth practice business. The terms of the transaction were not disclosed.

Bedford Hills, NY-based Lloyd Bedford was founded in 1921. This fourth-generation retail insurance agency is a provider of compelling insurance coverage, services, and risk assessment tools. It serves high net-worth individuals and families across the United States, Europe, the Bahamas, and the Caribbean. Thus, the addition will help the acquirer expand its high net-worth practice business.

Arthur J. Gallagher boasts an impressive inorganic story. Since January 2002, the company has acquired 597 companies. Its merger and acquisition pipeline is quite strong with about $300 million revenues associated with nearly 40 term sheets either agreed upon or being prepared.

A solid capital position supports Arthur J. Gallagher in its growth initiatives. The company estimates more than $2.5 billion for mergers and acquisitions consisting of $1 billion in cash, about $650 million of net cash generation in the second half of 2021, and $600 million to $700 million of borrowing capacity.

This Zacks Rank #2 (Buy) insurance broker remains focused on long-term growth strategies for delivering organic revenue improvement and pursuing strategic mergers and acquisitions. It is also focused on productivity improvements and quality enhancements that should help it post sturdy numbers in the future.

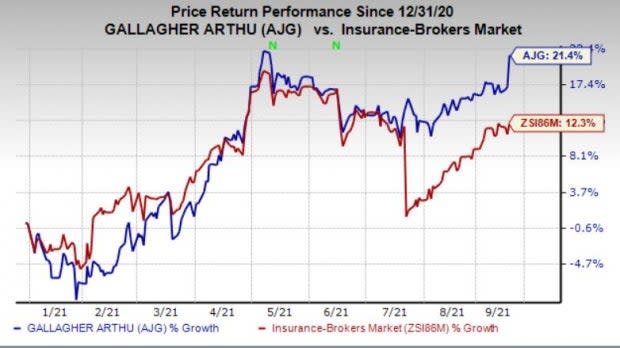

Shares of Arthur J. Gallagher have gained 21.4% year to date compared with the industry’s 12.3% increase. The efforts to ramp up its growth profile and capital position should continue to drive share price higher.

Image Source: Zacks Investment Research

Given the insurance industry’s adequate capital level, players are pursuing strategic mergers and acquisitions. Brown & Brown’s BRO subsidiary Brown & Brown of Massachusetts, LLC has agreed to buy the assets and operations of Berkshire Insurance Group, Inc., a subsidiary of Berkshire Hills Bancorp, Inc. BHLB. Marsh McLennan’s MMC Marsh McLennan Agency has acquired Vaaler Insurance.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Berkshire Hills Bancorp, Inc. (BHLB) : Free Stock Analysis Report

To read this article on Zacks.com click here.