Artisan Partners (APAM) Q4 Earnings Beat Estimates, AUM Rises

Artisan Partners Asset Management Inc.’s APAM fourth-quarter 2021 adjusted net income per adjusted share was $1.29, surpassing the Zacks Consensus Estimate of $1.25. The bottom line soared from $1.06 in the year-ago quarter.

Results were supported by a rise in revenues and higher assets under management (AUM). However, an increase in expenses was an undermining factor.

Net income attributable to Artisan Partners (GAAP basis) was $84.6 million, up from $73.1 million.

In 2021, adjusted net income per adjusted share of $5.03 beat the consensus estimate of $4.99 and rose 51% year over year. Net income available to common shareholders of $336.5 million increased from $212.6 million in 2020.

Revenues Climb, Expenses Increase

In 2021, total revenues climbed 36.4% year over year to $1.23 billion. Also, the top line surpassed the consensus estimate of $1.23 billion.

Fourth-quarter revenues were $315 million, rising 20.6% from the year-ago quarter. The rise primarily resulted from a higher average AUM balance. The top line surpassed the Zacks Consensus Estimate of $313.4 million.

Management fees earned from the Artisan Funds & Artisan Global Funds rose 25% year over year to $196.9 million. Management fees earned from Separate accounts grew 15.3% to $116 million.

Total operating expenses amounted to $177.2 million, up 20% year over year. The rise was primarily due to higher incentive compensation, compensation and benefits, and travel expenses.

The operating income was $137.8 million, up 21.4% year over year.

AUM Increases on Net Inflows

As of Dec 31, 2021, ending AUM was $174.8 billion, up 10.8% from the year-earlier quarter. The company witnessed net client cash inflows of $1.7 billion and $17.6 billion of investment returns in the fourth quarter.

The average AUM totaled $175.9 billion, up 40.8% year over year.

Balance Sheet Position Strong

Cash and cash equivalents were $189.2 million compared with $155 million as of Dec 31, 2020. The company’s debt leverage ratio, calculated in accordance with its loan agreements, was 0.3 as of Dec 31, 2021.

Capital Deployment Update

The company’s board of directors declared a variable quarterly dividend of $1.03 per share of Class A common stock along with a special dividend of 72 cents per share. The combined amount of $1.75 will be paid out on Feb 28, 2022, to shareholders of record as of the close of business on Feb 14.

Our View

Artisan Partners’ diverse investment products are expected to support growth. A rise in average AUM, given the inflows, supports the top-line expansion. However, escalating costs will hinder bottom-line growth to some extent.

Currently, Artisan Partners carries a Zacks Rank #4 (Sell).

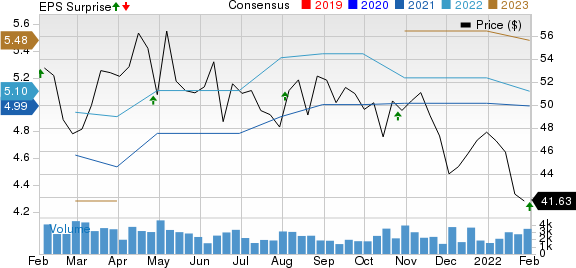

Artisan Partners Asset Management Inc. Price, Consensus and EPS Surprise

Artisan Partners Asset Management Inc. price-consensus-eps-surprise-chart | Artisan Partners Asset Management Inc. Quote

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

Federated Hermes FHI reported fourth-quarter 2021 earnings per share of 71 cents, in line with the Zacks Consensus Estimate. The figure, however, compares unfavorably with the prior-year quarter’s earnings of 93 cents.

Controlled expenses and improved AUM were driving factors. Also, FHI’s liquidity position was strong. Yet, reduced net investment advisory fees and net service fees affected Federated’s performance

T. Rowe Price TROW delivered fourth-quarter 2021 adjusted earnings per share of $3.17, which outpaced the Zacks Consensus Estimate of $3.07. The reported figure also climbed 9.7% year over year.

T. Rowe’s results were driven by higher revenues, backed by an upsurge in investment advisory fees, and administrative, distribution and servicing fees. Also, AUM improved. However, escalating expenses were an undermining factor.

Invesco’s IVZ fourth-quarter 2021 adjusted earnings of 86 cents per share handily outpaced the Zacks Consensus Estimate of 76 cents. The bottom line grew 19.4% from the prior-year quarter.

Invesco’s results reflect an improvement in revenues and solid growth in the AUM balance. However, a rise in operating expenses was a headwind.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Artisan Partners Asset Management Inc. (APAM) : Free Stock Analysis Report

Federated Hermes, Inc. (FHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research