The Ascendis Pharma (NASDAQ:ASND) Share Price Is Up 646% And Shareholders Are Delighted

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Ascendis Pharma A/S (NASDAQ:ASND) share price. It's 646% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors.

It really delights us to see such great share price performance for investors.

Check out our latest analysis for Ascendis Pharma

Ascendis Pharma wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

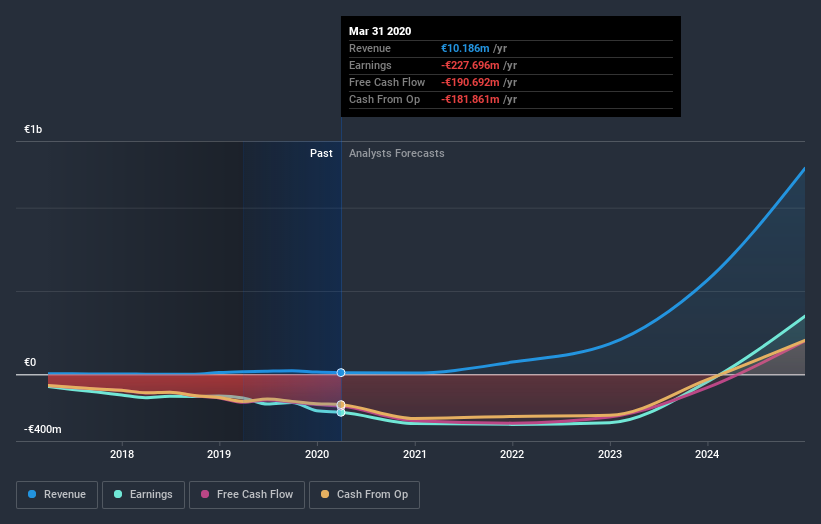

In the last 5 years Ascendis Pharma saw its revenue grow at 14% per year. That's a fairly respectable growth rate. Arguably it's more than reflected in the very strong share price gain of 49% a year over a half a decade. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Ascendis Pharma is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Ascendis Pharma stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

We're pleased to report that Ascendis Pharma shareholders have received a total shareholder return of 27% over one year. However, that falls short of the 49% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Ascendis Pharma you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.