Asos shares crash 20% on third profit warning since December

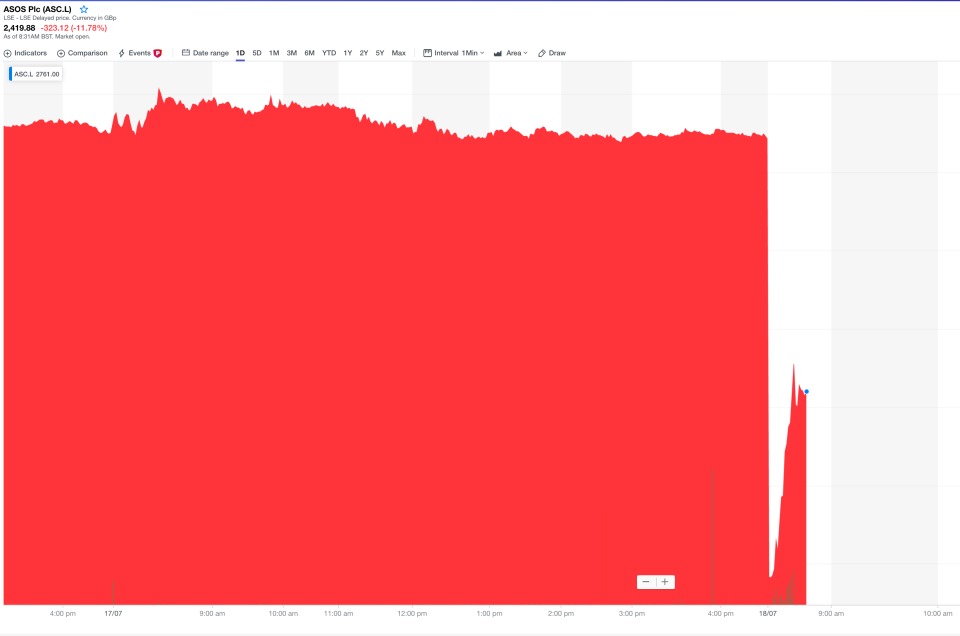

Shares in Asos (ASC.L) crashed over 20% on Thursday after the online fashion retailer warned profits would be lower than forecast.

Asos said “operational issues” related to upgrading its warehouses had hit sales in the US and Europe.

As a result of the teething problems, Asos said on Thursday that profits were likely to be between £30m and £35m this year. It had previously said profits would be £55m. Asos also cut its full-year sales growth forecast from 15% to 12%.

This represents the third profit warning in less than a year. The company also warned on profits in December 2018 and March of this year.

“Whilst we are making good progress in improving customer engagement, our recent performance in the EU and US was held back by operational issues associated with our transformational warehouse programmes,” CEO Nick Beighton said.

“Embedding the change from the major overhaul of infrastructure and technology in our US and European warehouses has taken longer than we had anticipated, impacting our stock availability, sales, and cost base in these regions.”

Asos’ share price fell by as much as 22% at the open on Thursday. Shares were still down 11% at 8.45am UK time.

“Initially sales guidance was for c.25% growth in FY2019 — that has now been halved in the space of six months,” Shore Capital analysts Greg Lawless and Clive Black said in a note to clients.

“The UK performance is relatively robust but clearly the warehouse transition in both Europe and the US have seen significant growing pains in recent months, which in our view, have been self-inflicted by the company.”

Shore Capital placed its “hold” rating on the stock under review following the profit warning.

Alongside the slashed full-year guidance, Asos also updated investors on third quarter trading. Sales grew by 11% in the quarter to £849m, with UK sales up by 16%.

“We are clear on the root causes of the operational challenges we have had, are making progress on resolving them, and now expect to complete these projects by the end of September,” Beighton said.

Asos invested $40m building a new warehouse in Atlanta but warned earlier this year it was struggling to cope with demand at the new facility.

“Despite these short-term challenges, the move to a multi-site logistics infrastructure will enable us to offer customers across the world our market leading proposition, facilitate our future growth, as well as leading to longer-term efficiency benefits,” Beighton said.

Asos was once one of the favourite stocks among fund managers and investors in the City of London due to its fast growth and relative consistency. However, the company has struggled with overseas expansion in recent years. As well as problems with overseas warehouses, the company pulled out of China in 2016 after failing to crack the market.

“Growing pains have been a consistent problem at Asos over some years, and this quarter is no exception,” Nicholas Hyett, an equity analyst at Hargreaves Lansdown, said.

“If, as expected, Asos can resolve its stock issues by the Autumn then this could be just another operational blip in the Asos timeline. We don’t think Asos should be written off just yet.”