Aspen's (AZPN) Q4 Earnings Beat Estimates, Revenues Fall Y/Y

Aspen Technology AZPN reported fourth-quarter fiscal 2021 non-GAAP earnings of $1.53 per share that beat the Zacks Consensus Estimate by 4.8%. The company reported non-GAAP earnings of $1.49 in the year-ago quarter.

Revenues of $198 million fell short of the Zacks Consensus Estimate by 4%. The company reported revenues of $201.9 million in the year-ago quarter.

The year-over-year decline in top line was owing to constrained customer spending environment stemming from the COVID-19 crisis. In the quarter under review, the company noted that global recovery was not even as end-market demand for fuel and chemicals bounced back to around pre-COVID levels but countries like Australia, India, Singapore and Japan were heavily impacted by spike in infection rates resulting in stringent lockdowns.

In the quarter under review, total bookings were $225.6 million, down 4.5% year over year

Following the announcement, shares are down 11% in the premarket trading on Aug 12. In the past year, shares of Aspen Technology have returned 13.2% compared with the industry’s rally of 36.2%.

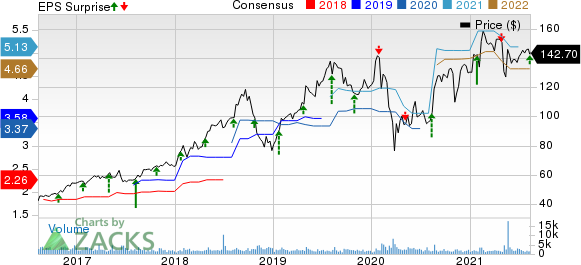

Aspen Technology, Inc. Price, Consensus and EPS Surprise

Aspen Technology, Inc. price-consensus-eps-surprise-chart | Aspen Technology, Inc. Quote

Quarter in Detail

License revenues (73.4% of revenues) declined 3% year over year to $145.3 million.

Maintenance revenues (23%) dropped 0.3% year over year to $45.6 million.

Services and other revenues (3.6%) increased 10.4% from the year-ago quarter’s figure to $7 million.

As of Jun 30, 2021, the annual spend (which Aspen Technology defines as the annualized value of all term license and maintenance contracts at the end of the quarter) amounted to $621 million, up 4.8% year over year and 1.9% quarter over quarter.

Margins

Gross profit declined 1.7% year over year to $183.7 million. As a percentage of total revenues, the figure expanded 30 basis points (bps) on a year-over-year basis to 92.8%.

Total operating expenses increased 10.3% from the year-ago quarter’s figure to $77.8 million due to increase in general & administrative expenses, research and development as well as selling and marketing.

Non-GAAP operating income of $118.4 million compared with $125.5 million reported in the prior-year quarter. Non-GAAP operating margin was 59.8% compared with 62.2% operating margin reported in the year-ago quarter.

Balance Sheet & Cash Flow

As of Jun 30, 2021, cash and cash equivalents were $379.9 million compared with $317.1 million as of Mar 31, 2021. The company’s total borrowings, net of debt issuance costs, stood at $293.2 million as of Jun 30, 2021.

The company generated $103.2 million cash from operations during the quarter under review compared with $98.7 million in the previous quarter. Non-GAAP free cash flow was $103.7 million in fiscal fourth quarter.

The company resumed buyback activity in fiscal fourth quarter by repurchasing 361,000 shares for $50 million.

In Jun 2021, Aspen Technology announced that its board of directors approved a new $300-million share buyback authorization to be executed in fiscal year 2022. The new buyback authorization includes an accelerated share repurchase ("ASR") agreement to repurchase up to $150 million of the company’s common shares in the first quarter of fiscal 2022, while the remaining $150 million worth of shares will be repurchased over the next three quarters of fiscal 2022.

Fiscal 2022 View

In the first half of fiscal 2022, management expects to witness persistent constraints in consumer spending. Nevertheless, it expects to benefit from increasing customer spending on improved business outlook in the second half. Management also added that COVID recovery was uneven globally and the emergence of the delta variant strain has made situation very fluid.

For fiscal 2022, Aspen Technology expects revenues in the range of $702-$737 million. The Zacks Consensus Estimate for revenues is pegged at $700.5 million.

Annual spend growth rate is expected between 5% and 7%, while total bookings are projected in the range of $766-$819 million.

Non-GAAP net income is anticipated in the range of $4.79-$5.17 per share. The consensus mark for earnings is pegged at $4.66.

Management projects non-GAAP operating income in the range of $361-$391 million. Free cash flow is anticipated between $275 million and $285 million.

Zacks Rank & Stocks to Consider

Currently, Aspen Technology carries a Zacks Rank #3 (Hold).

Some other top-ranked stocks in the broader technology sector are Apple AAPL, Silicon Motion Technology SIMO and Shopify SHOP. All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Long-term earnings growth rate of Apple, Silicon Motion and Shopify is pegged at 12.7%, 8% and 25%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research