Assertio (ASRT) to Report Q4 Earnings: What's in the Cards?

We expect investors to focus on the sales performance of Assertio Holdings’ ASRT marketed drugs when it reports fourth-quarter 2022 results.

Assertio Holdings’ earnings surpassed expectations in three of the trailing four quarters and missed the same on one occasion, the average surprise being 54.96%. In the last reported quarter, ASRT witnessed a negative earnings surprise of 14.29%.

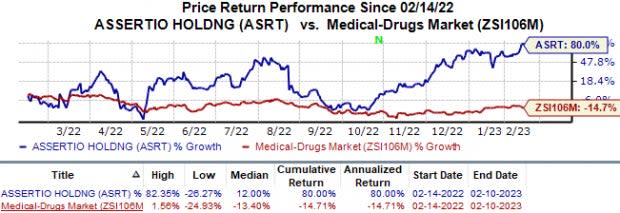

In the trailing 12 months period, shares of Assertio Holdings have surged 80.0% against the industry’s 14.7% fall.

Image Source: Zacks Investment Research

Assertio Holdings, Inc. Price and EPS Surprise

Assertio Holdings, Inc. price-eps-surprise | Assertio Holdings, Inc. Quote

Let’s see how things have shaped up for the quarter to be reported.

Factors to Consider

Assertio Holdings currently has multiple marketed products in its portfolio targeting a diverse range of diseases. The company’s lead product is Indocin, approved by the FDA for multiple indications, including rheumatoid arthritis, ankylosing spondylitis and osteoarthritis. The drug is approved by the regulatory agency for use in suppository and oral solution forms.

Other marketed products include Cambia (for acute treatment of migraine attacks), Otrexup (for treating rheumatoid arthritis and psoriasis indications), Oxaydi (for acute and chronic pain management), Sprix (for opioid pain relief), Sympazan(treatment of seizures associated with Lennox-Gastaut Syndrome)and Zipsor (for mild to moderate pain relief).

In the last reported quarter, net product sales rose 32% year over year, driven by net price favorability for Indocin, Cambia and Zipsor, a trend that most likely continued in the to-be-reported quarter too.

Key Development

Last October, Assertio signed a deal with Aquestive Therapeutics AQST. Per the terms of the deal, Assertio obtained an exclusive license for Sympazan, approved by the FDA as an adjunctive treatment of seizures associated with Lennox-Gastaut Syndrome (LGS) in patients aged two years and above. In consideration of these rights, Assertio paid $9.0 million to Aquestive as an upfront payment. The company also paid Aquestive an additional $6.0 million as a milestone payment upon patent allowance for Sympazan during the fourth quarter. Aquestive will also be eligible to receive royalties on net product Sympazan sales.

Based on the acquisition of the Sympazan license, management has also increased its outlook for the full year 2022. It expects full-year product sales to be greater than $152 million, a rise from the previously provided expectation of greater than $141 million. ASRT expects Sympazan sales to be immediately accretive to earnings. In the trailing 12 months ended Jun 30, 2022, Sympazan sales were $9.5 million.

Earnings Whispers

Our proven model predicts an earnings beat for Assertio Holdings this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Fortunately, that is the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Assertio Holdings has an Earnings ESP of 2.38% as the Most Accurate Estimate of 22 cents per share is higher than the Zacks Consensus Estimate of 21 cents.

Zacks Rank: Assertio Holdings currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few other stocks worth considering, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Alkermes ALKS has an Earnings ESP of +49.57% and a Zacks Rank #2.

Alkermes’ stock has risen 17.4% in the past year. Earnings of Alkermes beat estimates in three of the last four quarters while meeting the mark on another. On average, Alkermes witnessed a trailing four-quarter positive earnings surprise of 306.73%, on average. In the last reported quarter, Alkermes’ earnings met estimates. Alkermes is scheduled to release its fourth-quarter 2022 results on Feb 16, before market open.

Bayer BAYRY has an Earnings ESP of +6.25% and a Zacks Rank #3.

Bayer’s stock has risen 5.6% in the past year. Bayer beat earnings estimates in three of the last four quarters while missing the mark on one occasion. Bayer has a four-quarter earnings surprise of 18.23%, on average. In the last reported quarter, Bayer’s earnings missed estimates by 3.33%. BAYRY is scheduled to release its fourth-quarter 2022 results on Feb 28.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Assertio Holdings, Inc. (ASRT) : Free Stock Analysis Report

Aquestive Therapeutics, Inc. (AQST) : Free Stock Analysis Report