Asset Growth Likely to Support Blackstone's (BX) Q1 Earnings

Blackstone BX is scheduled to report first-quarter 2021 results on Apr 22, before the opening bell. Its revenues and earnings are likely to have increased in the quarter on a year-over-year basis.

In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate. Results primarily benefited from an improvement in revenues. Moreover, a rise in assets under management (AUM) balance, mainly driven by inflows, was a positive for the company.

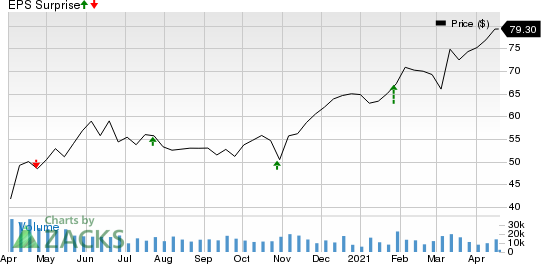

Blackstone has a decent earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in two, met in one and lagged in one of the trailing four quarters, the average surprise being 6.5%.

Blackstone Group IncThe Price and EPS Surprise

Blackstone Group IncThe price-eps-surprise | Blackstone Group IncThe Quote

However, business prospects and activities of the company in the first quarter failed to win analysts’ confidence. As a result, the Zacks Consensus Estimate for its earnings of 71 cents for the to-be-reported quarter has been unchanged over the past seven days. Nevertheless, the figure indicates a rise of 54.4% from the prior-year quarter’s reported number.

The consensus estimate for sales for the to-be-reported quarter is pegged at $1.74 billion, which suggests an increase of 52.2% from the year-ago quarter’s reported figure.

Now, let’s check the factors that are expected to have influenced the company’s first-quarter performance.

Key Factors to Note

Blackstone has been witnessing a rise in fee-earning AUM and total AUM for the past few years on the back of its diversified product and revenue mix, a superior position in the alternative investments space, and net inflows. Moreover, despite an overall challenging operating backdrop amid the coronavirus-induced crisis, the trend is likely to have continued in the to-be-reported quarter.

Similar to 2020, the first quarter of 2021 recorded a rise in market volatility and higher client activity. Moreover, the quarter witnessed decent asset inflows, which are expected to have aided AUM balance.

Notably, the Zacks Consensus Estimate for Blackstone’s first-quarter AUM is pegged at $627 billion, which indicates a rise of 1.3% from the previous quarter’s reported figure. Also, the consensus estimate for total fee-earning AUM of $480 billion suggests a sequential rise of 2.3%.

The Zacks Consensus Estimate for net management and advisory fees (segment revenues) for the to-be-reported quarter is pegged at $1.15 billion, which indicates growth of 1.7% from the prior quarter’s reported number.

However, the consensus estimate for fee-related performance revenues (segment revenues) of $30.54 million suggests a decline of 89.3% sequentially.

Blackstone’s expenses have been elevated over the past few years mainly because of higher general, administrative and other expenses. As the company continues to make investments in franchise, expenses are expected to have risen to some extent in the first quarter as well.

Here is what our quantitative model predicts:

According to our quantitative model, the chances of Blackstone beating the Zacks Consensus Estimate this time are high. That is because it has the right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or better.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Blackstone is +3.51%.

Zacks Rank: The company currently carries a Zacks Rank #3.

Other Stocks That Warrant a Look

Here are some other finance stocks that you may want to consider as these too have the right combination of elements to post an earnings beat in their upcoming releases, per our model.

BankUnited BKU is scheduled to release earnings on Apr 22. The company, which carries a Zacks Rank #3 at present, has an Earnings ESP of +0.64%.

The Earnings ESP for Invesco IVZ is +1.13% and it carries a Zacks Rank #3 at present. The company is slated to report quarterly numbers on Apr 27. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Capital One Financial Corporation COF is slated to report quarterly results on Apr 27. The company currently has an Earnings ESP of +1.47% and a Zacks Rank of 3.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

Blackstone Group IncThe (BX) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

BankUnited, Inc. (BKU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research