Assurant (AIZ) Q4 Earnings and Revenues Miss Estimates

Assurant, Inc. AIZ reported fourth-quarter 2020 net operating income of $1.82 per share, which missed the Zacks Consensus Estimate by 12.5%. Moreover, the bottom line declined 19.1% from the year-ago quarter.

The earnings reflect lower real-estate owned volumes in Global Housing, and softer investment income impacting each line of business in Global Lifestyle, offset by growth in domestic pre-funded funeral policies and prior period sales of the Final Need product in Global Preneed.

Total revenues were down 3.4% year over year to $2.5 billion due to lower fees and other income (down 29.4%) and net investment income (down 20.7%). Also, the top line missed the Zacks Consensus Estimate by 1.4%.

Total benefits, loss and expenses decreased 2.3% to $2.4 billion due to lower policyholder benefits, and selling, underwriting, general and administrative expenses.

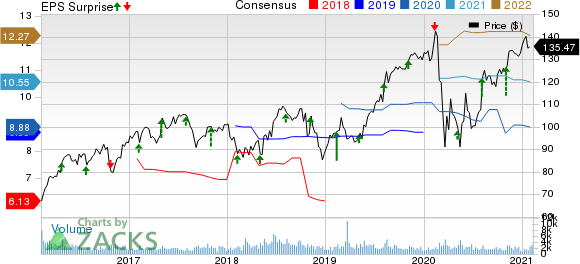

Assurant, Inc. Price, Consensus and EPS Surprise

Assurant, Inc. price-consensus-eps-surprise-chart | Assurant, Inc. Quote

Full-Year Highlights

In 2020, Assurant delivered net operating income of $8.63 per share, which missed the Zacks Consensus Estimate by 2.8%. However, the bottom line improved 0.9% year over year.

Total revenues of $10.1 billion missed the consensus mark by 0.7% but grew 0.9% year over year.

Segmental Performance

Net earned premiums, fees and others at Global Housing decreased 3% year over year to $496.7 million, primarily due to the expected run-off of small commercial business and declines in lender-placed policies in-force from the previously disclosed financially insolvent client as well as lower real estate owned volumes. The downside was partially offset by higher premium rates in lender-placed and continued growth in specialty products and multifamily housing.

The segment reported net operating income of $61.1 million, which decreased 16% year over year, primarily due to $28.2 million of higher reportable catastrophes, primarily from Hurricanes Zeta and Delta.

Net earned premiums, fees and others at Global Lifestyle decreased 2% year over year to $1.8 billion due to the impact from the mobile program contract change.

Net operating income of $87.9 million declined 10% year over year primarily due to a $16.3 million reduction in investment income impacting each line of business compared to the prior year period.

Net earned premiums, fees and others at Global Preneed rose 5% year over year to $53.8 million, primarily due to growth in domestic pre-funded funeral policies and prior period sales of the Final Need product. Net operating income declined 45% year over year to $8.8 million mainly due to $4.0 million of non-recurring items and updated assumptions for the earnings pattern of new policies. Higher mortality related to COVID-19 and lower investment income from lower yields also contributed to the decrease in the quarter.

Net operating loss at Corporate & Other was $22.9 million, wider than the year-ago quarter’s $21.6 million, primarily due to lower investment income from lower asset balances and yields compared to the prior-year period. The operating loss also includes $2.3 million of severance and real estate charges related to ongoing expense discipline and the evolution of Assurant’s workplace environment.

Financial Update

The company exited the fourth quarter with total assets of $44.6 billion, up 0.8% year over year. Debt was $2.2 billion, which increased 12.2% year over year.

Stockholders’ equity of $5.9 billion at the end of the quarter increased 5.3% year over year.

2021 Guidance

The company expects to provide its full-year 2021 outlook following the outcome of its evaluation of strategic alternatives, including a potential sale, of Global Preneed.

Zacks Rank & Peer Releases

The company currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Fourth-quarter earnings of Chubb Limited CB, Reinsurance Group of America RGA, and Markel Corporation MKL beat the respective Zacks Consensus Estimate.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Markel Corporation (MKL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research