Astec's (ASTE) Q2 Earnings Beat, Revenues Trail Estimates

Astec Industries, Inc.’s ASTE adjusted earnings jumped around 35.5% year over year to $1.03 per share in second-quarter 2018. Earnings also beat the Zacks Consensus Estimate of 93 cents.

Including one-time items, the company reported loss of $1.76 per share, in contrast with earnings of 62 cents per share recorded in the prior-year quarter.

Astec reported total revenues of $273 million in the June-end quarter, down 9.7% from $302 million posted in the year-ago quarter, mainly impacted by fall in domestic sales. In addition, the revenue figure missed the Zacks Consensus Estimate of $331 million.

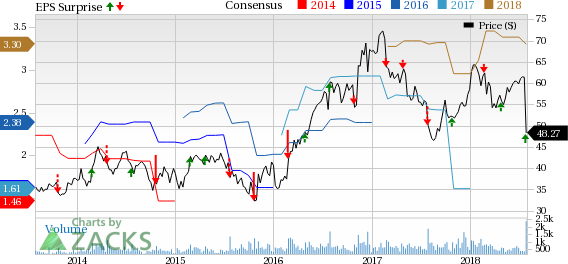

Astec Industries, Inc. Price, Consensus and EPS Surprise

Astec Industries, Inc. Price, Consensus and EPS Surprise | Astec Industries, Inc. Quote

Astec’s domestic sales dropped 14% year over year to $203 million. However, international sales increased 6.4% year over year to $69 million. Cost of sales rose nearly 15% year over year to $271 million. Gross profit came in at $1.1 million, down significantly from $65.5 million reported in the year-ago quarter. Gross margin contracted significantly year over year to 0.4%.

Selling, general, administrative and engineering expenses flared up 16% year over year to $51.3 million. The company reported adjusted loss of around $50.2 million against the adjusted earnings $21.3 million recorded in the prior-year quarter.

Segment Performance

Revenues for the Infrastructure Group segment slumped 42% to $83 million from $143 million in the year-ago quarter. The segment reported an operating loss of $62.7 million, against operating earnings of $9.9 million witnessed in the year-earlier quarter.

Total revenues for the Aggregate and Mining Group segment climbed 8.6% year over year to $116.3 million. Profit improved around 10% year over year to $12.5 million.

The Energy Group segment’s total revenues jumped 41% year over year to $73 million. The segment reported operating profit of $8.5 million, surging around 168% from $3.2 million in the comparable period last year.

Financial Position

Astec reported cash and cash equivalents of $65 million at the end of the June-end quarter, up from $52 million witnessed at the end of the year-ago quarter. Receivables decreased to $144 million as of Jun 30, 2018, from $149 million as of Jun 30, 2017. Inventories were at $394.8 million as of Jun 30, 2018, compared with $381.3 million as of Jun 30, 2017.

The company’s total backlog declined around 16% to $302.9 million as of Jun 30, 2018, from $360.5 million as of Jun 30, 2017. Backlog improved 38.9% and 33.6% in the Aggregate and Mining Group and Energy group, respectively. Backlog in the Infrastructure Group declined 51%. Domestic backlog decreased 23% year over year to $217.9 million as of Jun 30, 2018, and international backlog advanced 11% year over year to $85 million at the end of the reported quarter.

During the quarter under review, Astec and Highland agreed to restructure the company’s obligations related to Highland’s wood pellet plant and exit the company’s obligations regarding the plant. Per the terms of this agreement, Astec will pay $68 million in cash over the course of the next 120 days and forgive approximately $7 million in receivables. In exchange, Highland has agreed to release all of Astec’s contractual obligations related to the Arkansas wood-pellet plant.

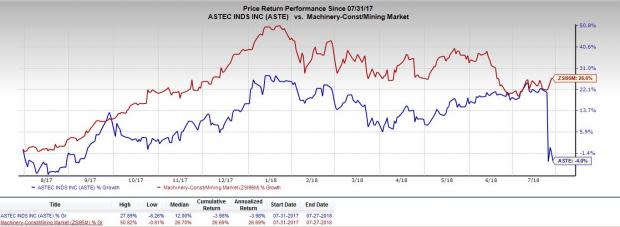

Share Price Performance

Astec’s shares have significantly underperformed the industry with respect to price performance over the past year. The stock has depreciated 4%, as against 27% growth registered by the industry.

Zacks Rank & Key Picks

Astec currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks in the same industry include W.W. Grainger, Inc. GWW, Chart Industries, Inc. GTLS and Terex Corporation TEX. While Grainger and Chart Industries Services sport a Zacks Rank #1 (Strong Buy), Terex carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Grainger has a long-term earnings growth rate of 12.5%. The stock has appreciated 104% in a year’s time.

Chart Industries has a long-term earnings growth rate of 26.9%. The company’s shares have been up 119% during the same time frame.

Terex has a long-term earnings growth rate of 21%. Its shares have rallied 12% in the past year.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Terex Corporation (TEX) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.