AstraZeneca (AZN) Q1 Earnings Top, COVID-19 Vaccine Adds $275M

AstraZeneca’s AZN first-quarter 2021 results were promising as it beat estimates for earnings as well as sales.

First-quarter 2021 core earnings of 82 cents per American depositary share (“ADS”) beat the Zacks Consensus Estimate of 71 cents. Core earnings per share of $1.63 were up 53% year over year at constant exchange rates (“CER”).

Total revenues were up 15% on a reported basis and 11% at CER to $7.32 billion in the quarter, driven by higher product sales. The company’s COVID-19 vaccine added $275 million to revenues from delivery of 68 million doses in several countries. Excluding COVID-19 vaccine sales, total revenues were up 7% at CER. Revenues beat the Zacks Consensus Estimate of $7.26 billion. However, sales were hurt due to COVID-19 pandemic.

Shares of AstraZeneca were up 3.7% in pre-market trading on Apr 30, following the announcement of first-quarter results. So far this year, the company’s shares have gained 2.7% compared with an increase of 2.1% for the industry.

All growth rates mentioned below are on a year-over-year basis and at CER.

Product Sales Rise

Product sales rose 11% at CER to $7.3 billion driven by higher sales of new medicines across Oncology and BioPharmaceuticals segments, including relatively newer medicines — Tagrisso and Farxiga.

Collaboration revenues were $63 million, up 42% at CER.

Among AstraZeneca’s various therapeutic areas, Oncology product sales were up 16%. In BioPharmaceuticals, New CVRM product sales were up 15% while Respiratory & Immunology segment declined 4%. Sales of other medicines declined 5%.

Sales in Detail

In Oncology, Lynparza product revenues rose 33% year over year to $543 million on the back of strong uptake in prostate cancer and first-line ovarian cancer. The drug is the leading PARP-inhibitor drug in the United States. AstraZeneca markets Lynparza in partnership with Merck MRK.

Tagrisso recorded sales of $1.15 billion, up 13% year over year on strong demand as an adjuvant therapy for treating lung cancer patients, partially offset by lower new patient diagnoses due to the impact of COVID-19, in the United States. European sales of the drug were driven by strong demand in first-line lung cancer treatment.

Imfinzi generated sales of $556 million in the quarter, up 17% year over year on strong demand for advanced lung cancer patients, partially offset by lower new patient starts amid COVID-19.

New drug Calquence generated sales of $209 million in the quarter compared with $182 million in the previous quarter. New drug, Koselugo, approved in April 2020, generated sales of $21 million in the quarter compared with $17 million in the previous quarter.

Sales of all legacy cancer drugs — Iressa, Zoladex, Arimidex, Faslodex and Casodex — declined during the quarter.

In CVRM, Brilinta/Brilique sales were $374 million in the reported quarter, down 11% year over year due to the impact of COVID-19.

Farxiga recorded product sales of $624 million in the quarter, up 50% year over year, reflecting growth across all regions. Bydureon sales increased 1% to $103 million. Sales of Seloken increased 36% to $200 million.

Crestor sales declined 12% to $274 million. Onglyza sales declined 31% to $101 million. Atacand sales were down 49% to $34 million. Byetta sales were down 20% to $16 million.

In Respiratory & Immunology, Symbicort sales declined 15% in the quarter to $691 million due to generic competition. Pulmicort sales declined 18% to $330 million reflecting fewer hospital treatment of respiratory patients.

Fasenra recorded sales of $260 million in the quarter, up 27% year over year driven by higher demand for Fasenra Pen home administration device, which partially offset the impact of lower new patient starts due to COVID-19.

Bevespi, a LAMA/LABA in a pressurized metered dose inhaler, recorded sales of $13 million in the quarter, up 5% year over year.

In Other Medicines, sales of Nexium rose 15% to $403 million while sales of Synagis and Seroquel declined 72% and 22% to $24 million and $29 million, respectively.

Profit Discussion

AstraZeneca’s core gross margin of 74.6% was down three-percentage points at CER. Core selling, general and administrative (SG&A) expenses increased 7% to $2.4 billion.

Core research and development (R&D) expenses rose 18% to $1.64 billion. Core operating profit rose 34% to $2.5 billion in the quarter. Core operating margin increased six percentage points to 34.5% in the quarter.

2021 Guidance Maintained

AstraZeneca maintained its previous guidance, issued on its fourth-quarter earnings call, for revenues and core earnings for 2021. The company expects total revenues to increase in low-teens percentage. Core earnings are expected to remain between $4.75 and $5.00 per share.

The guidance does not include any future sales from the COVID-19 Vaccine and any material impact of the Alexion Pharmaceuticals ALXN acquisition, expected to be completed in the third quarter of 2021.

AstraZeneca stated that it expects adverse impact of COVID-19 pandemic to reduce during the second half of 2021 and anticipates growth to accelerate during the same period.

Coronavirus Vaccine Update

AstraZeneca announced data from primary analysis of U.S. phase III study of its COVID-19 vaccine during the first quarter. Data showed vaccine efficacy of 76% at preventing symptomatic COVID-19, consistent with previously reported interim data. Moreover, vaccine efficacy was 85% in adults 65 years and older and the vaccine was 100% effective in preventing severe or critical disease and hospitalization.

Though the vaccine is approved for emergency/condition use in several countries, the company plans to submit a regulatory application seeking Emergency Use Authorization for its COVID-19 vaccine in the United States in a few weeks. Meanwhile, the vaccine faced backlash in March in several countries for potential risk of rare thrombotic events in people administered with the vaccine. Some countries temporarily paused inoculation with AstraZeneca’s vaccine. However, earlier this month, vaccination was resumed after regulatory agencies in the United Kingdom and Europe reaffirmed that the risk is outweighed by the vaccine’s overall benefits.

Other approved coronavirus vaccines for emergency use include Pfizer PFE/BioNTech’s BNT162b, Moderna’s mRNA-1273 and J&J’s single-shot coronavirus vaccine.

Apart from the vaccine, the company is conducting three phase II/III studies on AZD7442, a long-acting antibody combination therapy for the prevention and treatment of COVID-19. Initial data from these studies are expected later this year. In March, AstraZeneca amended an existing supply agreement with the U.S. government to supply the antibody drug following a potential approval/authorization from the FDA. Per the amended agreement, the company will supply up to additional 500,000 doses of the candidate. Initially, the company had an agreement for 100,000 doses. The company has a separate agreement with the Department of Defense of U.S. government for another 100,000 doses.

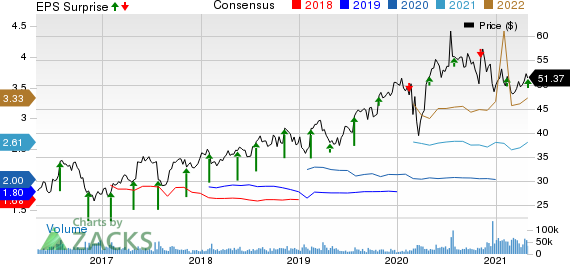

AstraZeneca PLC Price, Consensus and EPS Surprise

AstraZeneca PLC price-consensus-eps-surprise-chart | AstraZeneca PLC Quote

Zacks Rank

AstraZeneca currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alexion Pharmaceuticals, Inc. (ALXN) : Free Stock Analysis Report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research