AstraZeneca shares slump in wake of $39bn Alexion offer

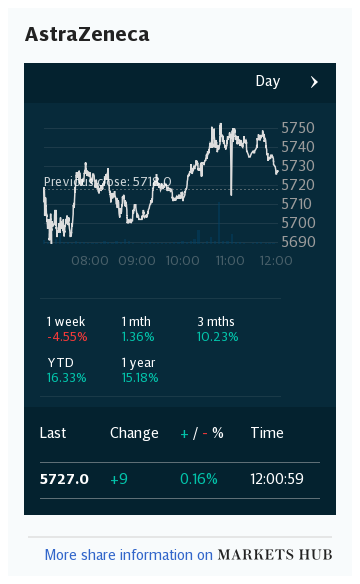

AstraZeneca shares slumped to an eight-month low after announcing a $39bn (£31bn) deal to buy rare disease specialist Alexion Pharmaceuticals.

The shares fell as much as 9pc to their lowest level since April on Monday amid investor fears that it was paying too high a price for the US biotech.

The $175-a-share offer represents a 45pc premium to the value of Alexion's shares before the deal was announced on Saturday.

AstraZeneca shares have also been under pressure in recent weeks amid questions surrounding the efficacy of its potential Covid vaccine and the way the late-stage trials were run.

However, Ketan Patel, a fund manager at EdenTree Investment Management, said it was common for shares to take a hit like this.

"When you get a large deal like this, unless it is knockout people always get nervous about it. So I have been brave today and I have topped up. It makes sense and will boost Astra's cash flow massively," he said.

Since he became chief executive of AstraZeneca in 2012, Pascal Soriot, has bet on a strategy of investing heavily over the long term in cutting-edge science and anticipating where innovation was heading. It was the reason why, six years ago, he batted away a bid from US rival Pfizer, arguing that AstraZeneca could deliver better value alone.

"Pascal said he could get a better return, and he has overdelivered," said Mr Patel.

Alexion has been touted as a takeover target for a long time. Activist investor Elliott earlier this year wrote to Alexion's board in May urging them to sell the company.

AstraZeneca, meanwhile, needs more blockbuster products in its portfolio to reach its revenue goal of $40bn by 2023. It also needs to increase its cashflow to raise the dividend, which as been flat for over a decade and would make it more attractive to investors.

John Rountree, a partner at Novastecta, said it was a good deal for both parties.

"The shares have taken a knock but this is a long-term deal, and I think AstraZeneca is seeing where innovation is going long-term and is boosting up the capability for that," he said.

"AstraZeneca has been investing heavily in oncology but realises this won't last forever so it is looking at the next wave of innovation, which is immunology. So it's a hedge and gives AstraZeneca access via Alexion to US capital markets where there is a lot of money."

Alexion is big in rare and ultra-rare diseases and its drugs adjust the way the immune system works to treat these diseases. Alexion’s Soliris medication was once the most expensive drug in the world. It costs $500,000 a year and still brings in $1bn a quarter, even though it was first approved in 2007.

Its portfolio will complement Astra's existing rare disease pipeline, which is small. It's also a hugely profitable company - margins on rare disease medications are 50pc to 80pc - and the shares are relatively cheap.

The stock is worth less than it was five years ago and the shares trade at just 10 times earnings - extremely low for a pharmaceutical company. "Some might argue the deal undervalues Alexion," Mr Rountree said.

Alexion will be able to leverage AstraZeneca's global muscle and infrastructure. Astra has huge operations across China and the developing world, while the lion's share of Alexion's sales are in the US and Europe.

"I think that it’s a good deal for both sets of shareholders," agreed David Cox, an analyst at Panmure Gordon.

"Alexion brings a strong rare disease franchise to AstraZeneca, that can complement its hugely successful oncology portfolio. Ultomiris, approved in 2018 is Alexion’s next generation drug from Soliris and has to be administered six to seven times a year vs Soliris at 26 times per year. So there is an ongoing commercial task to convert patients which AstraZeneca can help with and probably accelerate."

Shares in Alexion surged by just over 30pc in afternoon trading in New York to $158.33.

AstraZeneca closed 5.9pc lower at £76.78, bringing its market value down to just over £100bn.

If approved by shareholders, the deal will mark the largest transaction for AstraZeneca since it was founded in a 1999 combination of British and Swedish companies. It would also be the largest British takeover of a US company this year.

A combined group would have $32bn in annual sales and make AstraZeneca the world's seventh-largest pharmaceutical company and the biggest FTSE 100 outfit worth close to £180bn.