AtCor Medical Holdings Limited (ASX:ACG): How Does It Impact Your Portfolio?

For AtCor Medical Holdings Limited’s (ASX:ACG) shareholders, and also potential investors in the stock, understanding how the stock’s risk and return characteristics can impact your portfolio is important. The beta measures ACG’s exposure to the wider market risk, which reflects changes in economic and political factors. Different characteristics of a stock expose it to various levels of market risk, and the broad market index represents a beta value of one. Any stock with a beta of greater than one is considered more volatile than the market, and those with a beta less than one is generally less volatile.

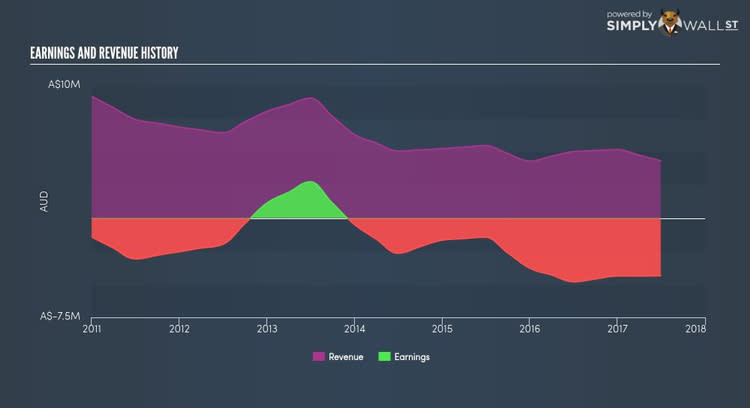

View our latest analysis for AtCor Medical Holdings

What does ACG’s beta value mean?

AtCor Medical Holdings’s five-year beta of 1.42 means that the company’s value will swing up by more than the market during prosperous times, but also drop down by more in times of downturns. This level of volatility indicates bigger risk for investors who passively invest in the stock market index. According to this value of beta, ACG can help magnify your portfolio return, especially if it is predominantly made up of low-beta stocks. If the market is going up, a higher exposure to the upside from a high-beta stock can push up your portfolio return.

How does ACG’s size and industry impact its risk?

A market capitalisation of AUD A$6.74M puts ACG in the category of small-cap stocks, which tends to possess higher beta than larger companies. But, ACG’s industry, healthcare equipment and supplies, is considered to be defensive, which means it is less volatile than the market over the economic cycle. Therefore, investors can expect a high beta associated with the size of ACG, but a lower beta given the nature of the industry it operates in. This is an interesting conclusion, since its industry suggests ACG should be less volatile than it actually is. A potential driver of this variance can be a fundamental factor, which we will take a look at next.

Can ACG’s asset-composition point to a higher beta?

An asset-heavy company tends to have a higher beta because the risk associated with running fixed assets during a downturn is highly expensive. I test ACG’s ratio of fixed assets to total assets in order to determine how high the risk is associated with this type of constraint. Since ACG’s fixed assets are only 20.71% of its total assets, it doesn’t depend heavily on a high level of these rigid and costly assets to operate its business. As a result, the company may be less volatile relative to broad market movements, compared to a company of similar size but higher proportion of fixed assets. This outcome contradicts ACG’s current beta value which indicates an above-average volatility.

What this means for you:

Are you a shareholder? You may reap the gains of ACG’s returns during times of economic growth by holding the stock. Its low fixed cost also implies that it has the flexibility to adjust its cost to preserve margins during times of a downturn. I recommend analysing the stock in terms of your current portfolio composition before deciding to invest more into ACG. For more company-specific research on ACG, check out our our free analysis plaform here.

Are you a potential investor? Before you buy ACG, you should take into account how their portfolio currently moves with the market, in addition to the current economic environment. ACG may be a valuable addition to portfolios during times of economic growth, and it may be work looking further into fundamental factors such as current valuation and financial health. You can examine these factors in our free fundamental research report for ACG here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.