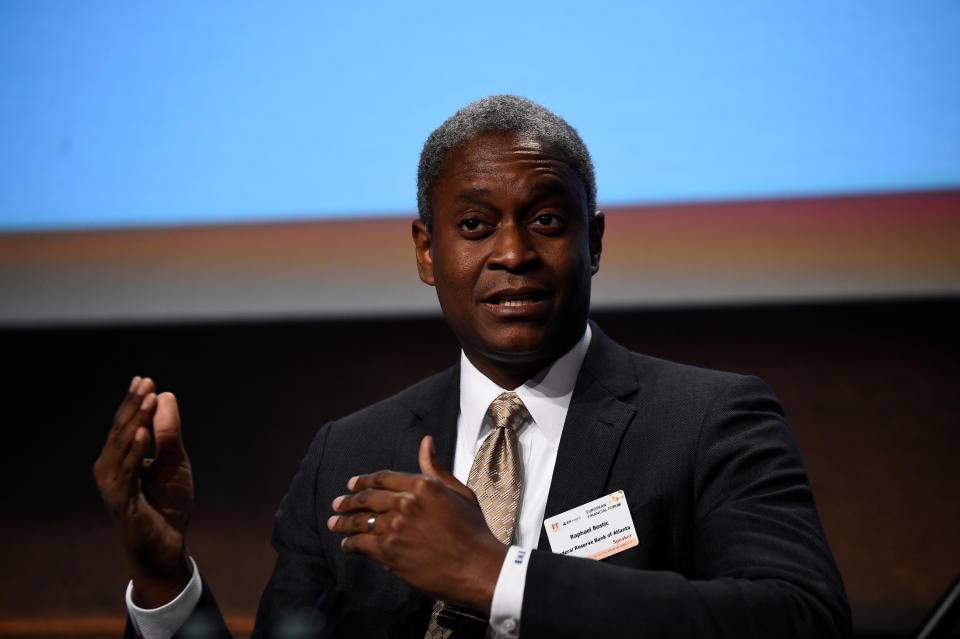

Atlanta Fed's Bostic: Economy could 'turn on again' in the third quarter

Federal Reserve Bank of Atlanta President Raphael Bostic told Yahoo Finance on Tuesday that the U.S. economy could begin its recovery in the third quarter, depending on the health response to the novel coronavirus.

Bostic said he is hopeful that portions of the U.S. can reach the peak of coronavirus cases soon, predicting the third quarter of this year “could be a time when we start to see things turn on again.”

But Bostic reiterated that the timing will depend on the health response, adding that the “recovery arc” could take longer if the virus is not properly contained.

In the meantime, Bostic said the Fed will continue to act “aggressively” to make sure businesses and households have access to credit.

"One thing that we learned coming out of the Great Recession was that Fed policy is most effective if it goes big and it goes early,” Bostic told Yahoo Finance in an exclusive interview on Tuesday.

Bostic said the Fed is taking “dramatic and drastic actions” to ensure the availability of credit through the banking system. The Fed has opened nine liquidity facilities to backstop markets ranging from U.S. Treasuries to U.S. dollar funding, all of which are aimed at calming financial markets that appeared to be malfunctioning as the coronavirus spread across the U.S.

Last week, the Fed unveiled $2.3 trillion in funding to the U.S. economy, with a focus on providing liquidity to Main Street loans and municipal debt markets. The announcement also included some help to companies with “fallen angel” debt, or investment-grade bonds that had slipped into junk territory.

Concerns over nonprofits and mortgage servicers

Bostic told Yahoo Finance that he has some concerns over the health of nonprofits and mortgage servicers.

Bostic said nonprofits, at the forefront of the relief efforts, may not benefit from the Paycheck Protection Program offered through the CARES Act, the part of the $2.2 trillion coronavirus stimulus meant to aid small businesses. On mortgage servicers, Bostic said late mortgage payments may stress the ability of servicers (which are in many cases, non-banks that are unsupervised by the Fed) to cover their obligations.

Bostic added that the gig economy is also seeing some signs of stress.

“We’re going to have to think about ways that we can restructure or provide carve-outs, so that we don't lose important activities and those sectors,” Bostic said.

Bostic said the municipal debt markets are still showing some signs of “pressure and tension,” hinting that Congress could give the Fed authorization to expand its relief efforts to state and local debt.

Amid the central bank’s efforts to soften the blow of COVID-19 to the economy, the Fed’s ballooning balance sheet has come into view as the central bank recently blew through the $6 trillion mark on its asset holdings.

Bostic said the many liquidity facilities have “sunset times” on them and added that the pace of asset purchases will not last forever.

“I’m not expecting our balance sheet to remain at this size,” Bostic said. “As we get into the recovery phase, I think the natural course of events will lead our balance sheet to start to shrink.”

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

Powell: Fed will act 'forcefully, proactively, and aggressively' to support the US economy

Federal Reserve announces $2.3 trillion in funding for households, local governments

Coronavirus could wipe out nearly a fifth of small businesses: NY Fed survey

Banks undergoing 'real stress test' as recession fears continue

A glossary of the Federal Reserve's full arsenal of 'bazookas'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.