Is Atlanta (NSE:ATLANTA) Using Debt In A Risky Way?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Atlanta Limited (NSE:ATLANTA) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Atlanta

What Is Atlanta's Debt?

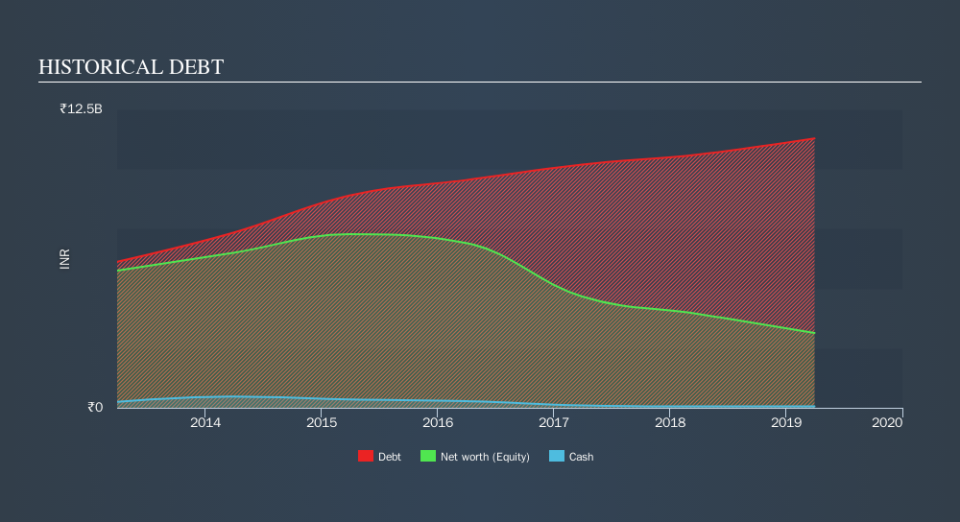

The image below, which you can click on for greater detail, shows that at March 2019 Atlanta had debt of ₹11.3b, up from ₹10.6b in one year. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Atlanta's Balance Sheet?

The latest balance sheet data shows that Atlanta had liabilities of ₹3.79b due within a year, and liabilities of ₹9.36b falling due after that. On the other hand, it had cash of ₹58.7m and ₹944.7m worth of receivables due within a year. So its liabilities total ₹12.1b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the ₹578.7m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Atlanta would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Atlanta will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Atlanta made a loss at the EBIT level, and saw its revenue drop to ₹482m, which is a fall of 75%. That makes us nervous, to say the least.

Caveat Emptor

Not only did Atlanta's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping ₹158m. When you combine this with the very significant balance sheet liabilities mentioned above, we are so wary of it that we are basically at a loss for the right words. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it lost ₹920m in the last year. So we think buying this stock is risky, like walking through a minefield with a mask on. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Atlanta's profit, revenue, and operating cashflow have changed over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.