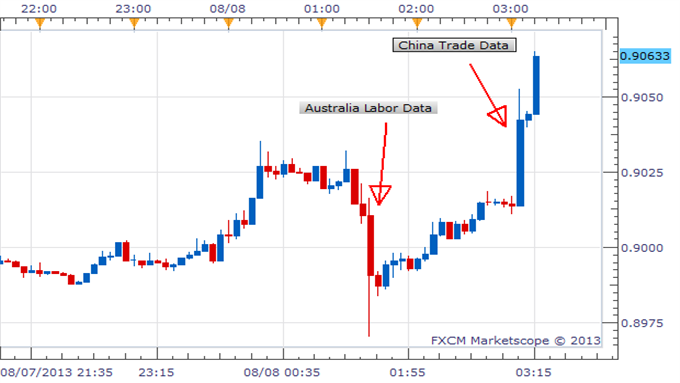

AUD/USD Lower On Employment Data, Higher On China Trade Balance

THE TAKEAWAY:Australia prints soft employment figures > Investors likely increased expectations for RBA easing > Investors reduce expectations after China releases positive trade data that likely points to stronger economic growth > AUD/USD Higher

The Aussie traded lower against the US Dollar as the Australian economy lost 10,200 jobs in July, missing expectations for a 5000 increase. Full-time employment led the decline with 6700 jobs lost while part-time employment saw 3500 jobs disappear. Unemployment rate remained the same at 5.7 percent but only because participation rate declined to 65.1 percent, the lowest this year. This release contrasts June’s promising labor data and likely serves to confirm the reserve bank’s expectation for below trend growth in the near term.

The pair fell nearly 40 pips after the release, likely on investor expectations for the RBA to consider scope for further easing. However, price movements failed to signal a breakout, likely hinting at traders waiting for Chinese trade balance data.

The Aussie rallied on a positive Chinese report. Although a 17.82 billion dollar trade surplus missed expectations, exports and imports grew 5.1 and 10.9 percent year-over-year respectively. For Australia, higher Chinese exports could point to more productive industrial production that increases demand for Australian commodities. Higher imports could suggest more domestic consumption that fuels economic growth. This data likely fueled investor speculation for a more positive economic outlook that reduces the RBA’s need to encourage economic growth, thus moving the pair higher.

Looking forward, China is scheduled to release more data that will help gauge the health of its economy. Investors will likely be looking towards CPI and industrial production to help direct their expectations for future RBA policy.

AUD/USD (5-Minute Chart)

Source: FXCM Marketscope

New to Forex? Watch this introduction video.

Jimmy Yang, DailyFX Research Team

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.