August Starts, Permits Rise: 7 Construction Stocks to Bet on

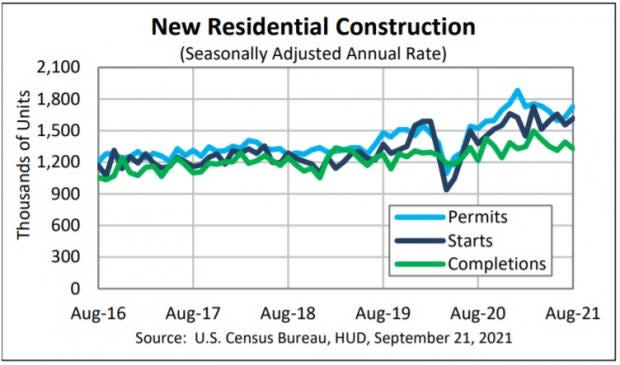

The Construction sector is currently banking on a positive housing momentum. The recent housing starts data and builders confidence bear testament to the fact. U.S. housing starts inched up in August after a significant drop in July, thanks to an improvement in the construction of multifamily housing units. Building permits also surged to the second-highest level since April. Impressively, U.S. housing starts and building permits came ahead of analysts’ expectations by 3.9% and 6.7%, respectively.

Despite struggling with various supply-side woes and affordability issues, the housing market witnessed solid demand for new homes. U.S. residents have been looking for new homes in lower-density markets, including small metro areas, rural markets and large metro exurbs, seeking larger homes to work from home.

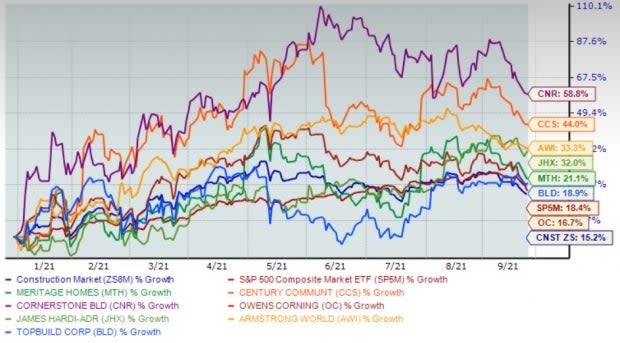

In the year-to-date period, the Zacks Construction sector and S&P 500 composite have gained 15.7% and 18.5%, respectively.

Key Takeaways

On Sep 21, the U.S. Census Bureau and U.S. Department of Housing and Urban Development jointly reported that privately-owned housing starts climbed 3.9% to a seasonally adjusted annual rate of 1.615 million units in August from the previous month’s upwardly revised 1.554 million units. A 21.6% rise in multi-family housing starts was partially overshadowed by a 2.8% drop in single-family homebuilding units.

Image Source: U.S. Census Bureau, HUD

In August, privately-owned housing starts increased 167.2%, 11.4% and 1.4% from July levels in Northeast, Midwest, and South, respectively. Yet, the metric decreased in the West region by 21.1%.

Building permits for the said month rose 6% to 1.728 million units from July’s revised 1.630 million units. Single-family authorizations inched up 0.6%.

Housing starts and building permits rallied 17.4% and 13.5% from the year-ago figures, respectively.

Stabilizing Lumber Prices & Higher Demand to Overcome Risks

Although a risk of affordability is expected to rise in the coming months due to accelerating home prices, declining softwood lumber prices raise hopes. The recent homebuilder confidence level also signals a positive outlook. The September reading registered its first monthly gain over the past four months. (Read more: Builders Regain Confidence in September: Top 4 Housing Picks)

Input prices used for residential construction — excluding energy — fell 0.7% in August from a month ago, per the latest Producer Price Index report released by the Bureau of Labor Statistics. The downturn was largely due to a decline in lumber and wood products prices. This was the first monthly decline since the start of the last recession. Also, hiring in the construction sector increased 5.2% in July from the June reading, per the recent BLS’ Job Openings and Labor Turnover report.

Image Source: Zacks Investment Research

Per the Census Bureau’s recent Monthly Construction Spending report, private residential construction spending rose 0.5% in July from the June reading. Total private residential construction spending was 27% higher than a year ago.

The positive momentum is likely to continue on low mortgage rates, which remained below 3% for the majority of 2021. Per Freddie Mac’s latest Primary Mortgage Market Survey, the average U.S. 30-year fixed-rate mortgage for the week ended Sep 16 declined 2 basis points (bps) to 2.86% from a week ago. The metric also declined 1 bps from 2.87% recorded in the corresponding prior-year period.

Persistent supply chain disruptions since the pandemic outbreak and significant job loss drastically ailed the homebuilding and related construction industries. These headwinds are likely to persist in the second half of 2021 as well.

Nonetheless, the willingness for more space to accommodate working and learning from home will drive the U.S. housing market.

Top 7 Construction Picks

On the back of a solid housing market backdrop and the ongoing woes, here are a few stocks from the Zacks Building Products - Home Builders, the Zacks Building Products - Concrete and Aggregates, and the Zacks Building Products - Miscellaneous industries that investors might include in their portfolio.

These stocks are picked with the help of the Zacks Stock Screener and carry a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Meritage Homes Corporation MTH: This leading designer and builder of single-family homes mainly benefits from strategic initiatives to boost profitability and focus on entry-level LiVE.NOW homes. Earnings estimates for the year have moved 28.9% upward in the past 60 days, implying 72.4% year-over-year growth. The company’s shares have appreciated 21.1% so far this year. Currently, it sports a Zacks Rank #1.

Century Communities, Inc. CCS: This Zacks Rank #1 homebuilder banks on strong demand for affordable new homes and the strength of its competitive positioning and national footprint across 30 high-growth markets. Its shares have gained 44% in the year-to-date period. Earnings estimates for the current year have witnessed an upward revision of 18% in the past 60 days, indicating 115.9% year-over-year growth.

Both Meritage Homes and Century Communities have outperformed the industry’s 15.1% rally.

Cornerstone Building Brands, Inc. CNR: This leading manufacturer of exterior building products, primarily in North America, currently carries a Zacks Rank #1. It primarily rides on a solid business model, strategic efforts to optimize its portfolio, strong residential demand and price actions. Its shares have gained 58.8% year to date, outperforming the industry’s 24.4% growth. Earnings estimates for the current year have witnessed an upward revision of 104.8% in the past 60 days, suggesting 547.9% year-over-year growth.

Owens Corning OC: This building materials systems and composite solutions provider has been riding on inorganic drive, strong volumes and price realization as well as high manufacturing efficiencies across businesses. This Zacks Rank #2 company’s shares have gained 16.7% so far this year. Earnings estimates for the year have increased 8.7% in the past 60 days, pointing to 68.1% year-over-year growth.

James Hardie Industries plc JHX: This leading producer and marketer of high-performance fiber cement and fiber gypsum building solutions gains from robust housing demand, high-value product mix and innovations via expansion into new categories. Its shares have gained 32% in the year-to-date period. In the past two months, the company’s earnings estimates have remained stable at $1.34 per share, indicating 30.1% year-over-year growth. Currently, it carries a Zacks Rank #2.

Armstrong World Industries, Inc. AWI: This global producer of ceiling systems for commercial, institutional, and residential buildings benefits from an increased focus on new products along with a systematic inorganic strategy to enhance its portfolio. This Zacks Rank #2 company’s shares have gained 33.3% so far this year. Earnings estimates for the year have increased 10.5% in the past 60 days, pointing to 16.3% year-over-year growth.

TopBuild Corp. BLD: This Zacks Rank #2 installer and distributor of insulation and other building products mainly rides on solid housing market fundamentals, systematic inorganic strategy, Insulation Installation business, and improving repair and remodeling activities. Its shares have gained 44% in the year-to-date period. Earnings estimates for the current year have witnessed an upward revision of 18% in the past 60 days, indicating 115.9% year-over-year growth.

Impressively, Owens Corning, James Hardie, Armstrong World and TopBuild have outperformed the industry’s 8.1% rise.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Century Communities, Inc. (CCS) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

James Hardie Industries PLC. (JHX) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Cornerstone Building Brands, Inc. (CNR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research