Is Ausdrill Limited (ASX:ASL) Potentially Underrated?

I’ve been keeping an eye on Ausdrill Limited (ASX:ASL) because I’m attracted to its fundamentals. Looking at the company as a whole, as a potential stock investment, I believe ASL has a lot to offer. Basically, it has a a great track record of performance and a buoyant growth outlook not yet priced into the stock. In the following section, I expand a bit more on these key aspects. For those interested in digger a bit deeper into my commentary, take a look at the report on Ausdrill here.

Very undervalued with high growth potential

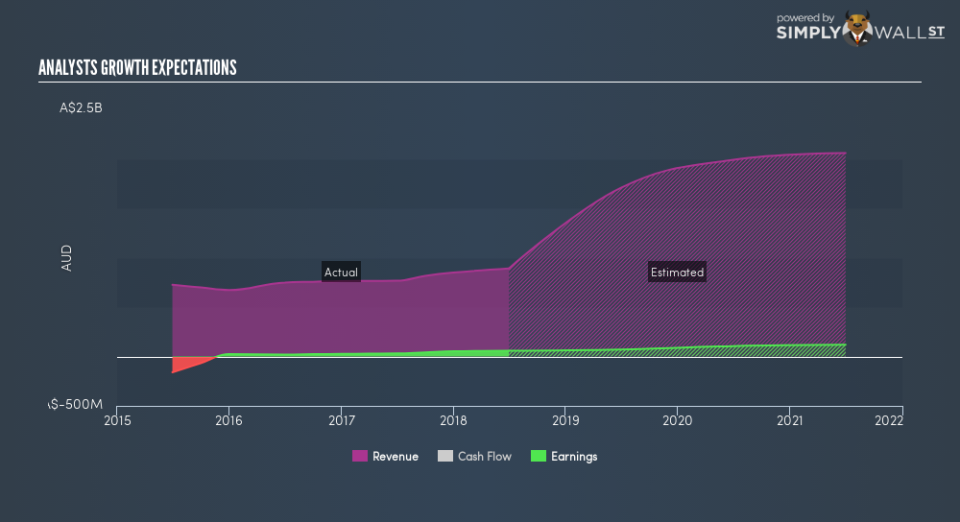

One reason why investors are attracted to ASL is its notable earnings growth potential in the near future of 24%. Earnings growth is paired with an eye-catching top-line trajectory also doubling over the same period, which indicates a high-quality bottom-line expansion, as opposed to those driven by unsustainable cost-cutting activities. ASL delivered a bottom-line expansion of 92% in the prior year, with its most recent earnings level surpassing its average level over the last five years. In addition to beating its historical values, ASL also outperformed its industry, which delivered a growth of 26%. This is an notable feat for the company.

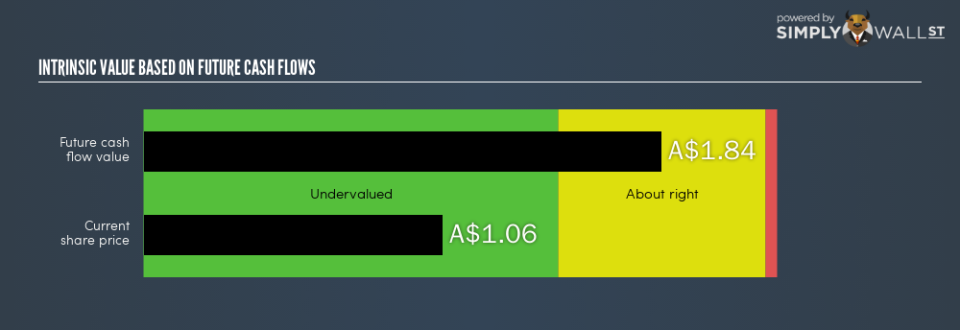

ASL’s shares are now trading at a price below its true value based on its discounted cash flows, indicating a relatively pessimistic market sentiment. Investors have the opportunity to buy into the stock to reap capital gains, if ASL’s projected earnings trajectory does follow analyst consensus growth, which determines my intrinsic value of the company. Compared to the rest of the metals and mining industry, ASL is also trading below its peers, relative to earnings generated. This bolsters the proposition that ASL’s price is currently discounted.

Next Steps:

For Ausdrill, I’ve compiled three fundamental aspects you should further examine:

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Dividend Income vs Capital Gains: Does ASL return gains to shareholders through reinvesting in itself and growing earnings, or redistribute a decent portion of earnings as dividends? Our historical dividend yield visualization quickly tells you what your can expect from ASL as an investment.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of ASL? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.