Australian Dollar Faces Make-or-Break Event Risk as FOMC Meets

Australian Dollar Faces Make-or-Break Event Risk as FOMC Meets

Fundamental Forecast for Australian Dollar: Neutral

Australian Dollar Floundered Alongside US Treasury Yields on Fed QE “Taper” Bets

FOMC Now in Focus; Outright QE Reduction, Hawkish Rhetoric to Sink the Aussie

DailyFXSSI Speculative Sentiment Gauge Argues for Further Aussie Dollar Selling

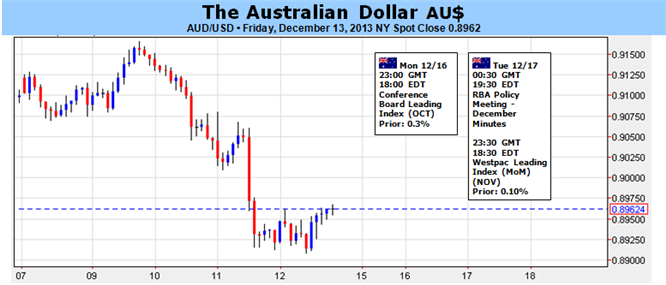

The Australian Dollar accelerated downward last week, losing nearly 2 percent against its US namesake and entering the weekend at the lowest level in three months. The move lower over the past eight weeks has closely mirrored a recovery in benchmark 10-year US Treasury bond yields, suggesting the liquidation reflects building speculation about an imminent cutback of the Federal Reserve’s QE3 asset purchases.

The foundation for scaling down stimulus appears to be in place. Fiscal drag fears – already on the decline since end of the government shutdown in mid-October – appear to have all but faded after Congress secured a two-year budget deal last week. Meanwhile, US economic data has increasingly outperformed relative to market forecasts since the beginning of November (according to data compiled by Citigroup). Finally, near-term inflation expectations have started to perk up, with the 1-year breakeven rate (a measure of the price growth outlook priced into bond yields) surging in late November to the highest level since mid-April.

The moment of truth arrives next week as the Fed’s policy-setting FOMC committee meets for its sit-down of the year. A Bloomberg survey shows that 14 out of 65 polled economists expect a slowdown in MBS purchases while 20 out of 65 predict a reduction in Treasury bond intake. That points to a dramatic increase in taper bets compared with what the same survey showed just a few weeks ago but leaves those calling for the status quo in the majority.

On balance, that skews outsized volatility risk toward the hawkish side of the spectrum, meaning the most potent outcome is likely to be an outright QE cutback. A decision to hold off this time around against a backdrop of taper-supportive cues in the Fed’s updated set of economic forecasts and/or Ben Bernanke’s last press conference as Chairman represents the second-most volatile scenario.

Either outcome is likely to give a negative jolt to risk appetite trends while pushing the US Dollar higher, amplifying selling pressure on the Aussie in the process. Needless to say, the absence of either of these developments stands to yield the inverse dynamic, although follow-through might be less dramatic considering such a result would fall broadly in line with the consensus view.

On the domestic front, December’s HSBC Chinese Manufacturing PMI report represents the only bit of noteworthy event risk. Expectations call for a slight pickup in factory-sector activity. As a stand-alone release, this might have helped the Aussie higher, but taken against a backdrop of Fed-related macro gyrations across the financial markets the data may not even register on investors’ radar. - IS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.