Australian Trade Balance Reaches Largest Deficit Since 2008, Aussie Sold

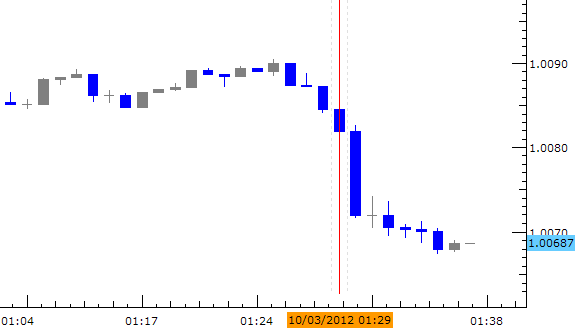

THE TAKEAWAY: Aussie trade balance reached largest deficit since March 2008 > High exchange rate, global slowing largely to blame > Australian dollar sold

The Aussie Dollar traded lower versus its major counterparts as the Australian trade balance recorded a deficit of A$2,027 million marking the biggest deficit since March of 2008. The negative print serves as further confirmation that an elevated exchange rate continues to weigh on economic growth. The RBA monetary policy release yesterday highlighted soft global growth and an elevated exchange as the key drivers behind their decision to reduce financing costs in an attempt to help spur growth and unwind speculative carry demand for the higher yielding currency.

Chinese non-manufacturing industry also reached record slowing affirming the economic stagnation in Europe may be spilling over to the service industry along with weak manufacturing. Chinese demand for Australian exports is a major driver behind Aussie growth.

Markets appear to be pricing in a 80 percent chance of another 25 basis point reduction to rates during next month’s RBA policy meeting.

AUD/CAD, 1 Minute Chart

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.