Auto Roundup: GM Tops Q4 Earnings Mark, Ford Misses & More

Last week, many auto biggies released U.S. vehicle sales data for January 2023. Among the automakers that revealed monthly sales numbers, Honda, Ford, Mazda, Hyundai, Kia, Subaru and Volvo registered year-over-year gains, while Toyota posted a decline in sales. Per Motor Intelligence, the seasonally adjusted annualized rate of sales reached 16.21 million last month, marking the best level since May 2021. Per LMC Automotive, U.S. light vehicle sales totaled 1.04 million units in January, up 4.5% year over year. But lest we forget, January 2022 was the first January since 2012 that couldn’t record vehicle sales of even 1 million units amid severe supply chain issues. While sales in the last month rose year over year, it’s certainly not a sign that the auto industry is rebounding to pre-pandemic levels. In fact, January 2023 recorded the weakest vehicle sales since 2014 if we exclude January 2022 sales data.

Meanwhile, a host of auto players released fourth-quarter results last week. U.S. legacy automaker General Motors GM beat earnings estimates, while its cross-town rival Ford F missed the same. U.S. motorcycle giant Harley-Davidson HOG, auto retailer Asbury Automotive ABG and automotive equipment provider Lear Corporation LEA surpassed fourth-quarter earnings estimates.

GM, F, HOG, ABG and LEA carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Snapshot of Last Week’s Key Earnings Releases

General Motors reported fourth-quarter 2022 adjusted earnings of $2.12 per share, surpassing the Zacks Consensus Estimate of $1.68. Higher-than-expected revenues and profit from the North America segment led to the outperformance. The bottom line also surged from the year-ago quarter’s earnings of $1.35 per share. Revenues of $43,108 million beat the Zacks Consensus Estimate of $41,313 million. The top line soared 28.3% from the year-ago figure of $33,584 million. The company recorded adjusted earnings before interest and taxes (EBIT) of $3,799 million, higher than $2,839 million in the prior-year quarter.

General Motors had cash and cash equivalents of $19,153 million as of Dec 31, 2022, compared with $20,067 million as of Dec 31, 2021. The long-term automotive debt at the end of the quarter was $15,885 million compared with $16,355 million as of Dec 31, 2021. General Motors’ automotive cash provided by operating activities amounted to $7,488 million during the quarter under review, down 20.2% year over year. The company recorded an adjusted automotive free cash flow of $4,460 million in fourth-quarter 2022, down 30.3% year over year. (General Motors Q4 Earnings Beat on GMNA Unit Strength)

Ford reported adjusted earnings of 51 cents per share in fourth-quarter 2022, missing the Zacks Consensus Estimate of 60 cents. Lower-than-expected profits from all but International Markets Group unit led to this downslide. The bottom line improved 96.2% from the year-ago quarter’s earnings of 26 cents. The company’s consolidated fourth-quarter revenues came in at $44 billion, rising 17% year over year. Revenues from Ford Automotive segment increased 18% to $41.8 billion and surpassed the Zacks Consensus Estimate of $39.4 billion.

Ford reported an adjusted FCF of $2.4 billion during the quarter. It had cash and cash equivalents of $25,134 million as of Dec 31, 2022, compared with $20,540 million on Dec 31, 2021. Long-term debt excluding Ford Credit totaled $19.2 billion at the end of 2022, up from $17.2 billion as of Dec 31, 2021. Adjusted EBIT for 2023 is estimated to be in the range of $9 billion - $11 billion. Adjusted FCF is envisioned to be $6 billion. Along with the regular first-quarter dividend of 15 cents per, Ford declared a supplemental dividend of 65 cents per share, aided by robust FCF. (Ford Q4 Earnings Miss Estimates, Sales Grow 17% Y/Y)

Harley-Davidson reported fourth-quarter 2022 adjusted earnings of 28 cents per share, beating the Zacks Consensus Estimate of 3 cents. Higher-than-anticipated revenues from the Motorcycles & Related Products and Financial Services segments resulted in this outperformance. The bottom line also shot up 100% from 14 cents per share reported in the year-ago quarter. The motorcycle manufacturer generated consolidated revenues (including motorcycle sales and financial services revenues) of $1,142 million, up 12% from the year-earlier quarter.

Harley-Davidson had cash and cash equivalents of $1.4 billion as of Dec 31, 2022, down from $1.8 billion as of Dec 31, 2021. In the same period, the long-term debt decreased to $4,457 million from $4,595.6 million recorded on Dec 31, 2021. For 2023, the company expects revenues from the motorcycles segment to grow in the band of 4%-7%. The operating income margin expectation for the motorcycles segment is in the range of 14.1% to 14.6%. HOG expects its operating income for Financial Services to decline by 20-25%. Capital expenditure projection for the full year is in the range of $225-$250 million. (Harley-Davidson's Q4 Earnings Breeze Past Estimates)

Lear reported fourth-quarter 2022 adjusted earnings of $2.81 per share, surging from $1.22 recorded in the year-ago quarter. The bottom line also surpassed the Zacks Consensus Estimate of $2.54 per share. Higher-than-expected earnings across both business segments led to the outperformance. In the reported quarter, revenues increased 10% year over year to $5,370.9 million. The top line also beat the Zacks Consensus Estimate of $5,226 million.

The company had $1,114.9 million in cash and cash equivalents at the quarter’s end versus $1,318.3 million recorded as of Dec 31, 2021. Lear had long-term debt of $2,591.2 million at quarter end, lower than a debt of $2,595.2 million as of 2021-end.Lear projects full-year net sales in the band of $21,200-$22,200 million, up from $20,891 million recorded in 2022. Core operating earnings are envisioned in the range of $875-$1,075 million, implying an uptick from $871 generated in 2022. Operating cash flow is projected within $1,075-$1,225 million. Lear anticipates FCF in the band of $375-$525 million. Capital spending forecast is $700 million. Adjusted EBITDA is envisioned within the range of $1,475-$1,675 million. (Lear Q4 Earnings Surpass Estimates, '23 View Upbeat)

Asbury reported impressive fourth-quarter 2022 adjusted earnings of $9.12 per share, which increased 22.2% year over year and topped the Zacks Consensus Estimate of $8.23 per share. This outperformance can be primarily attributed to higher-than-expected gross profit from the new vehicle and finance & insurance units. In the reported quarter, revenues amounted to $3.7 billion, surging 40% year over year. The top line, however, fell short of the Zacks Consensus Estimate of $3.8 billion.

As of Dec 31, 2022, the company had cash and cash equivalents of $235.3 million, up from $178.9 million on Dec 31, 2021. It had long-term debt of $3,301.2 million as of Dec 31, 2022, down from $3,582.6 million on Dec 31, 2021. During 2022, Asbury repurchased approximately 1.6 million shares for nearly $300 million. During the last reported quarter, the company adopted a Rule 10b5-1 trading plan, effective for trading Dec 19, 2022, through Feb 1, 2023. From Oct 1, 2022 through Feb 1, 2023, the company repurchased around 600,000 shares for $108 million. On Jan 26, 2023, Asbury boosted its share repurchase authorization to $200 million. As of Feb 1, the company had $200 million share repurchase authorization remaining. (Asbury Q4 Earnings Outstrip Estimates, Jump 22.2% Y/Y)

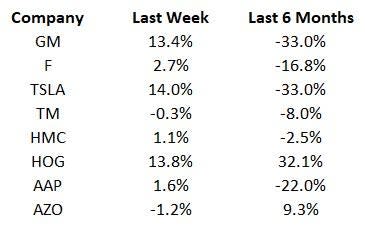

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will track China vehicle sales data for January 2023, which is likely to be released by the China Association of Automobile Manufacturers this week. Also, stay tuned for the quarterly results of major S&P 500 sector companies like O’Reilly and BorgWarner, which will report soon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report