Auto Stock Q3 Earnings Lined Up for Oct 22: HOG, PCAR & PII

The third-quarter earnings season for the Auto-Tires-Trucks sector has just started, with a host of companies set to release quarterly numbers this week. Till now, just one S&P auto stock, Genuine Parts Company GPC has unveiled third-quarter results. The Atlanta-based automotive replacement parts supplier reported better-than expected earnings on the back of strategic buyouts of PartsPoint, Inenco and Alliance Automotive Group. However, the firm lowered its guidance for 2019.

A look back at the Q2 earnings season reflects that auto sector’s earnings recorded a decline of 0.7% year over year, while revenues inched up 0.1%. In the third quarter again, revenues are expected to scale up 0.9%, while overall earnings for the auto sector are projected to decline 10.5% year over year, per the latest Earnings Preview.

So what’s up in the auto sector?

Challenges Galore in Auto Sector in Third Quarter

Automakers around the globe have been struggling with declining car sales amid economic slowdown concerns. This trend is likely to have continued in the third quarter. Auto sales in China, the world’s largest car market, continued to plunge during the quarter amid recession worries and trade war tensions that have been denting confidence of consumers and holding back manufacturers. Increasing popularity of ride-sharing platforms are also likely to have weighed on car sales. Stricter emissions woes, and shift toward electric and autonomous vehicles are likely to have changed the sector’s dynamics. Widespread usage of technology and rapid digitalization resulted in fundamental restructuring of the automotive market. This is likely to have increased the cost of manufacturing vehicles, which was passed on to consumers and dented demand. Meanwhile, technological complications call for high-priced aftersales services, which may have created new opportunities for auto equipment manufacturers to capitalize on.

HOG, PCAR and PII in Spotlight

Given the bleak year-over-year backdrop, let’s take a glance at how the three auto players are placed ahead of third-quarter results, which will be released on Oct 22.

Harley Davidson, Inc. HOG: The American motorcycle manufacturer is slated to report quarterly results before the opening bell.

Our proprietary model clearly indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

In the last reported quarter, although Harley Davidson came up with better-than-expected earnings, the bottom line fell 4% year over year amid weaker U.S. and international retail sales.As far as earnings surprises are concerned, the firm surpassed the Zacks Consensus Estimate in three of the last four quarters.

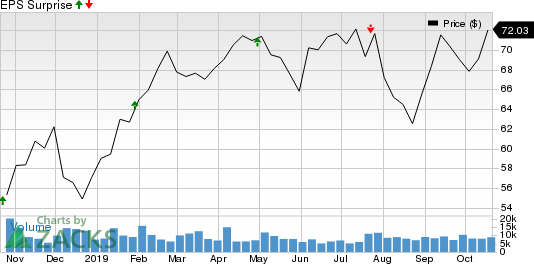

Harley-Davidson, Inc. Price and EPS Surprise

Harley-Davidson, Inc. price-eps-surprise | Harley-Davidson, Inc. Quote

Encouragingly, our model indicates that Harley Davidson may beat on earnings in the to-be-reported quarter as well, as it has the favorable combination of an Earnings ESP of +0.70% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The current Zacks Consensus Estimate for the quarter to be reported is earnings of 51 cents per share on revenues of $1.04 billion. Harley-Davidson’s efforts to launch lighter motorcycles and bolster dealer networks are likely to have positively impacted third-quarter performance. The firm’s initiatives to lower expenses are expected to have boosted margins in the quarter to be reported. However, softness in the U.S. market and tariffs from the European Union and China on Harley Davidson motorbikes are likely to have dented sales volume and the top line in the third quarter. Evidently, the Zacks Consensus Estimate for revenues from the sale of motorcycles for the third quarter is pegged at $760 million, suggesting a 7.5% year-over-year decline. (Read more: Harley-Davidson to Report Q3 Earnings: What's Up?)

PACCAR Inc. PCAR: The Washington-based truck manufacturer is also set to unveil quarterly numbers before the market opens. In the last reported quarter, PACCAR came up with weaker-than-expected results. However the bottom line rose year over year amid record truck delivery and part sales. As far as earnings surprises are concerned, the firm surpassed the Zacks Consensus Estimate in three of the last four quarters.

PACCAR Inc. Price and EPS Surprise

PACCAR Inc. price-eps-surprise | PACCAR Inc. Quote

However, this time around, things are not looking up for PACCAR as the firm carries a Zacks Rank of 3 and an Earnings ESP of -1.44%.

The current Zacks Consensus Estimate for the to-be-reported quarter is earnings of $1.62 a share on revenues of $5.86 billion. Stellar economy and freight growth are likely to have aided demand for its Class 8 trucks in the to-be-reported quarter. The company expects global deliveries to improve 5-7% year over year. Third-quarter gross margins for Truck, Parts and Other are expected in the 14.5-15% range. Gross margin at the segment in the year-ago quarter was 14.09%. However, rising commodity prices amid tariff woes, and material and labor costs due to supply constraints might have been one of the key issues that affected PACCAR’s margin growth in the quarter ended September. (Read more: PACCAR to Report Q3 Earnings: What's in the Cards?)

Polaris Industries Inc. PII: The Minnesota-based motorcycles and off-road vehicles will also post quarterly results before the opening bell. The company reported better-than-expected results in the last reported quarter on the back of higher-than-anticipated sales in off-road vehicles (ORV)/snowmobiles and global adjacent market segments. As far as earnings surprises are concerned, the firm surpassed the Zacks Consensus Estimate in each of the last four quarters.

Polaris Industries Inc. Price and EPS Surprise

Polaris Industries Inc. price-eps-surprise | Polaris Industries Inc. Quote

However, our model indicates that the company may not be able to maintain earnings beat streak in the quarter to be reported, as it has an unfavorable combination of a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%.

The current Zacks Consensus Estimate for the quarter is earnings of $1.57 a share on revenues of $1.78 billion. The company is expected to have benefited from increasing year-over-year revenues across all product segments including ORV/snowmobiles, boats, aftermarket, global adjacent markets and motorcycles. Evidently, the consensus mark for revenues from ORV/snowmobiles, motorcycles and global adjacent markets is pegged at $1,114 million, $185 million and $105 million, indicating year-over-year increase of 7.5% 19.3% and 9.3%, respectively. However, the positives are likely to have been more than offset by higher costs and tariff woes. Moreover, China 301 list 3 tariff increase and higher selling, general and administrative costs are likely to have weighed on the firm’s bottom line in the to-be-reported quarter.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

Polaris Industries Inc. (PII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research