Autoliv (ALV) Q1 Earnings Beat on Seatbelts Unit Strength

Autoliv, Inc. ALV reported first-quarter 2021 adjusted earnings of $1.79 per share, which topped the Zacks Consensus Estimate of $1.39. Higher-than-anticipated revenues from the Seatbelts and Associated Products segment led to the outperformance. The bottom line was also higher than 88 cents per share recorded in the year-ago quarter. Robust demand of Autoliv’s products and cost-cut efforts resulted in improved year-over-year performance.

The company reported net sales of $2,242 million for the quarter, up from the prior-year figure of $1,846 million. Moreover, the figure beat the Zacks Consensus Estimate of $2,177 million.

Autoliv reported adjusted operating income of $237 million, up 74% year over year. Adjusted operating margin from continuing operations was 10.6% for the reported quarter, higher than 7.4% in the corresponding period of 2020.

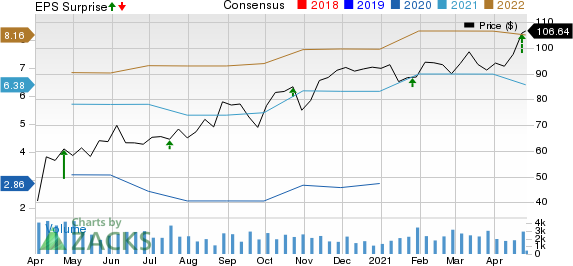

Autoliv, Inc. Price, Consensus and EPS Surprise

Autoliv, Inc. price-consensus-eps-surprise-chart | Autoliv, Inc. Quote

Segmental Performance

Sales in the Airbags and Associated Products segment totaled $1,463 million, in line with Zacks Consensus Estimate. The figure was 21.7% higher on a year-over-year basis. While knee airbags witnessed the highest sales growth rate on a year-over-year basis, revenues from steering wheels and inflatable curtains also rose sharply.

Sales in the Seatbelts and Associated Products segment totaled $779 million, up 21.1% from the prior-year quarter. Further, the figure topped the consensus mark of $722 million. Higher revenues from China, Europe, India and ASEAN aided the results.

Financial Position

Autoliv had cash and cash equivalents of $1,254 million as of Mar 31, 2021. Long-term debt totaled $2,039 million, decreasing from $2,209 million as of Mar 31, 2020. Net capital expenditure decreased to $93 million from the year-ago figure of $88 million.

Road Ahead

The firm expects semiconductor shortage to result in LVP production decline at least till the fourth-quarter 2021, which may in turn result in lost revenues for Autoliv. It expects full-year 2021 net sales to rise 23% year over year versus the prior guidance of 25% growth. Adjusted operating margin is expected to be 10%. Operating cash flow for 2021 is envisioned to be on par with 2020 levels.

Zacks Rank & Key Picks

Autoliv currently holds a Zacks Rank #4 (Sell). Some better-ranked stocks from the auto space include BRP Inc. DOOO, Gentherm Inc. THRM and The Shyft Group, Inc. SHYF, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

Gentherm Inc (THRM) : Free Stock Analysis Report

BRP Inc. (DOOO) : Free Stock Analysis Report

The Shyft Group, Inc. (SHYF) : Free Stock Analysis Report

To read this article on Zacks.com click here.