AVEO Pharmaceuticals (AVEO) Inks Deal to be Acquired by LG Chem

Shares of AVEO Pharmaceuticals AVEO surged 42.4% on Oct 18 after the company announced that it has entered into an agreement to be acquired by the Korean company LG Chem.

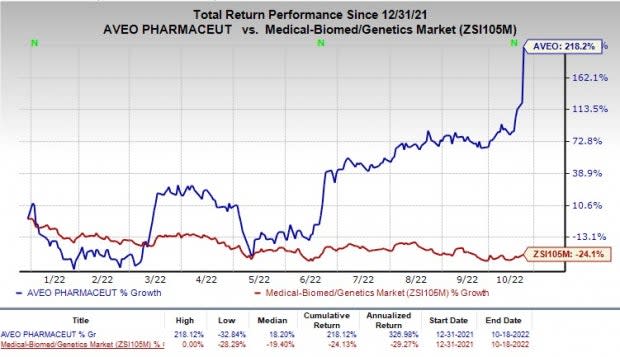

AVEO stock has surged 218.2% in the year-to-date period, compared to the industry’s decline of 25.9%.

Image Source: Zacks Investment Research

Pursuant to the agreement, LG Chem will acquire all outstanding shares of AVEO for $15.00 per share, or an approximate amount of $566 million, on a fully diluted basis, in an all-cash transaction. The offer price of $15 per share represents a premium of 43% of AVEO’s closing price on Oct 17.

The transaction has been approved by the board members of the companies and is anticipated to close early in 2023, subject to customary regulatory approvals. Post the completion of the deal, AVEO will no longer be listed as a separate company under Nasdaq.

For LG Chem, the acquisition is expected to strengthen its oncology portfolio with the addition of AVEO’s only FDA-approved and marketed product, Fotivda (tivozanib), for treating adult patients with relapsed or refractory advanced (R/R) renal cell carcinoma (“RCC”) and AVEO’s other preclinical candidates.

Last week, AVEO received a notification from the United States Patent and Trademark Office (USPTO) that a patent will be issued for Fotivda for treating RCC in 2022. The issued patent will provide patent protection for the candidate in the United States for the aforementioned indication up to 2039.

AVEO also has a portfolio of four wholly-owned clinical stage product candidates, ficlatuzumab, AV-380, AV-203, and AV-353, being developed for treating various forms of cancer.

LG Chem will add a promising marketed drug, Fotivda, to its portfolio, following the acquisition of AVEO. In the last reported quarter, AVEO recorded net Fotivda U.S product revenues of $25 million, up 24% year over year.

Thus, the AVEO acquisition is anticipated to push LG Chem towards realizing its long-term goal of becoming a global fully-integrated commercial-stage pharma company.

AVEO Pharmaceuticals, Inc. Price

AVEO Pharmaceuticals, Inc. price | AVEO Pharmaceuticals, Inc. Quote

Zacks Rank and Key Picks

AVEO Pharmaceuticals currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the same sector include ACADIA Pharmaceuticals ACAD,BioMarin Pharmaceuticals BMRN, and Pliant Therapeutics PLRX, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Acadia’s loss per share estimates for 2022 have narrowed down from $1.30 to $1.29 in the past 30 days. The loss per share for 2023 has also narrowed down from 67 cents to 60 cents in the same time frame.

Earnings of Acadia beat estimates in two of the trailing four quarters, while missing the same on the remaining two occasions. The average negative earnings surprise for ACAD is 6.83%.

BioMarin’s earnings per share estimates for 2022 are down by a cent at $1.98 in the past 30 days. The same for 2023 has improved by a cent from $3.80 to $3.81 in the same time frame.

Earnings of BioMarin beat estimates in all of the trailing four quarters. The average earnings surprise for BMRN is 98.90%.

Pliant’s loss estimates for 2022 have remained steady at $3.01 over the past 30 days. The earnings estimate for 2023 also remained steady at $3.26 per share in the same time frame.

PLRX earnings were in-line in one of the trailing four quarters, beat the same in one, and missed the same in the remaining two occasions. The average earnings surprise for Pliant is 0.90%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

AVEO Pharmaceuticals, Inc. (AVEO) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Pliant Therapeutics, Inc. (PLRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research