Avid Technology (AVID) to Post Q1 Earnings: What's in Store?

Avid Technology AVID is set to report first-quarter 2020 results on May 7.

On Apr 7, Avid Technology reiterated its first-quarter 2020 expectations in response to the impact of the novel coronavirus (COVID-19) on its business operations.

For first-quarter 2019, Avid expects total revenues to be approximately 13% - 15% below the mid-point of the prior guidance of $95 million to $105 million. However, the first quarter is seasonally lower than the fourth quarter. Hence, sequentially, revenue growth is anticipated to decline.

The Zacks Consensus Estimate for revenues currently stands at $99 million, suggesting a decline of 3.9% from the figure reported in the year-ago quarter.

The consensus mark for first-quarter earnings has remained steady at 11 cents over the past 30 days, same as the figure reported in the year-ago quarter.

Notably, the company missed the Zacks Consensus Estimate in three of the trailing four quarters and beat the same in one, the average negative surprise being 8.5%.

Let’s see how things have shaped up for this announcement.

Factors to Consider

Avid Technology’s first-quarter 2020 results are expected to reflect higher recurring revenues, driven by growth in subscriptions and long-term agreements already signed.

Based on a preliminary review of results for the first quarter, the company expects its subscription business to experience a record-growth quarter in terms of net new cloud-enabled software subscriptions.

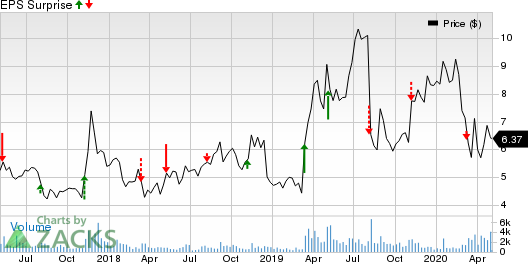

Avid Technology, Inc. Price and EPS Surprise

Avid Technology, Inc. price-eps-surprise | Avid Technology, Inc. Quote

For the first quarter 2020, the company expects its subscription and maintenance revenues between $44.5 million and $46.0 million.

Avid Technology announced record growth in cloud-enabled software subscriptions of over 30,000 in the first quarter, raising the total number to around 218,000 as of Mar 31, 2020.

Moreover, Avid Technology’s expanded paid subscriber base is a key catalyst. Growth in adoption of creative tools, driven by strong demand for the Avid First product family, is expected to have driven the top line in the soon-to-be-reported quarter.

In the first quarter, the company launched the Avid VENUE | S6L-48D control surface and Avid VENUE 6.2 software, providing engineers and sound designers the control and flexibility to take on the biggest and most complex live sound productions.

The company also released major updates to its flagship Pro Tools and Sibelius creative tools, control surfaces for any size venue or studio, and enhanced apps and services for creative collaboration and music distribution to streaming services.

Further, Avid Technology has been aggressively reducing operating expenses and capital expenditures to offset the decline in products and professional services revenues. This is expected to have had a positive impact on first-quarter 2020’s profitability.

Notably, the company expects to realize unplanned savings of approximately $3 million in the first half of 2020, resulting from its cancellation of major trade show appearances.

However, Avid Technology’s non-recurring revenues depend significantly on sales activity during the last few weeks of the quarter.

The postponement or cancellation of many music festivals and major sporting events, and the suspension of many film and television productions, particularly during the second half of March due to coronavirus-led lockdown is expected to have hurt the company’s product sales in the to-be reported quarter.

Moreover, global travel restrictions in the first quarter are expected to have negatively impacted product shipments and professional services revenues as the company’s ability to deliver certain professional services and to complete certain milestones at the end of the quarter was affected.

Key Q1 Developments

During the first quarter, Avid signed a new, significant multi-million dollar cloud services agreement with a major media company to enable customers to globally deploy cloud-based business continuity solutions so that productions can continue with remote workers, including with those working from home, which will be delivered in in the second quarter of 2020.

Avid Technology had cash and cash equivalents of approximately $81 million as of Mar 31, 2020. During the first quarter, the company drew $22 million on its existing revolving credit facility to strengthen its financial flexibility, given the volatility in markets and to operate with sufficient near-term liquidity amid crisis.

What Our Model Says

According to the Zacks model, the combination of a positive Earnings ESP and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Avid Technology has an Earnings ESP of 0.00% and a Zacks Rank #1. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks That Warrant a Look

Here are some companies, which, per our model, have the right combination of elements to post an earnings beat this quarter:

Shopify SHOP has an Earnings ESP of +23.41% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Inphi Corporation IPHI has an Earnings ESP of +20.04% and a Zacks Rank of 2.

Take Two Interactive TTWO has an Earnings ESP of +13.24% and a Zacks Rank #2.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Take-Two Interactive Software, Inc. (TTWO) : Free Stock Analysis Report

Avid Technology, Inc. (AVID) : Free Stock Analysis Report

Inphi Corporation (IPHI) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.