How to Avoid Bankruptcy: Tesla's 3rd-Quarter Outlook

After delivering 97,000 vehicles during the third quarter, Tesla Inc. (NASDAQ:TSLA) posted its results for the quarter today. The electric car company posted revenues of $6.35 billion and adjusted earnings per share of $1.86, causing its stock price to increase 10%. The resutls beat analysts' expectations of losses of 42 cents per share and indicates that the company's plan to get itself out of financial danger is showing success.

This past Thursday, Oct. 17, China's Ministry of Industry and Information Technology granted Tesla the certificate it needed to begin producing automobiles once its Gigafactory in Shanghai is completed. Production is expected to begin in April 2020. According to Tesla, the Model 3 Standard Range Plus produced in the Shanghai factory will cost $47,529, which is approximately 13% less than what the same car costs when it must be imported from the U.S. Considering that China is the largest electric vehicle market in the world, the completion of the factory may propel Tesla's net income from the negatives to the positives.

The question is, will Tesla be able to find its own niche market in China, or will the local electric vehicle competition turn out to be too much? And will Tesla be able to stave off bankruptcy long enough to increase sales in the U.S. and establish itself in a new country?

Bad timing for a cyclical to expand

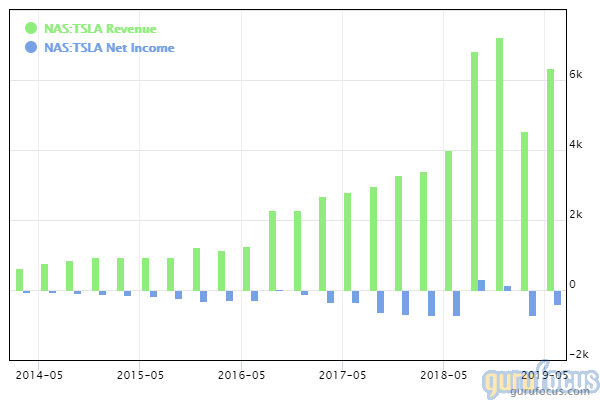

The automobile industry is known for being highly cyclical, posting extreme highs when the economy is strong and often going into the red during periods of economic recession. Tesla's net income has been firmly in the negatives for the previous two quarters, as shown in the chart below, so it is currently in a bad place for withstanding a decrease in sales.

The company has a cash-to-debt ratio of 0.35, an interest coverage ratio of 0.49, an Altman-Z score of 1.6 and an operating margin of 1.34%. It has a GuruFocus financial strength score of 4 out of 10, and its asset growth is faster than its revenue growth.

This past May, Tesla embarked on an expedition to avoid bankruptcy, issuing $2.7 billion in new stock and implementing a strict monitoring policy for company spending. At the time, CEO Elon Musk estimated these changes would let the company breakeven in 10 months if everything else from the first quarter of 2019 remained consistent. So far, it seems to be working, as evidenced by the positive third-quarter results. However, a decline in automobile buyers may be inevitable as both the U.S. and China brace themselves for recessions, and Tesla still has $11.971 billion in debt to contend with.

Potential competition

China is home to more than 100 electric car makers, so Tesla's entrance to the Chinese electric vehicle market will encounter stiff competition. The Chinese government has invested over $60 billion in its attempt to turn the country into the world's leader in electric vehicle research and manufacturing.

This should come as no surprise. China's high pollution levels, along with the fact that the U.S. dollar's prosperity is closely tied to its oil interests, means that China has far more incentive than the U.S. to pour resources into electric vehicles and renewable energy.

Popular Chinese electric cars include the BVD Qin EV300, produced by BYD Co. Ltd. (OTCPK:BYDDF). Priced at $23,000, this affordable electric sedan has a top speed of 150 kilometers per hour (93 miles per hour) and a range of 300 kilometers (186 miles).

Finding a market niche

Despite tough competition, Tesla has some of the best specs among fully electric cars currently on the market. With dual motor all-wheel drive, a 310-mile range and acceleration that can take it from zero to 60 mph in as little as 3.2 seconds, Tesla's Model 3 outperforms many competitors. Its safety ratings are the best available; it has an NHTSA rating of five stars in every category.

High specs and the price tag to match mean that Tesla may have an opportunity to make a name for itself as a luxury electric car in China, much like it has in the U.S. In general, Chinese-made electric cars trend towards the smaller, cheaper variety due to space-saving considerations and the fact it is still prohibitively expensive for most companies to build a high-performance electric car. As the first big name in the luxury U.S. EV market, Tesla has a chance to replicate that formula in China before competitors can catch up.

Disclosure: Author owns no shares in any of the stocks mentioned.

Read more here:

The Trickle-Down Effect: Decreased Spending Among the Wealthy Warns of an Economic Downturn

Boring Is Better: 3 Companies With Stellar Financials and Yawn-Inducing Job Descriptions

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.