What Awaits Public Service Enterprise (PEG) in Q1 Earnings?

Public Service Enterprise Group Incorporated PEG, better known as PSEG, is scheduled to report first-quarter 2022 results on May 3, before the opening bell.

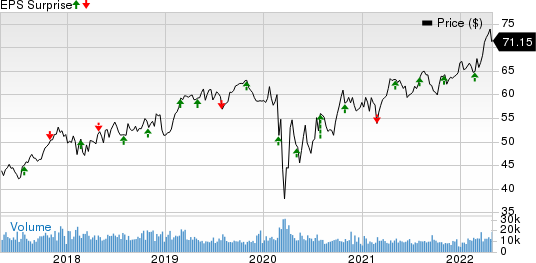

In the last-reported quarter, the company delivered an earnings surprise of 1.47%. PSEG has a trailing four-quarter earnings surprise of 5.32%, on average.

Factors to Note

During the January-March 2022 quarter, the company’s service territories witnessed mixed weather patterns. While at the onset of the first quarter, Public Service Enterprise’s service areas observed colder-than-normal temperature, in the mid and latter parts of the quarter, the temperature was warmer than normal.

Such a weather pattern might have had an adverse impact on the company’s top-line performance as a result of the lower usage of heaters. Usually, its service territories witness cold weather during the first quarter.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $2.54 billion, suggesting a decline of 12.1% from the year-ago quarter.

Public Service Enterprise Group Incorporated Price and EPS Surprise

Public Service Enterprise Group Incorporated price-eps-surprise | Public Service Enterprise Group Incorporated Quote

PSEG’s service territories suffered from severe storm activities during the first quarter, which might have damaged the company’s infrastructure. Costs related to the restoration of such power outages as well as mending of its infrastructural damage might have weighed on the first-quarter bottom line.

The Zacks Consensus Estimate for first-quarter earnings is pegged at $1.07 per share, indicating a decline of 16.4% from the prior-year reported figure.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for PSEG this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However this is not the case here.

Earnings ESP: The company’s Earnings ESP is 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: PSEG currently carries a Zacks Rank #3.

Stocks to Consider

Here are three Utilities players you may want to consider, as these have the right combination of elements to post an earnings beat this time around:

WEC Energy Group WEC has an Earnings ESP of +1.69% and a Zacks Rank #3. The stock boasts a long-term earnings growth rate of 6.1%.

The Zacks Consensus Estimate for WEC Energy’s first-quarter revenues and earnings is pegged at $2.80 billion and $1.66 per share, respectively. WEC has a four-quarter average earnings surprise of 9.07%.

Telephone and Data Systems TDS has an Earnings ESP of +34.62% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Telephone and Data Systems first-quarter revenues and earnings is pegged at $1.34 billion and 26 cents, respectively. TDS has a four-quarter average negative earnings surprise of 42.61%.

Dominion Energy D has an Earnings ESP of +0.86% and a Zacks Rank #3. The stock boasts a long-term earnings growth rate of 6.1%.

The Zacks Consensus Estimate for Dominion Energy’s first-quarter revenues and earnings is pegged at $4.28 billion and $1.17, respectively. D has a four-quarter average earnings surprise of 1.09%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Telephone and Data Systems, Inc. (TDS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research