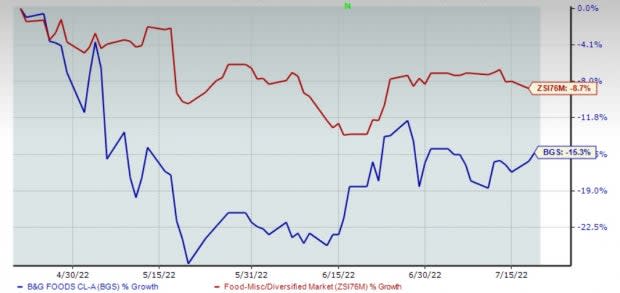

B&G Foods (BGS) Down 15% in 3 Months: High Costs a Key Reason

B&G Foods, Inc. BGS appears to be in not-so-great shape, with its shares down 15.3% in the past three months compared with the industry’s decline of 8.7%. The company has been encountering severe cost headwinds, which, along with supply-chain disruptions, led management to lower its adjusted EBITDA and earnings per share (EPS) view for fiscal 2022 when it reported first-quarter results.

The company expects adjusted EBITDA for fiscal 2022 in the range of $348-$358 million compared with the $358-$368 million range forecast earlier and the $358 million recorded in fiscal 2021. The adjusted EPS in fiscal 2022 is envisioned to be nearly in the band of $1.65-$1.75 now, down from the $1.70-$1.85 band projected before. In fiscal 2021, the metric came in at $1.88.

Let’s take a closer look at the downsides of this Zacks Rank #4 (Sell) company.

Image Source: Zacks Investment Research

Things Not So Rosy for B&G Foods

B&G Foods has been battling cost inflation like many other industry players. In the first quarter of 2022, the company’s adjusted gross profit came in at $101.3 million compared with $117.8 million in the year-ago period. The adjusted gross margin of 19% contracted 430 basis points (bps). The gross margin was hurt by greater-than-anticipated input cost inflation. This includes escalated raw materials (like oil, wheat, corn, fuel and other commodities) and transportation expenses.

Adjusted EBITDA decreased by 16.2% to $77.9 million due to the same factors impacting the adjusted EPS. The adjusted EBITDA margin contracted 380 bps to 14.6%. On its first-quarter earnings call, management stated that it anticipates similar levels of margin compression during the second quarter.

BGS expects the input cost inflation to have a considerably industry-wide effect in the remainder of fiscal 2022. Management expects cost of goods sold inflation in 2022 to be 19-20%. It expects to keep seeing significant cost inflation for inputs, such as ingredients, packaging and transportation, due to factors like the pandemic, the Ukraine war, weather conditions, supply-chain hurdles and the shortage of labor.

On its first-quarter 2022 call, management stated that apart from cost inflation, other pandemic-related factors, such as the duration of social distancing and stay-at-home trends, other waves or variants of the pandemic, the operation of manufacturing facilities, the company’s ability to procure ingredients and other raw materials and supply-chain status, among others, may impact the company’s performance.

Wrapping Up

B&G Foods is on track to mitigate the impact of inflation by undertaking cost-saving initiatives, increasing list prices and locking in prices via short-term supply contracts and advance commodities purchase agreements. That said, these may not fully offset additional cost headwinds in the remaining part of fiscal 2022.

Solid Food Stocks

Some better-ranked stocks are The Chef's Warehouse CHEF, Lamb Weston LW and Campbell Soup CPB.

The Chef's Warehouse, which engages in the distribution of specialty food products, sports a Zacks Rank #1 (Strong Buy). The Chef's Warehouse has a trailing four-quarter earnings surprise of 372.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CHEF’s current financial-year EPS suggests significant growth from the year-ago reported number.

Lamb Weston, which produces, distributes and markets value-added frozen potato products, carries a Zacks Rank #2 (Buy). Lamb Weston has a trailing four-quarter earnings surprise of 18.1%, on average.

The Zacks Consensus Estimate for LW’s current financial-year sales suggests growth of 9.3% from the year-ago reported number.

Campbell Soup, which manufactures and markets food and beverage products, currently carries a Zacks Rank #2. Campbell Soup has a trailing four-quarter earnings surprise of 10.8%, on average.

The Zacks Consensus Estimate for CPB’s current financial-year sales suggests growth of 0.5% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

B&G Foods, Inc. (BGS) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research