B&G Foods (BGS) Q3 Earnings in Line With Estimates, Sales Miss

B&G Foods, Inc. BGS reported mixed third-quarter fiscal 2022 numbers, wherein the bottom line was in line with the Zacks Consensus Estimate, while sales missed the same. Meanwhile, earnings declined year over year and sales improved. The company benefited from higher demand and pricing, offset by increased input cost inflation and continued supply-chain headwinds.

Management reiterated its net sales guidance for fiscal 2022, while lowering its view for adjusted EBITDA and the bottom line due to cost inflation.

B&G Foods posted adjusted earnings of 31 cents per share, which was in line with the Zacks Consensus Estimate but lagged our estimate of 33 cents. The bottom line declined 43.6% from the year-ago quarter. The downside was a result of industry-wide inflation in input costs and supply-chain bottlenecks, together with the impact of stock worth $6.5 million sold by the company via an at-the-market equity offering program. This was somewhat compensated by higher net pricing.

Net sales of $528.4 million increased 2.6% year over year mainly due to pricing gains and a favorable product mix. This was somewhat offset by soft volumes stemming from supply-chain hurdles and price elasticity. The top line missed the Zacks Consensus Estimate of $531 million and our estimate of $537 million.

Base business net sales advanced 2.5% to $527.5 million, owing to net pricing gains and a favorable product mix. These were partially countered by a fall in the unit volume and currency headwinds.

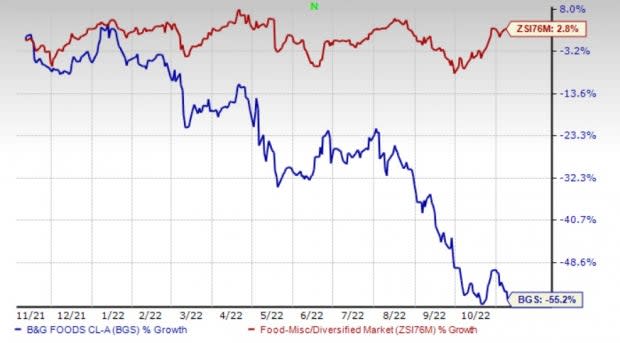

Shares of the Zacks Rank #5 (Strong Sell) company have dropped 55.2% in the past year compared with the industry’s growth of 2.8%.

Image Source: Zacks Investment Research

Quarterly Highlights

Net sales of Crisco, Cream of Wheat, Clabber Girl and Ortega rose 38.3%, 20.4%, 26.6% and 2.6%, respectively. However, net sales of Green Giant (including Le Sueur), Maple Grove Farms and spices & seasonings declined by 12.6%, 2.9% and 6.5%, respectively. Base net sales of all the other brands in the aggregate rose 0.5%.

The adjusted gross profit of $108 million declined 11.9% year over year from $122.6 million in the year-ago period. The adjusted gross margin contracted 340 basis points (bps) to 20.4%. The gross margin was hurt by greater-than-anticipated input cost inflation. This includes escalated raw materials and transportation expenses.

The company expects the input cost inflation to bear a significant impact industry-wide for the remainder of fiscal 2022 and in fiscal 2023. BGS is on track to mitigate the impacts of inflation on the gross margin by undertaking cost-saving initiatives, increasing list prices, and locking in prices via short-term supply contracts and advance commodities purchase agreements. Nonetheless, these actions may not fully offset the supplementary cost headwinds through the rest of fiscal 2022 and beyond.

B&G Foods, Inc. Price, Consensus and EPS Surprise

B&G Foods, Inc. price-consensus-eps-surprise-chart | B&G Foods, Inc. Quote

SG&A expenses escalated by 2.4% to $47.5 million on higher general and administrative expenses, selling expenses and consumer marketing expenses, partially negated by a decline in acquisition/divestiture-related and non-recurring expenses. As a percentage of net sales, SG&A expenses were flat to last year at 9%.

Adjusted EBITDA dipped 16.6% to $80.2 million, owing to industry-wide input cost inflation and supply-chain woes, somewhat offset by elevated pricing. The adjusted EBITDA margin contracted 370 bps to 15.2% in the third quarter of 2022.

Other Updates

B&G Foods ended the third quarter with cash and cash equivalents of $60 million, long-term debt of $2,418.1 million, and total shareholders’ equity of $841.6 million.

Concurrent with the earnings release, the company declared a quarterly cash dividend of 19 cents per share, payable on Jan 30, 2023, to shareholders of record as of Dec 30, 2022. This brings the company’s new intended annual dividend rate to 76 cents per share, currently representing a yield of 5%.

Given the latest dividend rate per annum and the company’s total share outstanding, B&G Foods expects to pay out dividends of $54.5 million in fiscal 2023.

Guidance

For fiscal 2022, management anticipates net sales of $2.1-$2.14 billion. In fiscal 2021, net sales amounted to $2,056.3 million ($2.06 billion). The company lowered its adjusted EBITDA view for fiscal 2022 to $290-$300 million compared with the $300-$320 million mentioned earlier, whereas it reported $358 million in fiscal 2021. Adjusted earnings per share (EPS) in fiscal 2022 are envisioned to be 90 cents to $1.00 versus $1.08-$1.28 stated before. In fiscal 2021, the company reported EPS of $1.88.

Management expects to maintain the momentum in demand for its products. It also anticipates the significant cost inflation for inputs, such as ingredients, packaging, labor and transportation, to continue based on factors like the pandemic, the Ukraine war, weather conditions, supply-chain hurdles and the shortage of labor. Although B&G Foods is undertaking various revenue-enhancing (like pricing and trade spend efforts) and cost-control measures, it is yet to be seen how effective these initiatives turn out.

Other pandemic-related factors such as the duration of social distancing and stay-at-home trends, other waves or variants of the pandemic, the operation of manufacturing facilities, the company’s ability to procure ingredients and other raw materials, and supply-chain status may impact BGS’ performance.

Solid Consumer Staple Stocks

Some better-ranked stocks are Lamb Weston LW, The Chef's Warehouse CHEF and The J. M. Smucker Co. SJM.

Lamb Weston, which is a leading global manufacturer, marketer and distributor of value-added frozen potato products, sports a Zacks Rank #1 (Strong Buy) at present. Lamb Weston has a trailing four-quarter earnings surprise of 47.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LW’s current financial-year sales and EPS suggests growth of 14.6% and 45.7%, respectively, from the year-ago reported number.

The Chef's Warehouse, which engages in the distribution of specialty food products, currently sports a Zacks Rank #1. Chef's Warehouse has a trailing four-quarter earnings surprise of 93.8%, on average.

The Zacks Consensus Estimate for CHEF’s current financial-year sales suggests growth of 46.5% from the year-ago reported number, while earnings indicate significant growth.

J. M. Smucker, a leading marketer and manufacturer of consumer food and beverage products, and pet food and pet snacks in North America, currently flaunts a Zacks Rank #1. SJM has a trailing four-quarter earnings surprise of 20.8%, on average.

The Zacks Consensus Estimate for SJM’s current financial-year sales suggests growth of 4.6% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

B&G Foods, Inc. (BGS) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research