Ballard's (BLDP) Q4 Loss In Line, Revenues Beat Estimates

Ballard Power Systems BLDP reported fourth-quarter 2019 operating loss of 4 cent per share, which was in line with the Zacks Consensus Estimate.

In 2019, the company reported a loss of 16 cents that was wider than a loss of 13 cents incurred in 2018.

Total Revenues

Ballard’s fourth-quarter revenues amounted to $41.9 million, which surpassed the Zacks Consensus Estimate of $31 million by 35.2%. The top line surged 47% from the year-ago quarter’s tally of $28.5 million.

In 2019, total revenues came in at $106.3 million, up 10% from $96.6 million in 2018.

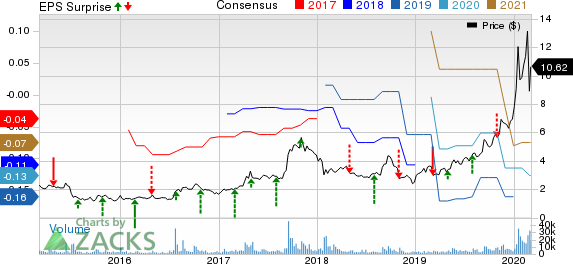

Ballard Power Systems, Inc. Price, Consensus and EPS Surprise

Ballard Power Systems, Inc. price-consensus-eps-surprise-chart | Ballard Power Systems, Inc. Quote

Highlights of the Release

In the reported quarter, gross margin declined 21% to $8.6 million due to a shift in revenues and product mix.

Operating expenses were $16.1 million, up 20.1% from the year-ago quarter’s tally.

Cash operating costs were $13.6 million, up 21.4% from the prior-year quarter’s figure.

Financial Details

As of Dec 31, 2019, the company had a cash balance of $147.8 million, down from $192.2 million as of Dec 31, 2018.

Cash used in operating activities in 2019 was $14.2 million compared with $31.7 million in 2018.

Outlook

Without providing any specific financial performance guidance for 2020, the company anticipates total revenues of approximately $130 million in 2020 supported by 12-month order book of $110.3 million at the end of 2019.

Moreover, the company also expects to experience supply-chain disruptions, a decline in sales activities as well as reductions in operations and workforce if the coronavirus outbreak persists.

Zacks Rank

Ballard Power Systems currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Fabrinet FN reported second-quarter fiscal 2020 adjusted earnings of $1 per share that beat the Zacks Consensus Estimate by 7.5%.

Palo Alto Networks PANW reported second-quarter fiscal 2020 non-GAAP earnings of $1.19 per share, which surpassed the Zacks Consensus Estimate by 6.25%.

Cogent Communications Holdings, Inc. CCOI reported impressive fourth-quarter 2019 financial results, with the top and the bottom line surpassing the Zacks Consensus Estimate. The stock inched up 1.4% post the results and closed at $76.01 on Feb 27.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fabrinet (FN) : Free Stock Analysis Report

Ballard Power Systems, Inc. (BLDP) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Cogent Communications Holdings, Inc. (CCOI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research