Bank of the Ozarks Cheers Investors With 2.6% Dividend Hike

Bank of the Ozarks’ OZRK board of directors recently approved a 2.6% hike in the quarterly common stock dividend. The revised quarterly dividend now comes in at 19.5 cents per share compared with the previous figure of 19 cents. The dividend will be paid on Apr 20 to shareholders of record as of Apr 13.

This is the 31st consecutive quarterly increase in dividend by the bank, reflecting its commitment to returning value to shareholders. Prior to this hike, the company increased its dividend by 2.7% (from 18.5 cents to 19 cents per share) in January 2018.

Given a solid capital and liquidity position, the company is expected to continue enhancing shareholder value through efficient capital deployment activities.

As of Dec 31, 2017, Bank of the Ozarks had total assets of $21.28 billion, while shareholders’ equity was $3.46 billion. Moreover, its investment securities were valued at $2.62 billion as of the same date.

Based on yesterday’s closing price of $46.96 per share, the dividend yield currently stands at 1.66%.

While, consistent growth in loans and deposits along with benefits from lower tax rates are expected to aid the company’s profitability, persistently rising expenses due to the company’s expansion strategy through de novo branching remains a concern and might hurt bottom-line growth in the quarters ahead. Moreover, margin pressure, despite higher interest rates, makes us apprehensive.

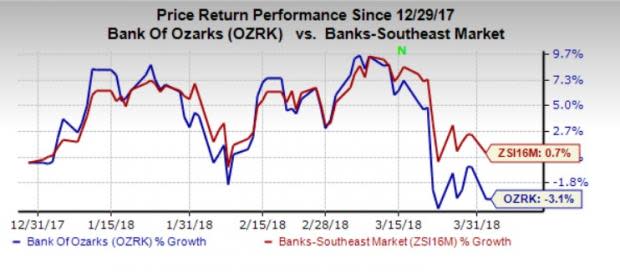

In fact, the company’s price performance also does not seem very impressive. Its shares have lost 3.1% so far this year as against 0.7% growth of its industry.

Moreover, the company’s Zacks Consensus Estimate for the current-year earnings have also been revised marginally downward over the last 7 days, reflecting analysts’ pessimism regarding its earnings growth potential.

Thus, the stock currently has a Zacks Rank #4 (Sell).

Stocks to Consider

A few better-ranked stocks in the same space worth considering are Carolina Financial Corporation CARO, Hancock Holding Company HBHC and Triumph Bancorp, Inc. TBK, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Carolina Financial for 2018 has increased 5.6% in the last 60 days. The company’s share price has increased 31.8% in the past year.

In the last 60 days, Hancock Holding witnessed a marginal upward earnings estimate revision for 2018. Its share price has risen 11.1% in the past year.

Triumph Bancorp’s shares have gained 54.6% in a year and its earnings estimates have increased nearly 1% for 2018, in the last 60 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of the Ozarks, Inc. (OZRK) : Free Stock Analysis Report

Carolina Financial Corporation (CARO) : Free Stock Analysis Report

Triumph Bancorp, Inc. (TBK) : Free Stock Analysis Report

Hancock Holding Company (HBHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research