Baozun's (BZUN) Earnings and Revenues Improve Y/Y in Q1

Baozun Inc.’s BZUN first-quarter 2019 non-GAAP net income per ADS was RMB 0.89 (13 cents), up 64.8% from the year-ago period.

The company’s revenues surged 41% year over year to RMB 1,287 million ($191.7 million).

A strong flourish in the e-commerce sector, backed by an emerging base of affluent middle-class Chinese consumers, is boosting growth.

The company’s initiatives to strengthen its omnichannel matrix of solutions with the addition of innovative proprietary tools and its digital marketing services led to solid growth in the reported quarter.

Quarterly Details

Services revenues soared 45% from the year-earlier quarter to RMB 669.2 million ($99.7 million). Strong growth in the company’s consignment model and the service fee model and its digital marketing services drove results.

Product sales revenues were RMB 617.6 million ($92 million), up 34.3% year over year, driven by the growing popularity of brand partners’ products, acquisition of new brand partners and the company’s effective marketing and promotional campaigns.

During the quarter under review, total Gross Merchandise Volume (GMV) expanded 58.4% to RMB 7,831 million. Notably, the company’s non-distribution business saw 61.6% growth in GMV during the quarter under consideration.

Baozun’s number of brand partners grew to 200 at the end of the first quarter from 156 during the same period last year. The newly added brands are mainly in FMCG, apparel, food and health plus cosmetics categories.

Operating Details

On a non-GAAP basis, the company’s operating income was RMB 64.7 million ($6.8 million), reflecting an increase of 41.6% year over year.

Non-GAAP operating margin was flat year over year at 5% in the quarter under discussion.

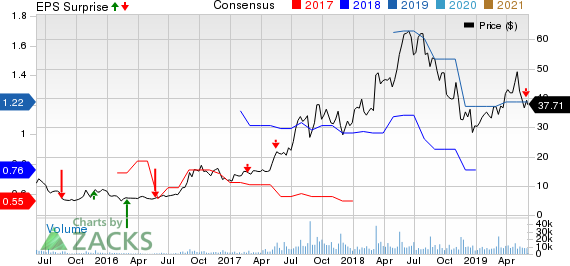

Baozun Inc. Price, Consensus and EPS Surprise

Baozun Inc. price-consensus-eps-surprise-chart | Baozun Inc. Quote

Balance Sheet

Baozun ended the first quarter with cash and cash equivalents and short-term investments of RMB 576.7 million compared with RMB 514 million sequentially.

Outlook

Per management, the recent introduction of a cloud system, Baozun Cloud, is projected to upgrade the company’s storing and computing capabilities for SaaS platforms and technologies to effectively address increasing demand from its brands and enhance elastic scalability of its system.

For second-quarter 2019, revenues are expected between RMB 1.55 and RMB 1.6 billion with a 40% rise in services revenues on a year-over-year basis.

Zacks Rank & Stocks to Consider

Baozun currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are eGain Corporation EGAN, Rosetta Stone RST and j2 Global, Inc. JCOM, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for eGain, Rosetta Stone and j2 Global is currently projected to be 30%, 12.5% and 8%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

j2 Global, Inc. (JCOM) : Free Stock Analysis Report

eGain Corporation (EGAN) : Free Stock Analysis Report

Baozun Inc. (BZUN) : Free Stock Analysis Report

Rosetta Stone (RST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research