Barnes Group (B) Q3 Earnings Beat Estimates, Revenues Miss

Barnes Group, Inc. B reported mixed third-quarter 2019 results, wherein earnings beat the Zacks Consensus estimate, but revenues missed the same.

Earnings/ Revenues

Quarterly adjusted earnings came in at 89 cents per share, up 14.1% year over year from 78 cents. Moreover, the bottom line beat the Zacks Consensus Estimate of 78 cents.

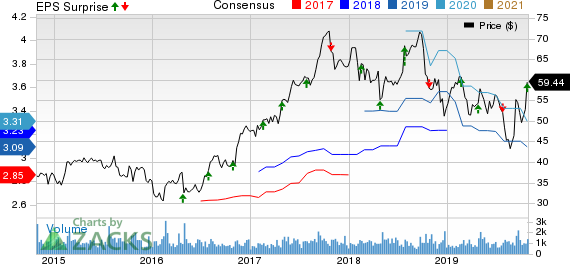

Barnes Group, Inc. Price, Consensus and EPS Surprise

Barnes Group, Inc. price-consensus-eps-surprise-chart | Barnes Group, Inc. Quote

Revenues were $373 million, down 0.8% year over year. The figure declined 1% organically. Also, the top line missed the consensus estimate of $374 million.

Segmental Breakup

Revenues from the Industrial segment were $231.7 million, down 5% year over year. The decline was due to continued softness in end markets on account of trade uncertainties and slowing global economies as well as unfavorable impact of foreign currency translation.

The Aerospace segment generated revenues of $140.9 million, up 12% year over year. The improvement was driven by solid aerospace OEM (Original Equipment Manufacturer) sales and strength in maintenance, repair and overhaul, and spare parts sales.

Costs/Margins

Cost of sales in the third quarter was $234.4 million, down 1% year over year. Selling, general and administrative expenses were $70.6 million, down from $73.9 million. Adjusted operating margin was 18.1%, down 170 basis points.

Balance Sheet/Cash Flow

Exiting the third quarter, Barnes Group had cash and cash equivalents of $80.5 million, down from $100.7 million recorded as of Dec 31, 2018. At the end of the reported quarter, long-term debt was $856.1 million compared with $936.4 million as of Dec 31, 2018.

In the first nine months of 2019, cash from operating activities totaled $161.3 million compared with about $158 million in the comparable year-ago period.

Outlook

Barnes Group has provided adjusted earnings view for 2019 in the range of $3.18-$3.23 compared with $3.18-$3.28 guided earlier.

Total revenues are likely to be flat, while organic revenue growth is predicted to decline in low-single digits range. This is comparable with the company’s earlier revenue growth guided range of 3-4%, and flat to up 1% for organic revenue growth.

Zacks Rank & Key Picks

Barnes Group currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the same space are Cimpress N.V CMPR, Brady Corporation BRC and Dover Corporation DOV. While Cimpress sports a Zacks Rank #1 (Strong Buy), Brady and Dover carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cimpress’ earnings surprise in the last reported quarter was a positive 137.04%.

Brady delivered average positive earnings surprise of 9.68% in the trailing four quarters.

Dover pulled off average positive earnings surprise of 6.70% in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barnes Group, Inc. (B) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

Cimpress N.V (CMPR) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research