Barrow, Hanley, Mewhinney & Strauss Trims Multiple Positions in 1st Quarter

- By Tiziano Frateschi

Investment firm Barrow, Hanley, Mewhinney & Strauss sold shares of the following stocks during the first quarter.

The Altria Group Inc. (MO) holding was reduced by 92.85%. The trade had an impact of -1.29% on the portfolio.

The brewer has a market cap of $98.84 billion and an enterprise value of $124.66 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 40.96% and return on assets of 12.58% are outperforming 75% of companies in the tobacco industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.12 is below the industry median of 0.37.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.30% of outstanding shares, followed by Tom Russo (Trades, Portfolio) with 0.27%, Barrow, Hanley, Mewhinney & Strauss with 0.06% and Joel Greenblatt (Trades, Portfolio) with 0.04%.

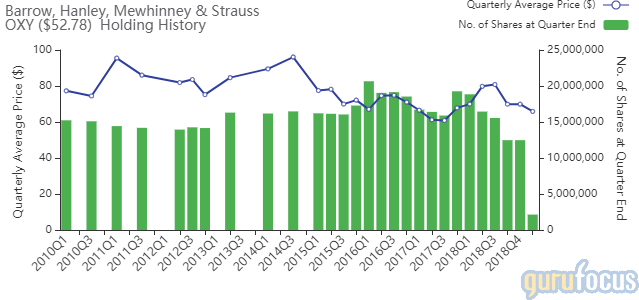

The firm curbed its Occidental Petroleum Corp. (OXY) position by 82.83%. The portfolio was impacted by -1.24%.

The oil producer has a market cap of $39.48 billion and an enterprise value of $48.05 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 19.10% and return on assets of 9.21% are outperforming 69% of companies in the Oil and Gas E&P industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.17 is below the industry median of 0.51.

The company's largest guru shareholder is Dodge & Cox with 4.06% of outstanding shares, followed by the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.43%, Pioneer Investments with 0.20%, Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.18% and Ken Fisher (Trades, Portfolio) with 0.26%.

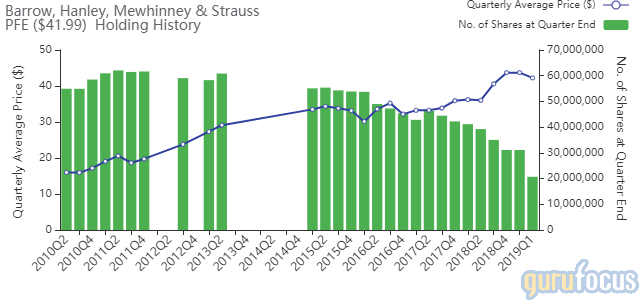

The firm trimmed 33.51% off its Pfizer Inc. (PFE) stake, impacting the portfolio by -0.89%.

The pharmaceutical company has a market cap of $233.46 billion and an enterprise value of $267.36 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 17.20% and return on assets of 7.06% are outperforming 87% of companies in the Drug Manufacturers - Major industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.26 is below the industry median of 2.03.

Fisher is the largest guru shareholder of the company with 0.77% of outstanding shares, followed by the T Rowe Price Equity Income Fund with 0.17% and Diamond Hill Capital (Trades, Portfolio) 0.14%.

The Cardinal Health Inc. (CAH) position was reduced by 82.1%. The portfolio was impacted by -0.65%.

The company, which provides pharmaceuticals and medical supplies to pharmacies, has a market cap of $13.96 billion and an enterprise value of $19.61 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 0.05% and return on assets of 0.01% are outperforming 59% of companies in the Medical Distribution industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.38 is below the industry median of 0.69.

The company's largest guru shareholder is the Vanguard Health Care Fund (Trades, Portfolio) with 2.29% of outstanding shares, followed by Richard Pzena (Trades, Portfolio) with 1.01%, Simons' firm with 0.69% and Charles Brandes (Trades, Portfolio) with 0.65%.

The firm reduced its Cigna Corp. (CI) position by 38.42% . The trade had an impact of -0.64% on the portfolio.

The health insurance services provider has a market cap of $57.99 billion and an enterprise value of $91.85 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. While the return on equity of 12.08% is outperforming the sector, the return on assets of 2.99% is underperforming 57% of companies in the Health Care Plans industry. Its financial strength was rated 4 out of 10. The cash-debt ratio of 0.12 was below the industry median of 1.15.

Dodge & Cox is the largest guru shareholder of the company with 3.49% of outstanding shares, followed by Larry Robbins (Trades, Portfolio) with 1.15%.

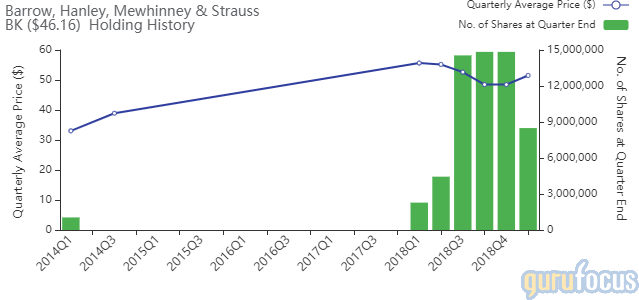

The Bank of New York Mellon Corp. (BK) stake was reduced by 42.77%. The portfolio was impacted by -0.59%.

The investment company has a market cap of $44.20 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The return on equity of 9.31% and return on assets of 1.13% are outperforming 54% of companies in the Asset Management industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 2.64 is below the industry median of 480.

The company's largest guru shareholder is Warren Buffett (Trades, Portfolio) with 8.45% of outstanding shares, followed by Dodge & Cox with 5.23% and First Eagle Investment (Trades, Portfolio) with 1.88%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Andreas Halvorsen Exits Salesforce, Trims Alibaba Position

Dodge & Cox Buys FedEx and Fox

Chris Davis Trims General Electric, Microsoft Positions

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.