Baxter (BAX) Beats on Q1 Earnings, Ups '23 EPS View

Baxter International Inc. BAX reported first-quarter 2023 adjusted earnings per share (EPS) of 59 cents, which beat the Zacks Consensus Estimate of 48 cents. However, the bottom line declined 37% from the year-ago quarter’s level due to the negative impact of foreign exchange and higher interest expense.

GAAP EPS in the quarter was 9 cents, down 36% from the prior-year quarter. The decline was due to the recognition of one-time special items totaling $253 million after tax.

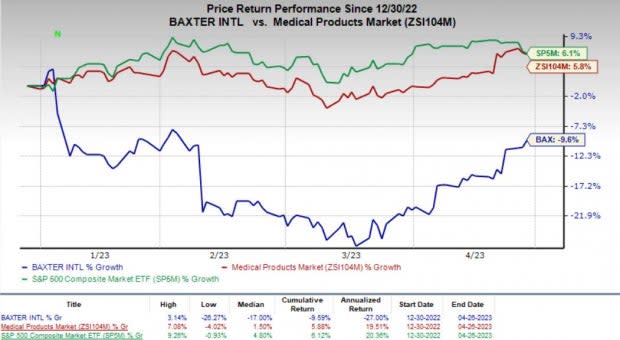

The company’s shares have declined 9.6% so far this year against the industry’s growth of 5.8%. The broader S&P 500 Index has moved up 6.1% in the same period.

Image Source: Zacks Investment Research

Revenue Details

Revenues of $3.65 billion beat the Zacks Consensus Estimate of $3.6 billion. The top line declined 2% year over year on a reported basis but improved 2% on a constant currency (cc) basis.

Geographical Details

Baxter reported operating results through three geographic segments — Americas (North and South America), EMEA (Europe, Middle East and Africa) and APAC (Asia Pacific).

In the Americas, revenues totaled $1.6 billion, down 1% on year-over-year as well as cc basis.

In EMEA, revenues totaled $714 million, up 2% from the year-ago quarter and up 9% at cc.

In APAC, revenues of $602 million declined 4% from the prior-year quarter but increased 3% at cc.

Segmental Details

Following the Hillrom buyout (in December 2021), Baxter added three new product categories — Patient Support Systems, Front Line Care and Surgical Solutions. During the reported quarter, the company recorded $731 million in sales from Hilrom’s businesses, down 3% on a year-over-year basis and 2% at cc.

Patient Support Systems reported revenues of $348 million, while Front Line Care and Surgical Solutions recorded revenues of $302 million and $81 million, respectively. While sales at Patient Support Systems declined year over year, the same at the other two segments improved.

Renal Care

This segment reported revenues of $892 million, flat year over year but up 4% at cc.

Medication Delivery

Revenues at the segment totaled $687 million, down 3% from the year-ago quarter and flat at cc.

Pharmaceuticals

Revenues at the segment amounted to $523 million, flat year over year and up 5% at cc.

Clinical Nutrition

Revenues at the segment were $224 million, down 1% from the year-ago quarter but up 3% at cc.

Advanced Surgery

Revenues at the segment totaled $246 million, up 8% from the year-ago quarter and 11% at cc.

Acute Therapies

This segment reported revenues of $180 million, down 4% from the prior-year quarter and 1% at cc.

BioPharma Solutions

This segment reported revenues of $139 million, down 11% from the prior-year quarter and 9% at cc.

Other

Revenues in the segment were $27 million, down 16% on a year-over-year basis and at cc.

Margin Analysis

Baxter reported an adjusted gross profit of $1.51 billion for the first quarter, down 9.9% year over year. As a percentage of revenues, the gross margin declined 380 basis points (bps) to 41.2% in the first quarter.

Selling, general and administrative expenses amounted to $1.01 billion, down 4% from the year-ago quarter. Research and development expenses were $164 million, up 9.3% on a year-over-year basis.

Adjusted operating income was $503 million, down 24.5% year over year. As a percentage of revenues, the operating margin contracted 420 bps to 13.8%.

2023 Guidance

For second-quarter 2023, Baxter anticipates sales to grow 1-2% on a reported basis and 2-3% at cc. The Zacks Consensus Estimate for the same is pegged at $3.76 billion, implying growth of 0.5% reportedly.

For the same period, adjusted EPS is expected between 59 cents and 61 cents. The Zacks Consensus Estimate for the same is pegged at 59 cents per share.

For full-year 2023, Baxter continues to expect sales to improve by 1-2%. The top line is anticipated to increase 1% at cc.

Baxter raised its outlook for full-year EPS. Adjusted EPS is now estimated in the range of $2.85-$3.00, up from the previous range of $2.75-$2.95. The Zacks Consensus Estimate for the same stands at $2.84.

Baxter International Inc. Price, Consensus and EPS Surprise

Baxter International Inc. price-consensus-eps-surprise-chart | Baxter International Inc. Quote

Summing Up

Baxter ended first-quarter 2022 on a positive note, wherein both revenues and earnings beat estimates. However, the company witnessed lower sales across five of its business units. Contraction in growth rates across two geographies — Americas and APAC — as well as in gross and operating margins is concerning. Unfavorable currency movement hurt the sales growth rate.

Although majority of its segments ended in red, the company expects demand for its medically essential products to continue amid a stabilizing macroeconomic climate and healthcare marketplace. It stated that the ongoing transformational actions, announced earlier this year, will likely boost its performance going forward.

The transformational actions, which include realigning its businesses and operations into four vertically integrated global business segments, are likely to complete by July 2024. Baxter is also progressing with the proposed spin-off of Kidney Care segment — comprising Renal Care and Acute Therapies product categories — into an independent, publicly traded company. This is also a part of its transformational actions.

Zacks Rank and Stocks to Consider

Currently, Baxter carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Intuitive Surgical ISRG, Chemed CHE and Edwards Lifesciences EW, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Intuitive Surgical reported first-quarter 2023 adjusted EPS of $1.23, beating the Zacks Consensus Estimate of $1.19 per share. Revenues of $1.7 billion outpaced the consensus mark by 6.9%.

Intuitive Surgical has a long-term estimated growth rate of 13%. ISRG’s earnings surpassed estimates in two of the trailing four quarters and missed the same twice, the average surprise being 1.86%.

Chemed reported first-quarter 2023 adjusted EPS of $6.90, which beat the Zacks Consensus Estimate by 0.2%. Revenues of $560 million outpaced the consensus mark by 2.6%.

Chemed has a long-term estimated growth rate of 8.8%. CHE’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 3.12%.

Edwards Lifesciences reported first-quarter 2023 adjusted earnings of 62 cents per share, beating the Zacks Consensus Estimate by 1.6%. Revenues of $1.46 billion surpassed the Zacks Consensus Estimate by 4.7%.

Edwards Lifesciences has a long-term estimated growth rate of 6.8%. EW’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average surprise being 1.69%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report