Baxter (BAX) Novum IQ SYR's FDA Clearance Boosts Patient Care

Baxter International Inc. BAX recently announced the receipt of the FDA’s 510(k) clearance for its new Novum IQ syringe infusion pump (SYR) with Dose IQ Safety Software. The Novum IQ SYR is capable of fully integrating with hospital electronic medical records via Baxter’s IQ Enterprise Connectivity Suite.

Baxter’s Novum IQ platform, which currently includes the Novum IQ SYR, Dose IQ Safety Software and IQ Enterprise Connectivity Suite, was designed to be forward-looking, as Baxter plans to expand the platform via continued product development and additional regulatory submissions.

It is worth mentioning that the Novum IQ large volume pump (LVP), another key part of the platform, is currently available in Canada. However, the FDA’s 510(k) clearance for the Novum IQ LVP in the United States is currently pending. Baxter expects to introduce the Novum IQ platform in the global markets to continue delivering a strong and streamlined experience for customers, subject to the receipt of necessary approvals.

The latest regulatory approval for Baxter’s Novum IQ SYR is expected to further solidify its foothold in the global infusion therapy space.

Significance of the Clearance

Syringe infusion pumps are generally used to accurately deliver small amounts of fluid at low rates, often in pediatric, neonatal or anesthesia care settings. The Novum IQ SYR delivers a technologically integrated user experience with enhanced safety features, advanced connectivity, configurable anesthesia care settings and a robust portfolio of sets designed to help deliver optimum accuracy. Its user interface incorporates features like guided syringe loading, among others.

The Novum IQ SYR uses intuitive technologies that have been built to aid in reducing infusion errors and was designed to satisfy FDA guidelines for infusion devices, including cybersecurity.

Per management, the Novum IQ syringe infusion pump, Dose IQ Safety Software and IQ Enterprise Connectivity Suite will likely advance the interoperability and data insights needed to help prevent harm and customize therapy for patients, including neonates and other vulnerable patients.

Industry Prospects

Per a report by Future Market Insights, the global infusion pumps market was valued at $4.4 billion in 2022 and is anticipated to reach $6.6 billion by 2030 at a CAGR of 5%. Factors like increasing demand for ambulatory infusion pumps and the growing adoption of specialty infusion systems to minimize infusion errors are expected to drive the market.

Given the market potential, the recent FDA’s approval is likely to provide a significant boost to Baxter’s Medication Delivery business globally.

Notable Developments

In July, Baxter announced its second-quarter 2022 results, wherein it recorded solid uptick in its overall top line as well as in Medication Delivery and Advanced Surgery product categories. The company’s performance in the Americas was also encouraging.

In April, Baxter received the FDA’s 510(k) clearance for its ST Set used in continuous renal replacement therapy (CRRT). The system is expected to offer additional options to provide CRRT for patients in an acute care environment.

Price Performance

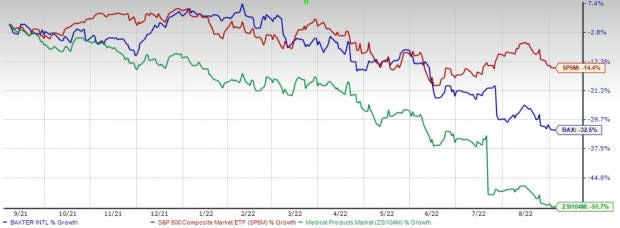

Shares of the company have lost 32.6% in the past year compared with the industry’s 51.8% fall and the S&P 500's 14.4% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Baxter carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corporation MCK.

AMN Healthcare, flaunting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 3.2%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 15.7%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has lost 10.6% compared with the industry’s 38.5% fall in the past year.

ShockWave Medical, sporting a Zacks Rank #1 at present, has an estimated growth rate of 33.1% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has gained 24% against the industry’s 33.9% fall over the past year.

McKesson, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 9.9%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average beat being 13%.

McKesson has gained 77.1% against the industry’s 14.8% fall over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baxter International Inc. (BAX) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research