Baxter's (BAX) $100M Investment to Strengthen Global Presence

Baxter International Inc. BAX recently announced an expansion of around $100 million with respect to its sterile fill/finish manufacturing facility based in Halle/Westfalen, Germany. Interestingly, BioPharma Solutions (“BPS”) — a business unit of Baxter — operates this facility. The construction of the new manufacturing building is anticipated to begin in 2022, while completion is expected in 2024.

It is worth mentioning that BPS specializes in collaborating with leading pharmaceutical and biotech companies when it comes to the development and contract manufacturing of drug products for parenteral (injectable) pharmaceuticals.

This expansion is likely to provide a boost to Baxter’s global foothold.

More on the News

Per management at BPS, Baxter’s aforementioned manufacturing site is one of the most advanced facilities in its global network and has witnessed substantial growth over the last few years. This investment is likely to ensure that the facility can serve the company’s partners at the highest level in the present as well as in the future.

Image Source: Zacks Investment Research

This strategic investment is likely to expand BPS’ manufacturing footprint and provide it access to superior equipment that help products achieve stability and enhanced shelf life through lyophilization (freeze drying). Apart from this, construction is likely to add an aseptic syringe filling line, which will enable BPS to meet the rising demand for this delivery platform in both Europe and the United States.

It is important to note here that pre-filled syringes can improve efficiency and ease-of-use for clinicians and reduce microbial contamination and minimize medication dosing errors during medication preparation, which are crucial to patient safety.

Market Prospects

Per a report by Grand View Research, the global prefilled syringes market is projected to attain a value of $22.5 billion by 2025, witnessing a CAGR of 11.2% during the forecast period (2014-2025). Increase in use of prefilled syringes and technological advancements in auto-injectors are the main factors driving the market. Hence, this announcement comes at an opportune time for Baxter.

Recent Developments

This month, Baxter presented new data that showed that kidney patients might experience a nearly two-times higher survival rate and a prolonged time to an adverse event (AE) and hospitalization by utilizing the Sharesource remote patient management digital health platform to help manage home automated peritoneal dialysis (APD).

In October, the company announced the CE marking of the NEPHROCLEAR CCL14 Test in collaboration with a global leader in in vitro diagnostics.

In September, the company announced the receipt of the FDA’s approval and commercial launch of premix (ready-to-use) Norepinephrine Bitartrate in 5% Dextrose Injection (norepinephrine).

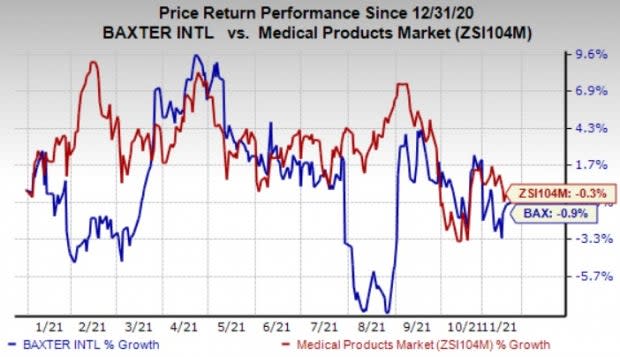

Price Performance

Shares of this Zacks Rank #3 (Hold) company have lost 0.9% on a year-to-date basis compared with the industry’s decline of 0.3%.

Stocks to Consider

Some better-ranked stocks in the broader medical space are Thermo Fisher Scientific Inc. TMO, McKesson Corporation MCK, and AngioDynamics, Inc. ANGO.

Thermo Fisher’s long-term earnings growth rate is estimated at 14%. The company currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Thermo Fisher surpassed earnings estimates in each of the trailing four quarters, the average surprise being 9.02%. The company’s earnings yield of 3.7% compares favorably with the industry’s (3.6%).

McKesson’s long-term earnings growth rate is estimated at 8.9%. The company currently carries a Zacks Rank #2.

McKesson surpassed earnings estimates in each of the trailing four quarters, the average surprise being 19.9%. The company’s earnings yield of 9.9% compared to the industry’s 3.2%.

AngioDynamics’ consensus mark for revenues for fiscal 2022 stands at $313.3 million, suggesting an improvement of 7.7% from the prior-year reported figure. The company currently carries a Zacks Rank #1.

AngioDynamics surpassed earnings estimates in three of the trailing four quarters and missed once, the average surprise being 125.6%. The company’s earnings yield of 0.1% compares favorably with the industry’s (3.6%).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research