BD (BDX) Q4 Earnings and Revenues Beat Estimates, Margins Up

Becton, Dickinson and Company BDX, popularly known as BD, delivered adjusted earnings per share (EPS) of $2.75 for the fourth quarter of fiscal 2022, up 27.9% year over year. The figure surpassed the Zacks Consensus Estimate by 0.7%.

The adjustments include expenses related to purchase accounting adjustments and integration costs, among others.

GAAP EPS for the quarter was 92 cents, reflecting an uptick of 100% from the year-earlier figure.

Full-year adjusted loss per share was at $11.35, up 0.6% compared with the end of fiscal 2021. The figure surpassed the Zacks Consensus Estimate by 0.4%.

Revenues in Detail

BD registered revenues of $4.76 billion in the fiscal fourth quarter, down 1.8% year over year. However, the figure surpassed the Zacks Consensus Estimate by 1.1%.

At constant exchange rate (CER), revenues climbed 2.3%.

The top-line improvement primarily resulted from strength in base revenue growth. However, the overall top-line improvement was partially offset by a fall in worldwide COVID-only testing revenues.

Base revenues were $4.72 billion in the fiscal fourth quarter, up 4.2% year over year on a reported basis and 8.6% at CER.

Base organic revenue growth for the fiscal fourth quarter was 2.4% on a reported basis and 6.8% at CER.

Full-year revenues were $18.87 billion, reflecting a 1.4% decline from the comparable fiscal 2021 period. The metric topped the Zacks Consensus Estimate by 0.3%.

Segment Details

BD’s operations consist of three worldwide business segments — BD Medical, BD Life Sciences and BD Interventional.

For the quarter under review, BD Medical reported worldwide revenues of $2.38 billion, up 5.8% from the year-ago quarter on a reported basis and 10.2% at CER. Per management, this upside can be attributed to strong performance across the segment.

Worldwide revenues in the BD Life Sciences segment totaled $1.29 billion, down 15.9% year over year on a reported basis and down 11.6% at CER. The decline resulted primarily from the Integrated Diagnostic Solutions (IDS) unit’s fall in COVID-only testing revenues. However, this was partially offset by the IDS unit’s strong growth in the base business (driven by leveraging BD’s increased BD MAX installed base, availability of BD’s specimen management products and incremental clinical microbiology instrument installations) and strength in the Biosciences unit.

BD Interventional segment generated worldwide revenues of $1.09 billion, up 2.4% from the year-ago quarter on a reported basis and 5.7% at CER. This was owing to strength across the segment.

Geographic Results

In the fiscal fourth quarter, revenues in the United States improved 2.2% to $2.71 billion.

International revenues grossed $2.05 billion, down 6.7% from the year-ago quarter on a reported basis but up 2.4% at CER.

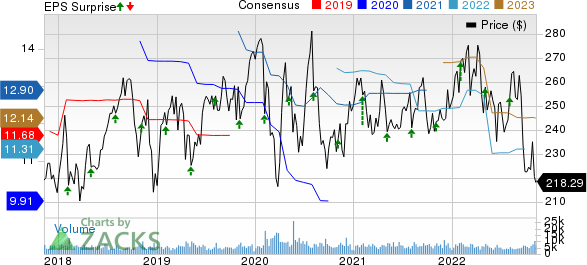

Becton, Dickinson and Company Price, Consensus and EPS Surprise

Becton, Dickinson and Company price-consensus-eps-surprise-chart | Becton, Dickinson and Company Quote

Margin Analysis

In the quarter under review, BD’s gross profit fell 0.5% to $2.08 billion. Gross margin expanded 59 basis points (bps) to 43.6%.

Selling and administrative expenses fell 8% to $1.18 billion. Research and development expenses declined 18.5% year over year to $300 million. Adjusted operating expenses of $1.48 billion decreased 10.3% year over year.

Adjusted operating profit totaled $594 million, reflecting a 37.2% jump from the prior-year quarter. The adjusted operating margin in the fiscal fourth quarter expanded 355 bps to 12.5%.

Financial Position

BD exited fiscal 2022 with cash and cash equivalents, and short-term investments of $1.01 billion compared with $2.29 billion at the end of fiscal 2021. Total debt (including current debt obligations) at the end of fiscal 2022 was $16.07 billion compared with $17.61 billion at the end of fiscal 2021.

Cumulative net cash flow from operating activities at the end of fiscal 2022 was $2.47 billion compared with $4.13 billion a year ago.

Meanwhile, BD has a consistent dividend-paying history, with its five-year annualized dividend growth being 3.64%.

Fiscal 2023 Guidance

BD initiated its financial outlook for fiscal 2023.

BD projects its full fiscal year revenues to be in the range of $18.6 billion-$18.8 billion. The Zacks Consensus Estimate for revenues is pegged at $19.33 billion.

The revenue projections for fiscal 2023 include base-business revenue growth at CER of 5.25-6.25%. The outlook estimates around $125 million-$175 million in COVID-19-only diagnostic testing revenues.

For the full fiscal year, adjusted EPS is anticipated to be $11.85-$12.10. The Zacks Consensus Estimate for the same is pegged at $12.15.

Our Take

BD exited the fourth quarter of fiscal 2022 with better-than-expected results. An improvement in the overall base revenues and the year-over-year uptick in bottom-line results are impressive. Robust performances by the majority of its segments and in the United States are impressive. BD’s recent agreement with Biocorp to bring connectivity and traceability to self-administered injectable drug therapies and a co-exclusive commercial agreement with Magnolia Medical Technologies, Inc. look promising. The company also launched BD Research Cloud in the United States and BD Effivax, a next-generation glass prefillable syringe during the quarter, which raises our optimism.

BD and CerTest Biotec’s announcement of the worldwide commercial availability, including the United States, of their newly developed molecular polymerase chain reaction assay for monkeypox virus — CerTest VIASURE Monkeypox molecular research use only assay — is another quarterly highlight. The expansion of both margins is a plus.

However, the year-over-year decline in reported revenues is disappointing. The fall in BD Life Sciences and international revenues is worrying. Lower COVID-only testing revenues are discouraging from a business perspective.

Zacks Rank and Key Picks

BD currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are AMN Healthcare Services, Inc. AMN, Medpace Holdings, Inc. MEDP and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy), reported third-quarter 2022 adjusted EPS of $2.57, which beat the Zacks Consensus Estimate by 10.3%. Revenues of $1.14 billion outpaced the consensus mark by 3.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed estimates in all the trailing four quarters, the average being 10.9%.

Medpace Holdings, sporting a Zacks Rank #1, reported third-quarter 2022 EPS of $2.05, which beat the Zacks Consensus Estimate by 39.5%. Revenues of $383.7 million outpaced the consensus mark by 8.1%.

Medpace Holdings has an estimated growth rate of 44.9% for the full-year 2022. MEDP’s earnings surpassed estimates in all the trailing four quarters, the average being 22%.

Merit Medical, carrying a Zacks Rank #2, reported third-quarter 2022 adjusted EPS of 64 cents, which beat the Zacks Consensus Estimate by 20.8%. Revenues of $287.2 million outpaced the consensus mark by 5.2%.

Merit Medical has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average being 25.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research