Bear Of The Day: Air Products Chemicals (APD)

Air Products Chemicals (APD) is a Zacks Rank #5 (Strong Sell) and it is the Bear of the Day today. That may make you think that it is a bad stock or something to remove from your radar screen, but to me it’s more of a chance to get to know a stock that you probably haven’t been looking at. Let’s face it, a $250+ stock that isn’t TSLA, NVDA or FB is probably under the radar for a lot of investors.

Description

Air Products & Chemicals, Inc. is a world-leading Industrial Gases company. The Company's core industrial gases business provides atmospheric and process gases and related equipment to manufacturing markets, including refining and petrochemical, metals, electronics, and food and beverage. Air Products is also the world's leading supplier of liquefied natural gas process technology and equipment. The Company is the world's largest supplier of hydrogen and has built leading positions in growth markets such as helium and natural gas liquefaction.

Earnings History

I always look here first. I want to see if management can guide Wall Street to the right level for quarterly expectations. I see three misses and one beat. The misses are small, all less than 2% and the beat was almost 3%.

I cannot say that they get an immediate pass because of the pandemic, but you have to cut them a little slack.

Estimates

I see estimates for this quarter moving higher, not lower. Next quarter, however, is seeing estimates dropping.

The full year numbers have slipped, with the fiscal 2021 number going from $9.87 to $9.28 over the last 60 days.

The fiscal 2022 numbers are also lower by about the same amount… but there is still earnings growth.

Valuation

I see a 29x forward earnings multiple and that is a lot for a name that is seeing lower estimates and has a lot of earnings misses. The growth is minimal at 1.6% in the most recent quarter but there is a expectation for 9% in this fiscal year. The price to book at almost 5x is a lot… but margins in the 21% range is really attractive.

I would like to see how the next quarter goes before making a decision on this one, but I am glad that I got a chance to take a look at APD.

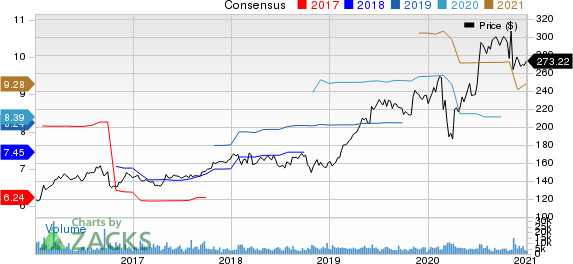

Chart

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking. Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research