Bear of the Day: Burlington Stores (BURL)

Burlington (BURL) is a Zacks Rank #5 (Strong Sell) that operates as a retailer of branded apparel product in the United States. The company deals in more than just coats, offering ladies sportswear, menswear, youth apparel, footwear, accessories, toys, gifts, baby furniture, home, and beauty products

The stock is well off its 2021 highs, dropping over 40% since August. While some of that downfall is due to market weakness, there is more to the story, which includes its first earnings miss since the second quarter of 2020.

About the Company

Burlington operates over 800 stores in 45 states and Puerto Rico. The company was founded in 1972 and is headquartered in Burlington, New Jersey.

Burlington is valued at $13 billion and has a Forward PE of 27. The company holds a Zacks Style Score of “A” in Growth, but “D” in both Value and Momentum. The company pays no dividend.

Q4 Earnings

Earnings were out in early March, which surprised to the downside by 21%. This was the first miss in seven quarters, which resulted in the stock dropping about 15% overnight.

Burlington reported $2.53 v the $3.22 expected and missed on revenues. Same Store Sales were up 6%, while margins came in at 39.8% or -230 basis points below 2019 levels.

The company did announce they would be adding $500M to their share buyback plan, which is about 3% of the market cap.

However, the comps over the last two months of the quarter were very negative and weighed on shares. Management cited Omicron and warmer weather as reasons for traffic deceleration. But the quarter also brought lower spend per visit by customers, which some analysts attribute to management missteps.

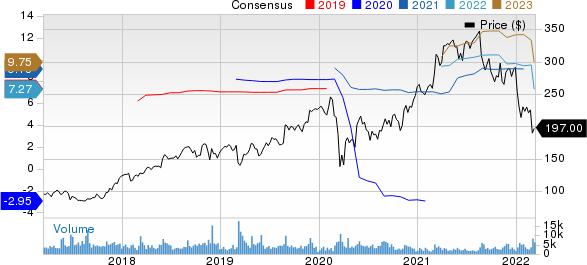

Burlington Stores, Inc. Price and Consensus

Burlington Stores, Inc. price-consensus-chart | Burlington Stores, Inc. Quote

Estimates

While analysts seem positive on the longer-term story, the company will have issues in the short run. Analysts are lowering estimates aggressively, citing customer traffic, supply constraints, inflation and margins.

For the current quarter, we have seen a drop over the last 30 days from $1.92 to $0.66, or 65%. For the current year, estimates have fallen 24% over that same time frame, from $9.55 to $7.27.

Technical Take

Burlington was trading at $250 before COVID and plunged to $105 at the height of the panic. From there, the stock went on a bull run to $357.

Moving averages are well above current trading levels, with the 200-day MA at $284. The 50-day MA has been sold on every up move and currently resides at $230.

Investors now find themselves below the pre-COVID trading level and the key $200 mark. This level is the 61.8% retracement from COVID lows to 2021 highs. A failure to hold this level could bring more sellers as the stock trends to the $150 area.

Longer term, $150 is likely a good support zone as it was in 2018-19. Until then investors might want to avoid the stock until the earnings story is remedied.

In Summary

Burlington’s short-term issues signal a caution flag to those investors looking to buy the dip. There might be some more downside and given the current market weakness, there is no sense stepping in at current levels.

For an investor interested in retail, a better option might be Target (TGT). The stock is a Zacks Rank #1 (Strong Buy) and the company is coming off an 11% EPS beat.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research