Bear of the Day: Whirlpool Corp. (WHR)

Bears have had a tight grip on the Zacks Household Appliances Industry in 2022, down more than 40% and widely lagging behind the S&P 500.

Image Source: Zacks Investment Research

Further, the industry is currently ranked in the bottom 11% of all Zacks Industries (222 out of 250).

A company residing in the realm that’s seen its near-term earnings outlook come under pressure over the last several months is Whirlpool Corp. WHR.

Image Source: Zacks Investment Research

Whirlpool is one of the largest manufacturers of home appliances in the world. The company's portfolio of products can be broadly classified into laundry appliances, refrigerators and freezers, cooking appliances, and other small household appliances.

Let’s dive deeper into how the appliance titan stacks up currently.

Share Performance

WHR shares have been no exception to the general market’s woes in 2022, down more than 30% and lagging behind the S&P 500 notably.

Image Source: Zacks Investment Research

Still, over the last month, WHR shares have tacked on a strong 15% in value, indicating that buyers have finally stepped up.

Image Source: Zacks Investment Research

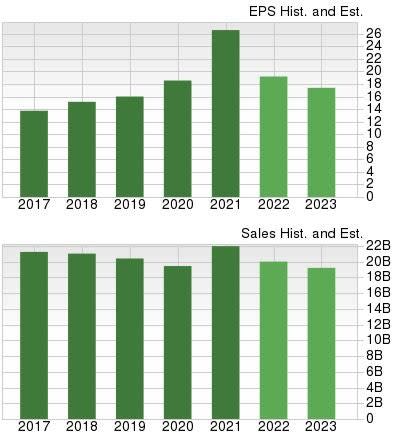

Growth Outlook

Whirlpool carries a less-than-favorable growth profile, with earnings forecasted to decrease by 28% in its current fiscal year (FY22) and a further 9.4% in FY23.

The projected earnings slowdown comes on top of forecasted Y/Y revenue decreases of 9% in FY22 and 4% in FY23.

Image Source: Zacks Investment Research

Quarterly Performance

In its latest release, Whirlpool fell short of the Zacks Consensus EPS Estimate by nearly 20%, snapping a long streak of positive surprises.

Further, revenue results have consistently come in under expectations as of late, with the company falling short of sales estimates in five consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

A slowdown in growth and negative earnings estimate revisions from analysts paint a less-than-ideal picture for the company in the short term.

Whirlpool Corp. WHR is a Zacks Rank #5 (Strong Sell), telling us it has a weak near-term earnings outlook.

Investors should pivot to stocks that either carry a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) – these stocks have a much stronger earnings outlook and potential to deliver explosive gains in the short-term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Whirlpool Corporation (WHR) : Free Stock Analysis Report