Bearish: Analysts Just Cut Their NVIDIA Corporation (NASDAQ:NVDA) Revenue and EPS estimates

The analysts covering NVIDIA Corporation (NASDAQ:NVDA) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

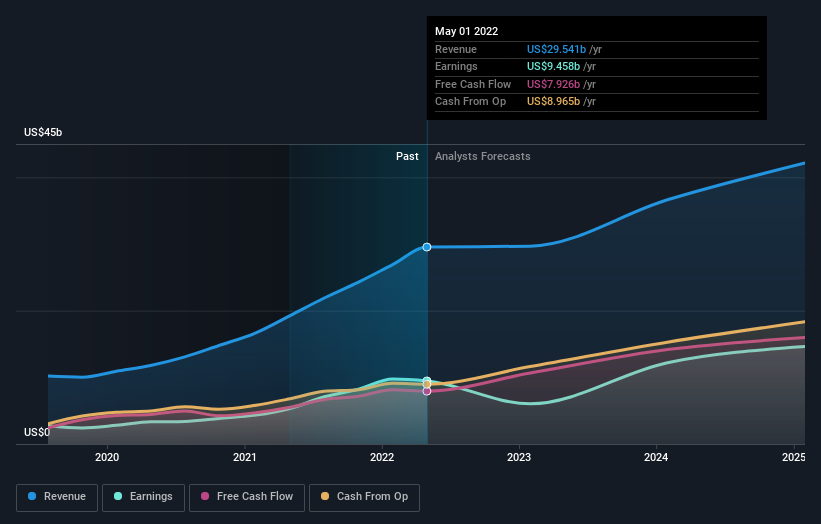

Following this downgrade, NVIDIA's 42 analysts are forecasting 2023 revenues to be US$30b, approximately in line with the last 12 months. Statutory earnings per share are anticipated to plummet 43% to US$2.14 in the same period. Prior to this update, the analysts had been forecasting revenues of US$33b and earnings per share (EPS) of US$4.08 in 2023. Indeed, we can see that the analysts are a lot more bearish about NVIDIA's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for NVIDIA

Despite the cuts to forecast earnings, there was no real change to the US$225 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values NVIDIA at US$370 per share, while the most bearish prices it at US$130. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the NVIDIA's past performance and to peers in the same industry. We would highlight that sales are expected to reverse, with a forecast 0.1% annualised revenue decline to the end of 2023. That is a notable change from historical growth of 25% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 8.8% annually for the foreseeable future. It's pretty clear that NVIDIA's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for NVIDIA. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of NVIDIA.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for NVIDIA going out to 2025, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here