Bearishness in the Right Places Pays Big Dividends

It's been a "tough year for short sellers." That's the Wall Street Journal's headline from the Nov. 25th edition, which proclaimed:

"The Dow Jones Industrial Average rose for the seventh week in a row. About the only people gnashing their teeth are short sellers, the investors who make a living betting that stocks will fall in price rather than rise. Short seller hedge funds are down nearly 15% from the start of this year, through October."

Reading articles like this might cause a person to improperly assume that bearishness hasn't produced good results in 2013. To the contrary, being bearish in the right places has paid off tremendously.

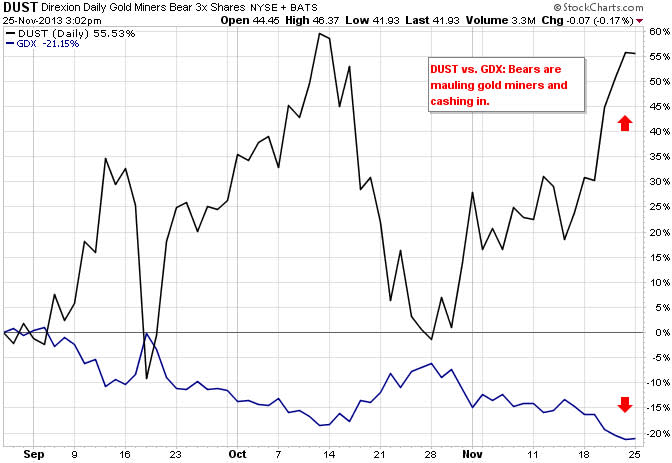

The below chart vividly illustrates this point by contrasting the monumental performance difference between the Direxion Gold Miners Bear 3x Shares (DUST - News) with the Market Vectors Gold Miners ETF (GDX - News). While DUST has soared over the past three-months, GDX has lost more than 20%.

DUST aims for triple daily opposite performance to gold mining stocks (RING - News).

Via our time stamped ETF Weekly Pick to subscribers on Sept. 18 (the same time frame as our chart) we wrote:

"Gold miners are a leveraged play on physical metals and if the next leg down in metals prices takes hold, as we suspect, miners should lead the way down. Buy DUST around $24.60 with a price limit up to $25.25. DUST aims for triple opposite daily performance to mining stocks. A tandem options trade is to buy the GDX Oct 2013 25 put options (GDX131019P00025000) around $40."

How did our gold trade turn out?

Via intraday alerts to our readers on 9/19 and 9/20 we sold our DUST position for a two-day +16.5% blended profit. DUST aims for triple opposite daily performance to mining stocks. Our tandem trade in the GDX Oct 2013 25 put options were sold for a two-day gain of +68%.

At the individual stock level, Tesla Motors (TSLA - News) - a Wall Street darling - is another example of how trading against the crowd can produce handsome results. Since hitting its Oct. 1 peak near $194, Tesla shares have sunk 37%.

Furthermore, Tesla is a brilliant example of how the stock market's psychology or sentiment can change on the dime, even for securities or markets with strong bullish performance.

Not being ready for a huge but sudden shift in market sentiment is how most people miss out on the truly big gains from bearish setups. But there's more to making money on bearish trades than just being ready. What's another key?

Being selectively bearish, as opposed to blindly bearish, is how smart bears make money. And in upcoming articles, we'll examine other markets where being selectively bearish - despite an overheated stock market - has been the right trade.

The ETF Profit Strategy Newsletter uses technical, fundamental, and sentiment analysis along with market history and common sense to keep investors on the right side of the market. Since the beginning of the year, 74% of our weekly ETF picks have been winners. (through Q3 2013)

Follow us on Twittter @ ETFguide

More From ETFguide.com